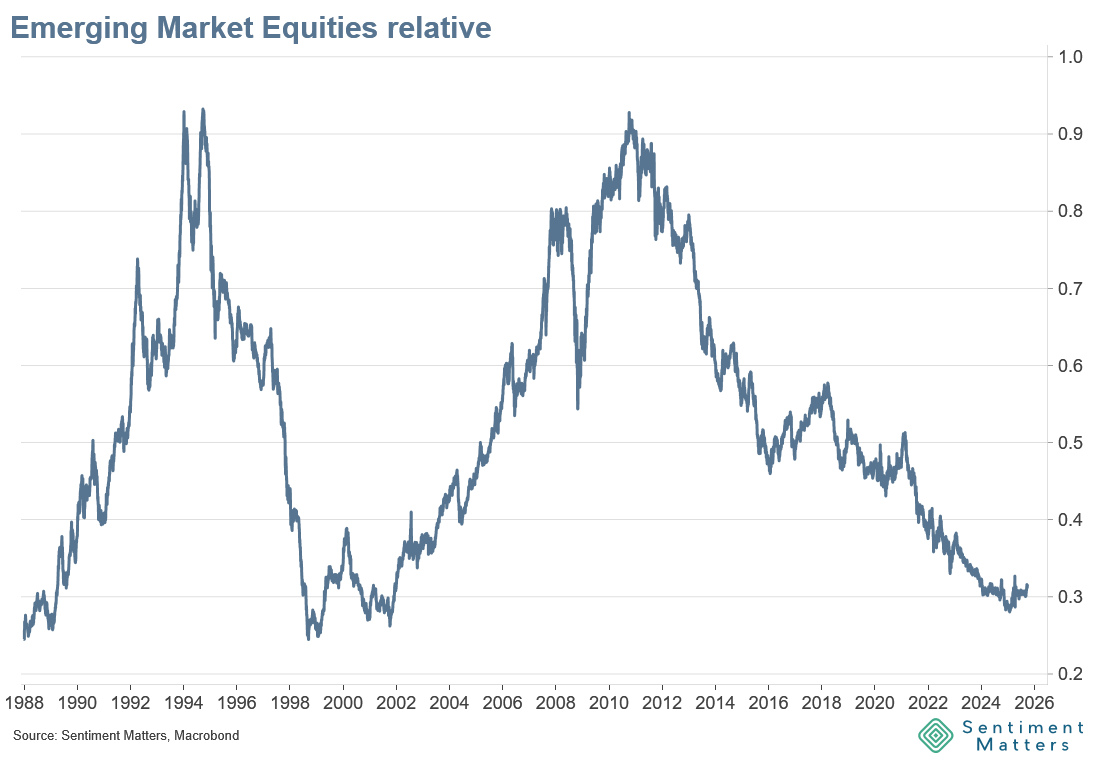

Most portfolio managers working today have never actually experienced an Emerging Markets bull market. The last one ended in October 2010—fifteen years ago. At the time, EMs and the BRICs were at the centre of every investment pitch, supposedly “decoupling” from developed economies that were weighed down by debt and expected to stagnate for years. The reality, of course, played out differently.

Sentiment Rebound

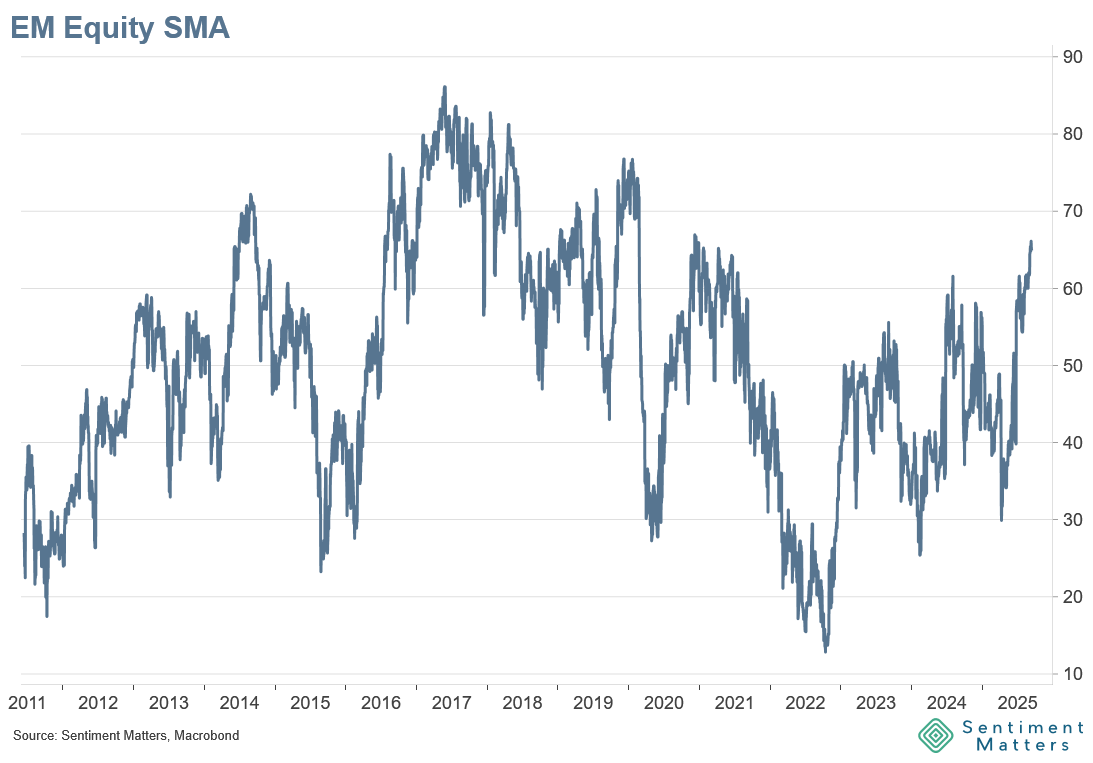

We are still very far from a true EM bull cycle, but something has shifted. Emerging Market equities are once again popular. By our measures, they are now at their most favoured in six years, matching levels last seen during the post-COVID rebound.

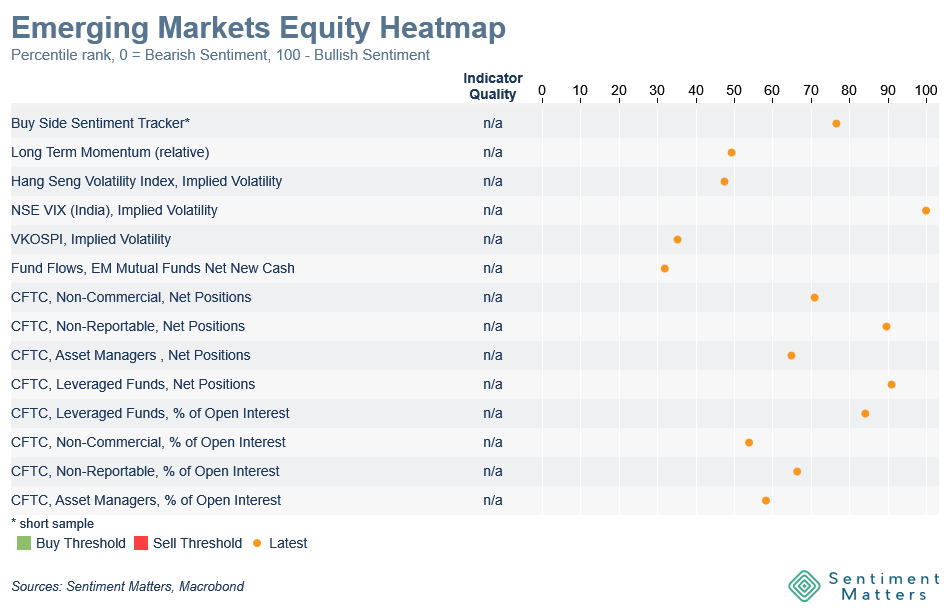

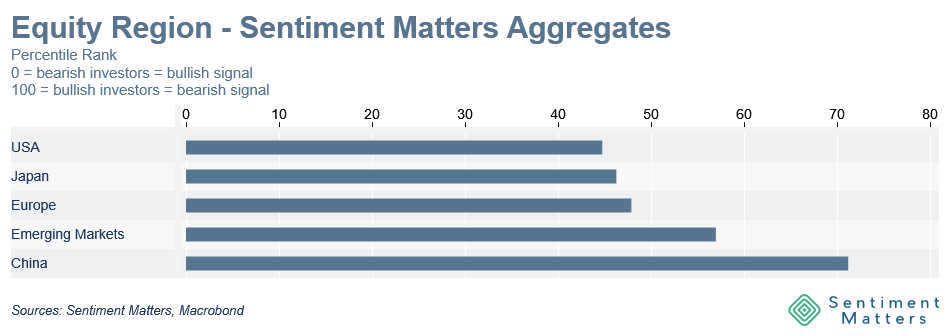

Our Sentiment Matters Aggregate for EM equities now sits at the 65th percentile. The heatmap shows strength across most of the indicators we track, a broad-based recovery.

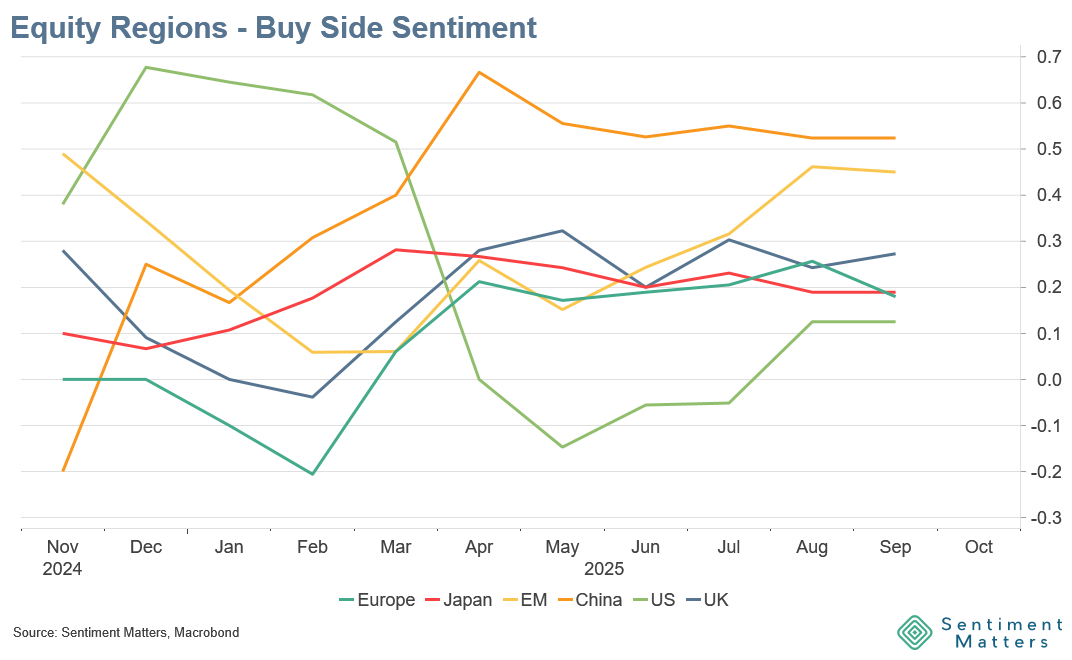

By comparison, sentiment towards developed markets is neutral at best. The US has been drifting steadily lower all year, Europe has lost the optimism that carried it through spring and now sits below neutral, while Japan is also middling but with a more positive trajectory.

The buy-side tells the same story. In our September Buy Side Sentiment Tracker, EMs and China ranked as the most popular region for the fourth month in a row, comfortably ahead of the rest.

This represents a remarkable turnaround. As recently as late 2022, EM sentiment was at extreme lows, plunging to the 15th percentile. That collapse coincided with Xi Jinping’s consolidation of power at the Communist Party Congress, which cemented investor unease over Chinese tech regulation, lack of transparency, unpredictable policymaking and weak cyclical conditions. At the time, many investors were ready to call Chinese assets “uninvestable.”

Why now?

So why the rebound? Geopolitics have played a central role. Rising doubts over the United States’ role in the global order have forced investors to reassess whether it makes sense to hold such a heavy US equity weighting. Trade wars and Washington’s increasingly unilateral stance have weakened faith in global institutions, opening space for China and other EM countries to assert more influence.

In that sense, the EM bid may reflect US weakness as much as EM strength. Initially, Europe was the main beneficiary of diversification away from the US, but increasingly EMs have been pulling flows too.

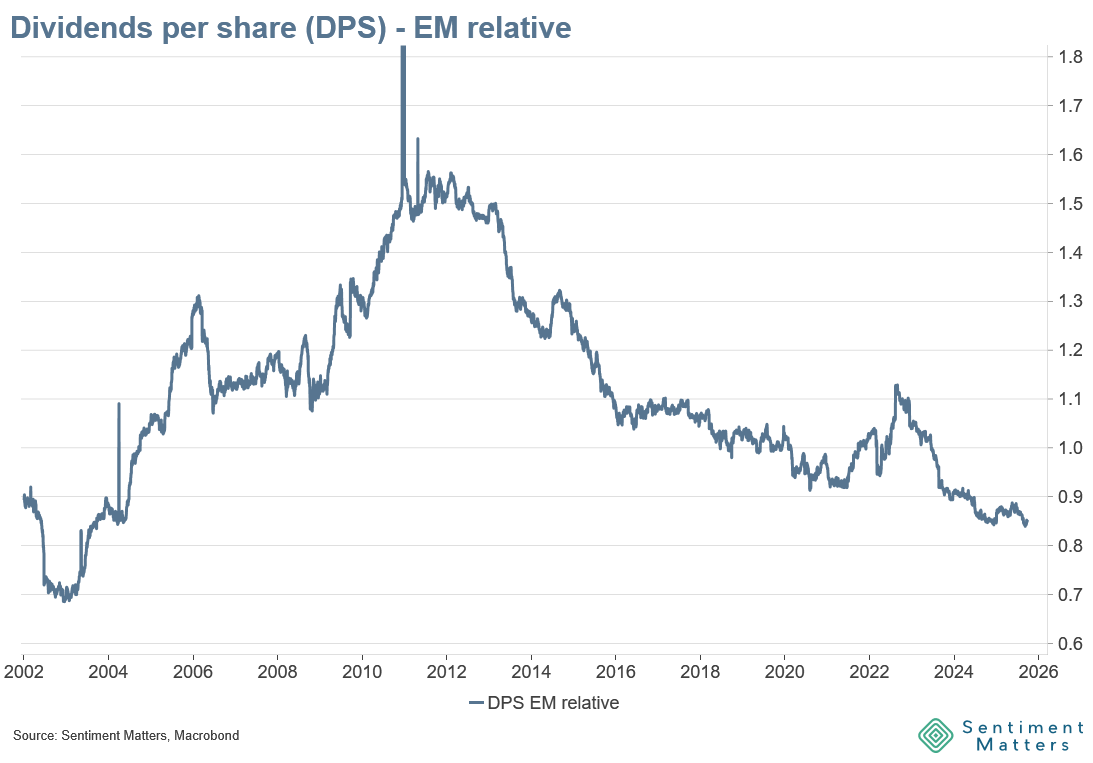

Fundamentals have not been the driver. Earnings and dividends have improved modestly, but only enough to keep pace with developed markets. That is better than the outright deterioration of previous years, but hardly an engine of outperformance.

The truth is that much of the recent EM recovery has been powered by hope more than hard evidence. The modest re-rating of EM equities relative to DM equities confirms as much.

Sentiment vs Performance

Sentiment is strong but still has room to run. Today’s 65th percentile reading is well below the extremes reached in previous cycles—the 77th percentile at the peak of the 2010 bull run, and the 84th percentile during the rally of 2016–17.

So far, the sentiment recovery has far exceeded outperformance. EM equities have had a solid year, but their outperformance versus US tech-heavy developed markets has been muted. After sixteen years of near-constant disappointment, merely keeping up with the global bull market is progress, but hardly a turning point.

Bull Case

The bull case is that positioning still lags sentiment. While sentiment can shift quickly—opinions can change overnight—actual portfolio allocations take much longer to adjust. Minds must be changed, new investment cases written, and investment committees convinced. That inertia is especially strong when investors have taken a public stance, as many did with the “China is uninvestable” narrative. The fact that sentiment has turned more positive at all means investors are once again open to allocating, but positioning will only catch up if fundamentals begin to improve in a sustained way.

So far, optimism has been priced in only cautiously. A modest re-rating has taken place, but from here, stronger earnings and dividend growth will be needed to drive further outperformance.

Bottom Line

EM Equity sentiment is he highest in six years. More bullish sentiment is not yet an obstacle to outperformance, but rather shows that investors are open to allocating more towards this long-neglected asset. EM equities need to deliver fundamentals to turn a good market into a bull market.