Bitcoin above $100k, but CFTC positioning data shows little bullishness. These indicators have been poor predictors of returns. I rate them 0.5 out of 3.

Not all Sentiment Indicators are created equal, Part 8

Need to know

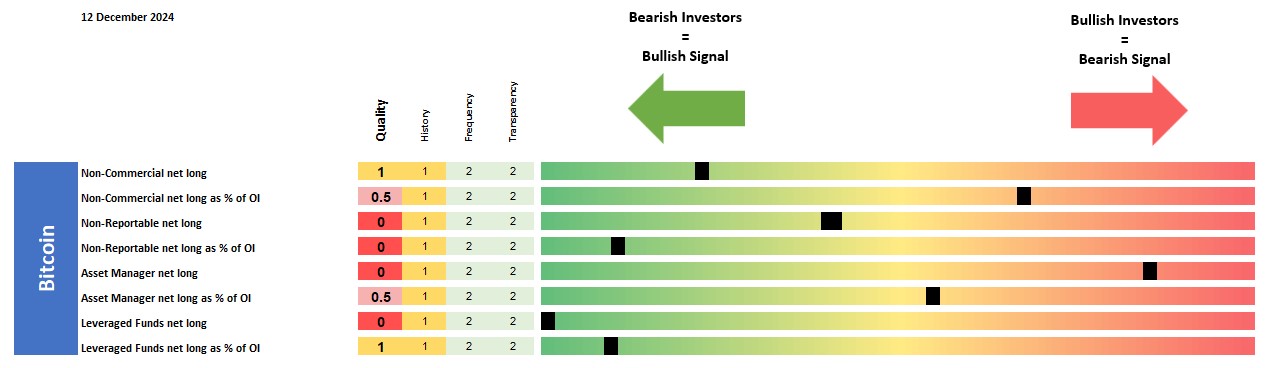

- What is it: Similar to my FX Sentiment Heatmap, I analyse CFTC positioning data for Bitcoin across investor groups, including net long positions and their percentage of open interest.

- The bad: Overall, few reliable signals, limited history, and inconsistent performance.

- The good: Speculative net long positions have occasionally acted as contrarian indicators.

- The future: CFTC data may cover the wrong type of investor, but this can change as crypto matures.

- Current message: No signs of extreme bullishness in the data; non-commercial positions are net short.

Go deeper

- Track record: These indicators have rarely provided reliable signals.

- The best one: Non-commercial net longs have been the most useful, with Bitcoin returns strongest following bearish positioning, particularly over short timeframes.

- Momentum rules: Several series (e.g., non-reportable net longs) show momentum dominating contrarian signals. The most bullish sentiment has typically been followed by the best returns, especially in the short term.

- New asset class challenges: The data, starting in 2018, has seen step changes and in some cases limited evidence of mean reversion, typical for a growing asset class. This may improve as crypto matures.

- Bearish Institutionals: CFTC data may not fully capture the investors driving Bitcoin’s rally, as retail investors—who have played a significant role—are not adequately represented. The lack of bullishness in the CFTC data could reflect institutional investors' structural skepticism. Over time, as the asset class matures and institutional participation grows, CFTC data may become more relevant.

- Frequency: Like all CFTC data, it is released weekly, reflecting positioning on Tuesday and published on Friday.

- Current level: Despite Bitcoin’s rally, CFTC data shows minimal bullishness, with non-commercial positions net short.

Conclusion

While the recent crypto rally suggests optimism, CFTC positioning data does not reflect extreme bullishness. However, these indicators have generally been unreliable predictors for Bitcoin. This may change as the cryptocurrency market matures.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.