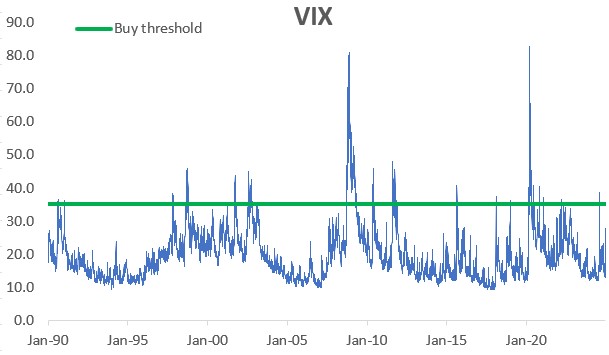

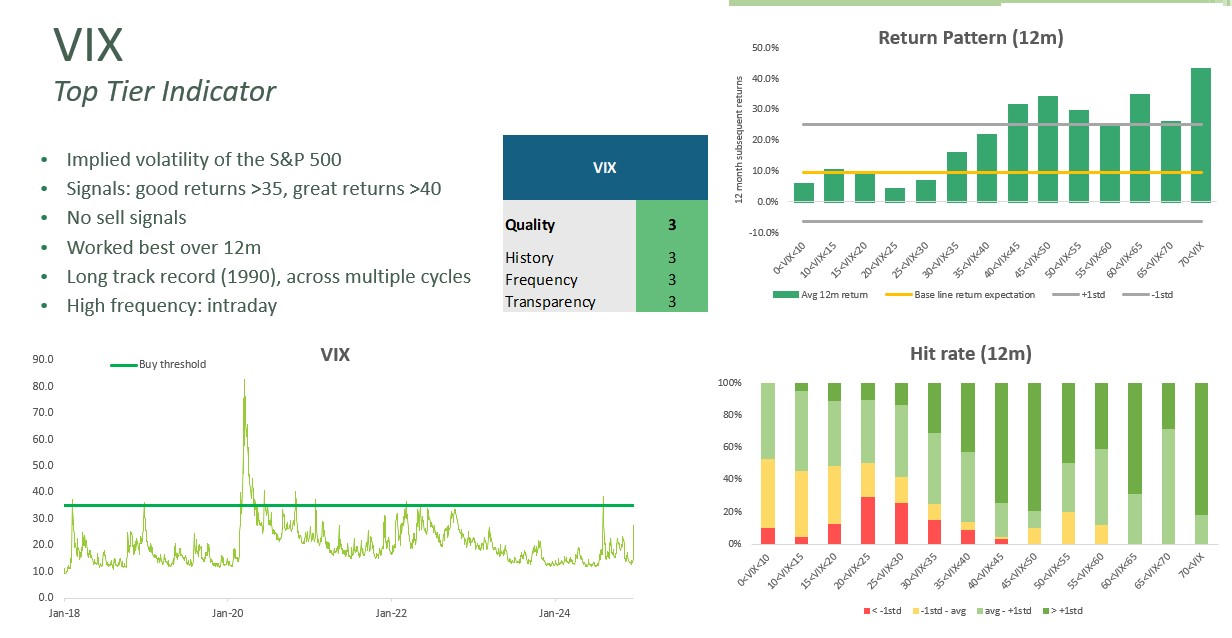

The VIX is an exceptional real-time sentiment indicator and consistently provides valuable signals. While it doubled during yesterday’s Fed-induced sell-off, it’s not at a level that signals a buy-the-dip opportunity.

Key points:

Proven track record: The VIX has the most important characteristic of a sentiment indicator: it consistently delivers useful signals. Equities have performed best after high VIX levels, though it doesn’t provide sell signals.

Strong buy signals:

A VIX above 35 has historically led to an average S&P 500 return of 28% over the next year, with a 90% hit rate of above-average returns.

If you raise the threshold to 40, both average returns and hit rates improve further.

All horizons: While results are strongest over a 12-month horizon, even shorter horizons, like one month, show significant positive returns following high VIX levels.

Current message: Yesterday’s VIX of 27 isn’t compelling. Historically, this level is consistent with slightly below-average S&P 500 returns and a 50/50 chance of above- or below-average performance.

Anyway, this morning’s price action shows stabilisation with the VIX drifting lower again, further away from a buy signal.

Conclusion: No buy signal from the VIX. It takes at least 35 for that.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.