Commodities have had a great run. At least some commodities have. It’s a bifurcated story.

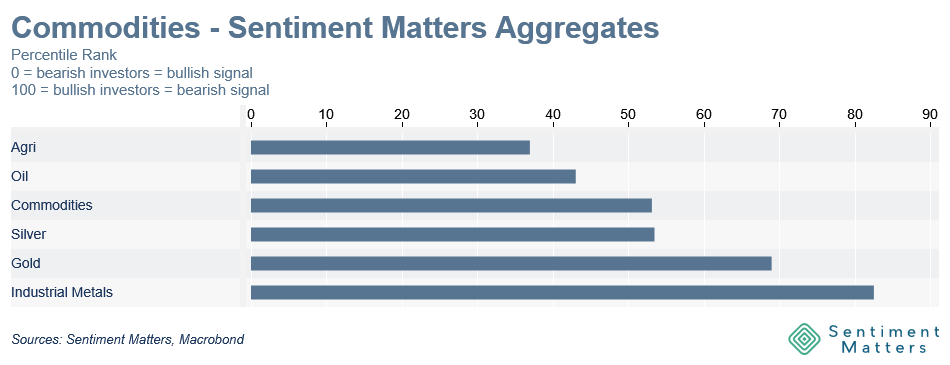

Gold (and silver) and industrial metals like copper sit at the top of the performance leaderboard. Oil and soft commodities are much closer to the laggards.

Gold in particular has broken out of being a niche exposures and moved into the investing mainstream. There will be very few multi-asset managers who haven’t fielded more questions about gold than at any point in their careers.

And that’s the point.

When sentiment becomes broad, extreme, and unusually unanimous, an asset can start to feel invincible. But that feeling of invincibility is often what creates the underlying vulnerability: the hurdle for further upside quietly rises, and the distribution of outcomes shifts toward asymmetric reactions to “less-good” news.

This note looks at sentiment across the broader commodity complex, then dives deeper into gold — and where the prevailing narrative could become vulnerable.

It is not a call to “sell gold” or pick a top. It’s a sentiment note — and sentiment analysis is best used to do two things:

- Spot when the hurdle for further upside is rising, and when the risks shift toward sharper reactions to disappointment.

- Identify the prevailing narrative and stress-test it: which parts are assumption-heavy, and what could realistically force the market to rethink the consensus view?

Sentiment & Positioning:

We always start with the data.

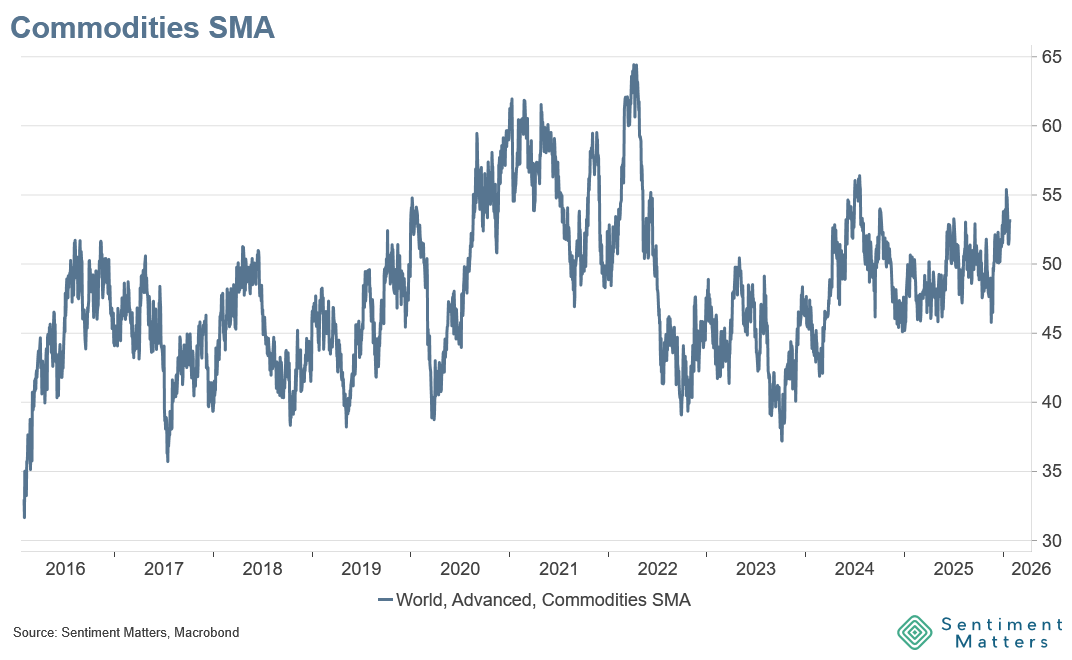

The first point to make is that there is no single sentiment message on commodities.

Our aggregate across indicators and commodities looks lukewarm at best. The average indicator sits at the 52nd percentile — broadly neutral. That’s towards the upper end of the past year’s range, but still close to the middle of the 10-year range and the very long-term history back to the 1980s.

But concluding “nothing to see here” from a sentiment perspective would be wrong. Let’s dig deeper.

Our Sentiment Matters Aggregates (SMAs) show a market split down the middle:

- Net bearishness: Softs / Agriculture and Oil

- Net bullishness: Precious Metals and Industrial Metals (especially Copper)

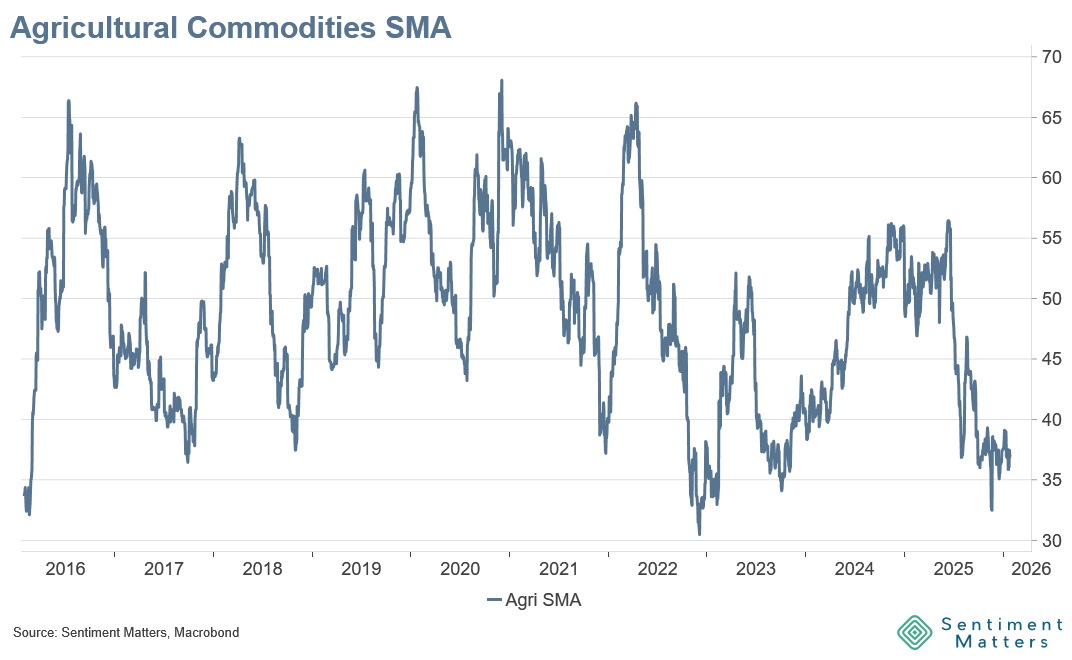

Agriculture: bearish — and getting more bearish

Agriculture stands out as one of the clearest bearish clusters in the commodity complex.

- The Agri SMA sits at the 11th percentile — a deeply depressed reading.

- The average indicator is at the 37th percentile: clearly net bearish.

- Importantly, it’s not just low — it’s been falling. Soft commodity sentiment has slid from the 57th percentile in mid-2025 down toward ~30th percentile, taking sentiment close to 15-year lows.