Long Tech has been the trade of the past few years. It’s almost difficult to imagine a world where Technology isn’t the market’s default leader.

And that’s the point.

When sentiment becomes broad, extreme, and unusually unanimous, a sector can start to feel invincible. But the feeling of invincibility is often what creates the underlying vulnerability: the hurdle for further upside quietly rises, and the distribution of outcomes shifts toward asymmetric reactions to “less-good” news.

This note isn’t a call to “sell Tech” or to pick the top. It’s a sentiment note — and sentiment analysis is best used to do two things:

- Spot when the hurdle for additional upside is rising, and when the risk shifts toward sharper reactions to disappointment.

- Identify the prevailing narrative and stress-test it: which parts are assumption-heavy, and what could realistically force the market to rethink the consensus view?

Before we go further, let’s remember 2022.

Remember 2022: sentiment doesn’t stay extreme forever

Tech isn’t immune to resets. It can go from “can’t lose” to “needs to prove itself” remarkably quickly.

In 2022, coming out of the pandemic and its best run since the Tech bubble — Tech suffered one of its worst years on record. What mattered wasn’t just valuations or yields. The bigger shift was that relative earnings expectations rolled over, and the market stopped paying for long-duration optimism.

Then ChatGPT arrived, the AI capex cycle ignited, and the narrative flipped again — fast.

It’s a reminder that nothing moves in a straight line forever. Even in a secular trend of Tech outperformance, there can be painful and prolonged setbacks.

Sentiment & positioning: from neutral to 15-year highs

We always start with the data.

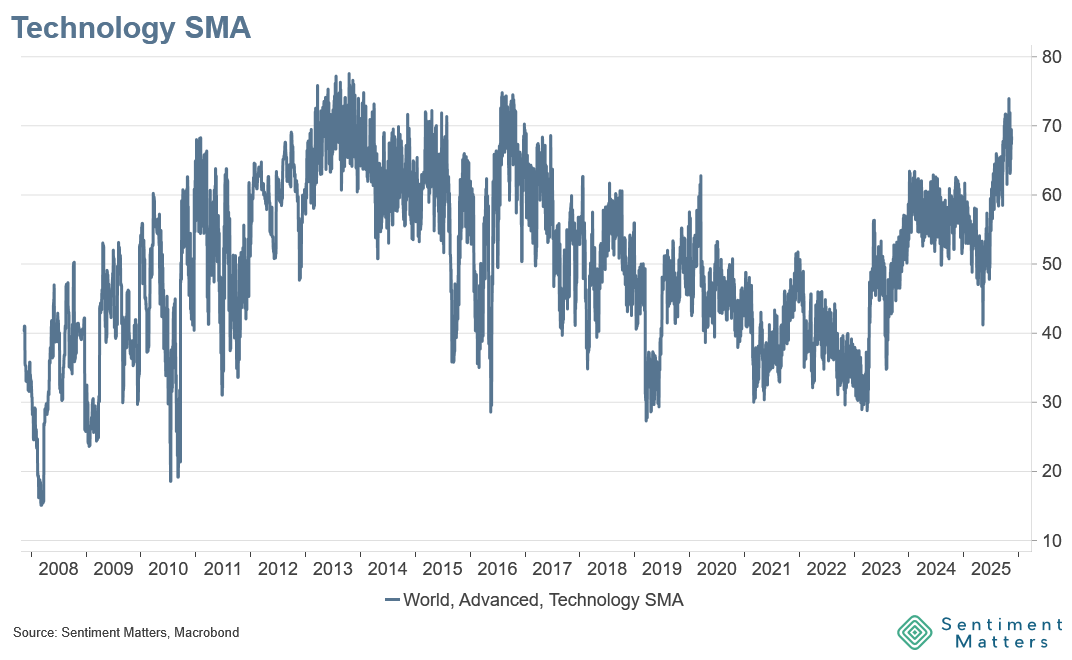

Our Sentiment Matters Aggregate for Technology has risen sharply since its post–Liberation Day lows. In April, the average indicator in our heatmap sat at the 48th percentile — essentially neutral. By late 2025 it had climbed to roughly the 75th percentile, the highest level in around 15 years.

But the turnaround goes back further. By the end of 2022, the average heatmap indicator had fallen to the 28th percentile — a multi-year low. Since then, the sector has travelled from a 15-year low in sentiment to a 15-year high.

This isn’t a one-indicator story — it’s broad-based