Daily News Sentiment Index: A Top-Tier Sentiment Indicator

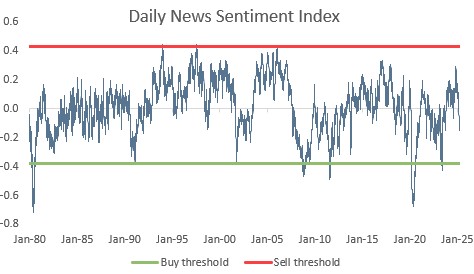

The San Francisco Fed’s Daily News Sentiment Index has been one of the most reliable sentiment indicators, especially for buy signals, with some value at extremes for sell signals. I rate it 3 out of 3.

Not all Sentiment Indicators are created equal, Part 11

Need to know

What is it: a high frequency index measuring economic sentiment in 24 major US newspapers.

The good: Simple, accessible, and highly effective—particularly for buy signals.

The bad: Slight lag due to smoothing; less effective for sell signals.

Current message: News Sentiment has fallen but is not yet at buy-signal levels.

Go deeper

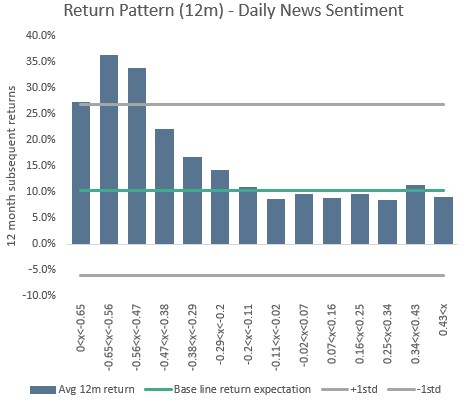

Track record: The most important test is whether an indicator has provided useful signals in the past - and this one has. Equity markets have historically performed best after periods of very negative news sentiment, and worst after overly positive sentiment.

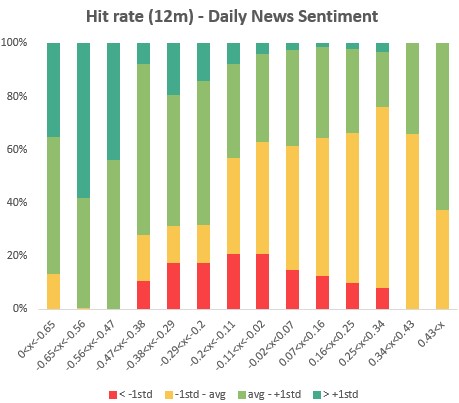

Best at extremes: Buy and sell signals have been most reliable when sentiment is at extreme highs or lows. Buy signals, in particular, become more powerful over longer time horizons, especially over 12 months.

Signals:

Buy signals: When News Sentiment drops below -0.38, the S&P 500 has averaged a 28.2% return over the next year, with above-average returns 85% of the time.

Sell signals: Less frequent, but when sentiment rises above 0.43, forward equity returns over 1, 3, and 6 months have been significantly below average, with high hit rates.

Construction: The San Francisco Fed’s News Sentiment Index uses natural language processing to scan 24 major U.S. newspapers, identifying economic terms and measuring the balance of positive vs. negative sentiment. A trailing weighted average is applied to smooth out day-to-day fluctuations and create a normalized index.

Recession indicator: Not surprisingly, economic news sentiment is worst in recession. The indicator also captures recession scares well - like those in 2011 and 2022.

Top Technicals: The series published daily, free to access, has a very long history going back to 1980 and has academic papers detailing the methodology.

Small time lag: The use of a trailing weighted average smooths the data, but it can also respond slightly slower to sudden shifts in sentiment.

Conclusion

The Daily News Sentiment Index stands out as one of the most effective contrarian sentiment indicators. It has consistently delivered reliable buy signals and at extremes also sell signals. While sentiment has recently dropped, it hasn’t yet reached the threshold for a new buy signal.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.