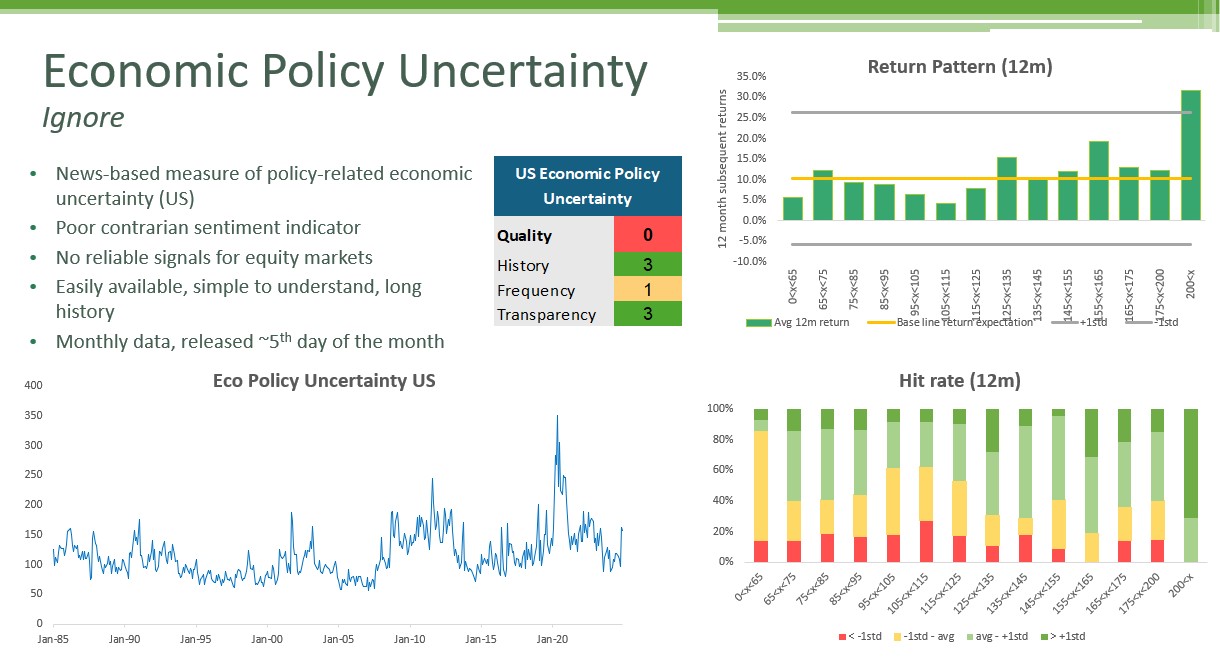

The US Economic Policy Uncertainty Index has not been a reliable sentiment indicator for markets. It has failed to generate consistent buy or sell signals, making it ineffective for market timing. I rate it 0 out of 3.

Not all Sentiment Indicators are created equal, Part 10

Need to know

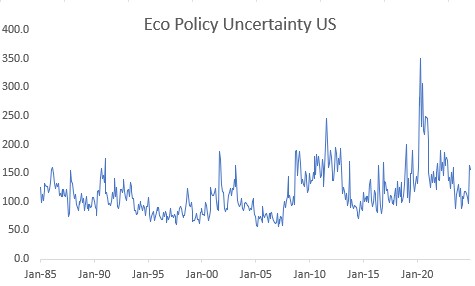

- What is it: a mostly news-based index measuring policy-related economic uncertainty in the US

- The good: Easily available, simple to understand, and a reasonable proxy for shifts in policy uncertainty.

- The bad: Has not provided reliable signals for equity markets.

- Current message: US policy uncertainty is high but not at historic extremes—no clear signal to add or reduce equities.

Go deeper

- Track record: It has NOT been useful as a contrarian indicator. Extreme uncertainty levels have not been followed by consistently high or poor equity returns. Instead, market performance has been average across all uncertainty levels.

- Pandemic anomaly: While the chart suggests strong equity returns after uncertainty readings above 200, these instances were entirely pandemic-related. It is safe to say the post-pandemic rally was not driven by an unwind of economic policy uncertainty.

- No signals: The index offers no predictive value for timing equity markets. If someone argues that high policy uncertainty means bad news is priced in—making it bullish for equities—you can confidently push back.

- Construction: The index consists of three underlying components. It measures the volume of news articles on economic policy uncertainty in US newspapers, the number of federal tax code provisions set to expire and disagreement among economic forecasters. There is a daily series, which only uses news volumes, but this does not improve predictive powers.

- Technicals: The main series is published monthly, typically around the 5th, and has a long history dating back to 1985.

- Top marks on transparency The data is freely available, with extensive documentation on its methodology.

Conclusion

US Economic Policy Uncertainty has not been useful as a contrarian sentiment indicator. It has failed to generate reliable buy or sell signals. High uncertainty should not be read as a bullish signal on the assumption that a future decline will drive equity gains.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.