The Kiwi has had a wild 2025. Lots of volatility, and yet it still ends up as one of the weaker performers on the year. So yes — “bearish sentiment” is easy to assume.

What’s more interesting is what the sentiment and positioning data is saying: pessimism isn’t just negative. It’s become broad, extreme, and unusually unanimous.

The goal of this note isn’t to call the exact bottom in Kiwi/USD (we may already have seen it). It’s to do what sentiment analysis is good at:

- Spot when the hurdle for further downside is rising — and when the risk shifts toward asymmetric reactions to “less-bad” news.

- Identify the prevailing narrative and stress-test it — which parts are most assumption-heavy, and what could realistically force the market to rethink the consensus view?

Sentiment Data Analysis

For us, the starting point is always sentiment and positioning data.

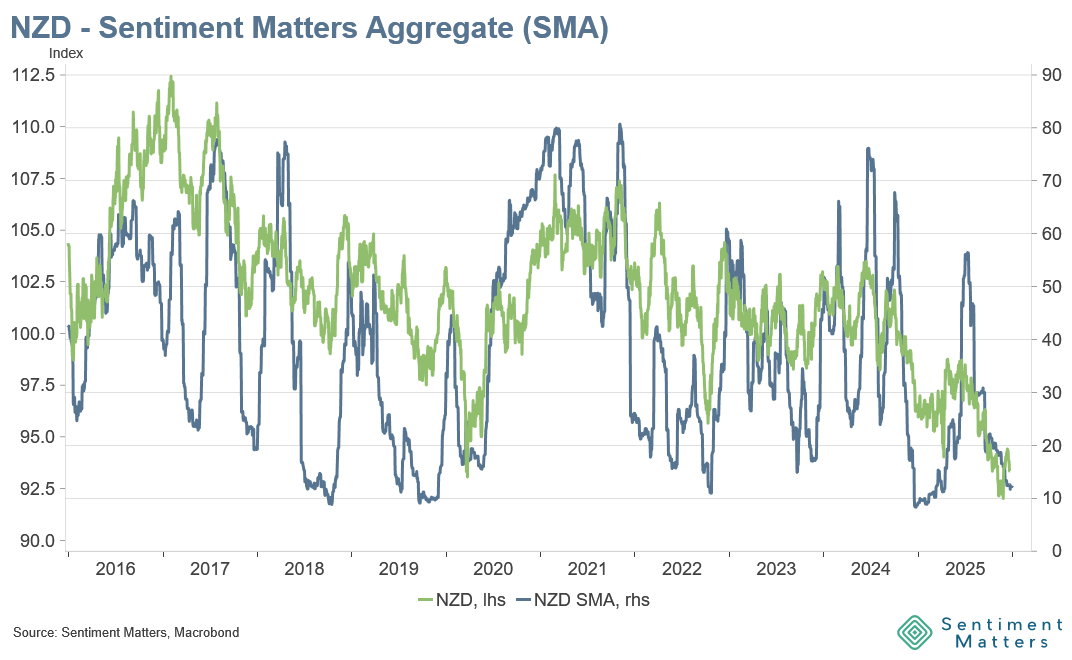

Since the June 2025 peak, our Sentiment Matters Aggregate for the Kiwi has fallen alongside the exchange rate. The average indicator we track was at the 55th percentile at the start of July, and fell as low as the 12th percentile in December.

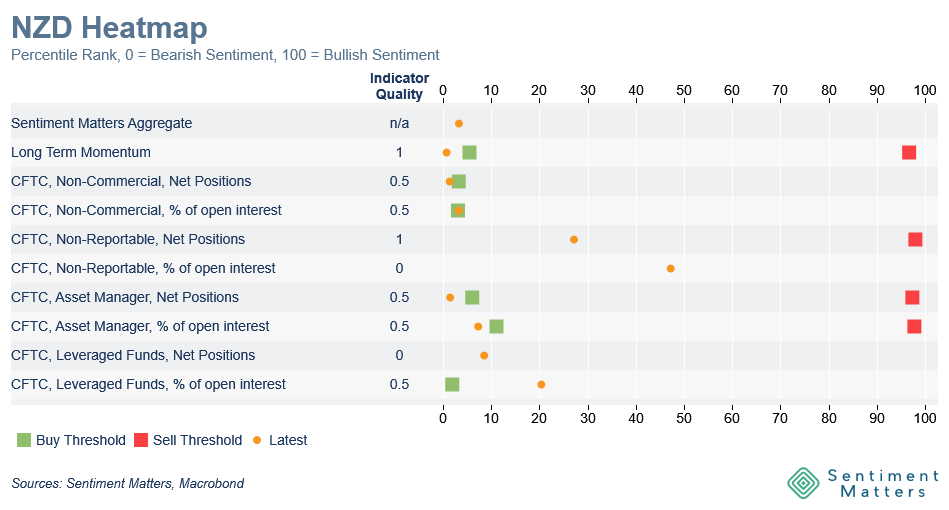

One level deeper, the Heatmap shows this isn’t a one-indicator story. The deterioration has been broad-based:

- 6 of the 9 indicators we track are below the 10th percentile.

- Two of the three outliers are CFTC positions of retail investors. These are still worth monitoring, but they represent a very small slice of futures and options activity — currently around 1% of open interest.

- Our Sentiment Matters Aggregate has only been lower 3% of the time.

The relative picture is even more striking:

- This is the most bearish reading across the 13 currencies we track.

- It’s the second most bearish across the 55 assets we track.

- It also has the most negative long-term momentum of any currency in our universe.