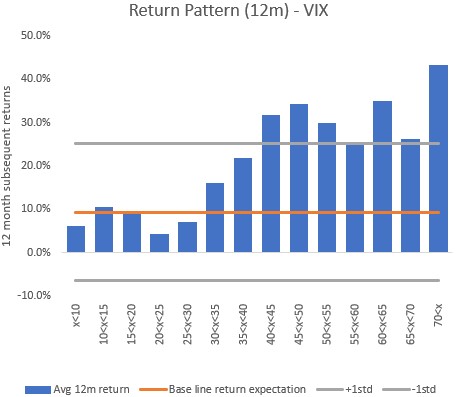

The VIX is an exceptional real-time sentiment indicator and consistently provides valuable signals. Today’s spike above 35 has triggered a VIX buy signal.

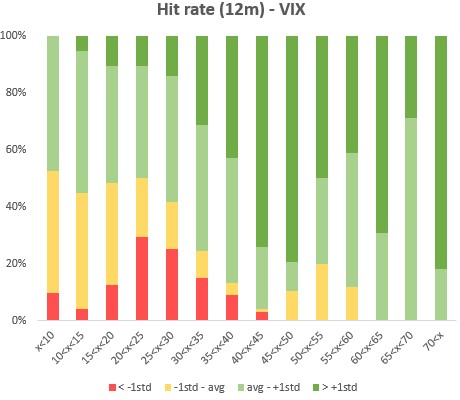

A VIX between 35 and 40 has historically led to an average S&P 500 return of 22% over the next year, with a 87% hit rate of above-average returns. The stats look even better with a VIX above 40.

This is when Sentiment Matters: As investors, we’re prone to emotional decision-making—getting greedy when markets rise and fearful when they fall. Sentiment analysis provides an objective tool to help manage these biases and avoid herd mentality.

Key points

- Proven track record: The VIX has the most important characteristic of a sentiment indicator: it consistently delivers useful signals. Equities have performed best after high VIX levels, though it doesn’t provide sell signals.

- Strong buy signals:

- A VIX above 35 has historically led to an average S&P 500 return of 28% over the next year, with a 90% hit rate of above-average returns.

- If you raise the threshold to 40, both average returns and hit rates improve further.

- All horizons: While results are strongest over a 12-month horizon, even shorter horizons, like one month, show significant positive returns following high VIX levels.

Conclusion

VIX says buy. It’s just one indicator, but a powerful one.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.