11 September 2025

As summer is fading, markets have remained remarkably resilient. Although our sentiment indicators continue to broadly drift into more and more bullish territory, we see few sentiment and positioning extremes at the risk asset level. For now anyway.

To mark the end of summer, this post is free to all paid & free members.

Bottom lines

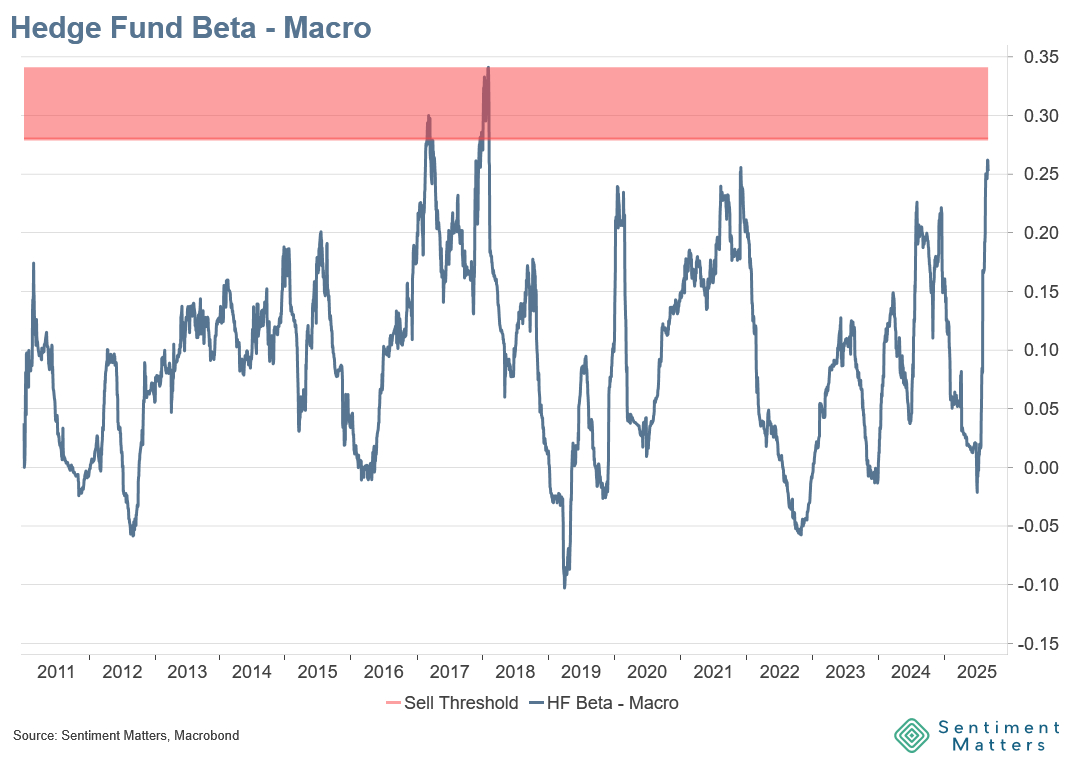

- Macro Hedge Fund Beta – Highest in 7 years

- Gamma Exposure Index (GEX) – not a sentiment indicator, but still useful

- Canadian dollar – record bearish CFTC positioning

Macro Hedge Fund Beta – Highest in 7 Years

- Macro Hedge Fund portfolios are now more equity-sensitive than at any point since 2018—higher than at the pre-pandemic peak, during the post-pandemic rally, or last year’s bull market.

- Sentiment overall has been drifting more bullish in recent months, but Macro Hedge Fund Beta is one of the biggest movers.

- I rate it a decent sentiment indicator (1/3).

- Historically, when Macro Beta > 0.25 (as now), the S&P 500 delivered only 3.3% average 12-month returns—less than half the long-run average. In those cases, returns were below average 60% of the time.

- In 2017 and 2018, when betas climbed even higher, forward returns were even worse, with an even higher hit rate of below-average outcomes.

- Other hedge fund strategies are also showing rising betas, but none as extreme as Macro funds.