One of the clearest patterns in equity markets in recent months has been the rotation into economically sensitive stocks — Cyclicals.

This shift first showed up in our sentiment and positioning indicators as early as October, well before it became obvious in price performance. Since then, the rotation has gathered momentum, followed by strong outperformance across most cyclical sectors and factors.

Sentiment has risen sharply across our indicators — and that brings with it a familiar implication: as sentiment strengthens, the hurdle for further upside quietly rises, and the balance of risks shifts toward greater sensitivity to disappointment.

This note takes stock of where sentiment and positioning on Cyclicals now stand.

Is sentiment already extreme?

Is the trade overcrowded?

Or is there still room for further rotation?

Sentiment & positioning

We always start with the data.

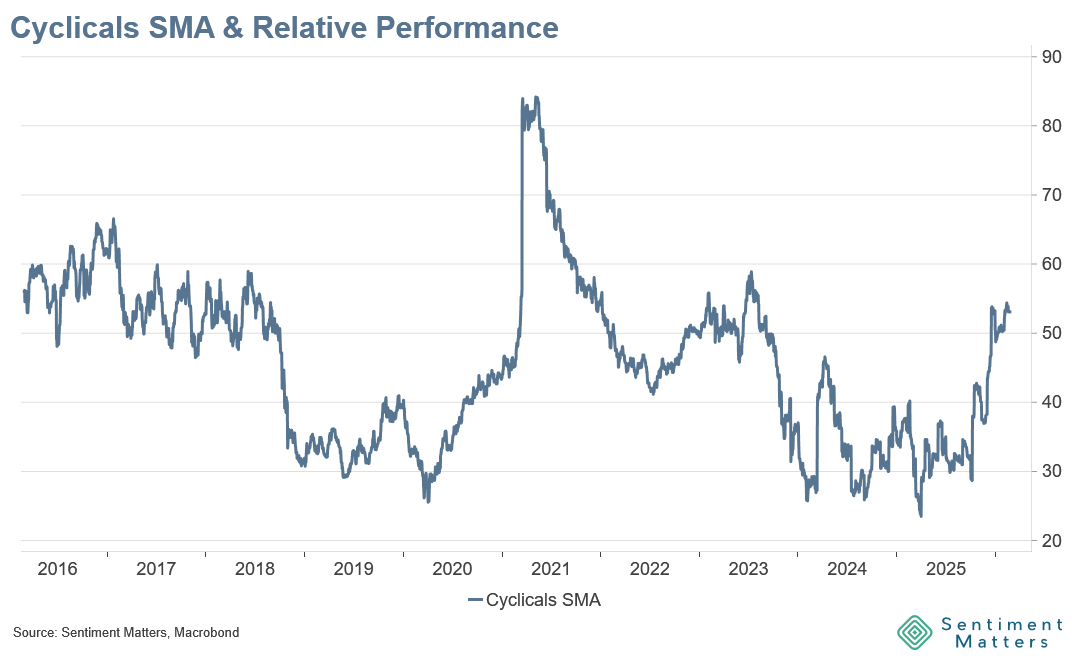

Sentiment toward Cyclicals has staged a remarkable recovery from the extreme pessimism seen around Liberation Day.

In April, the average cyclical sentiment indicator in our Heatmap sat at the 23rd percentile — around the lowest level in 24 years.

Since then, sentiment has rebounded sharply — accelerating in particular since October — to reach the 53rd percentile, the highest level in three years.

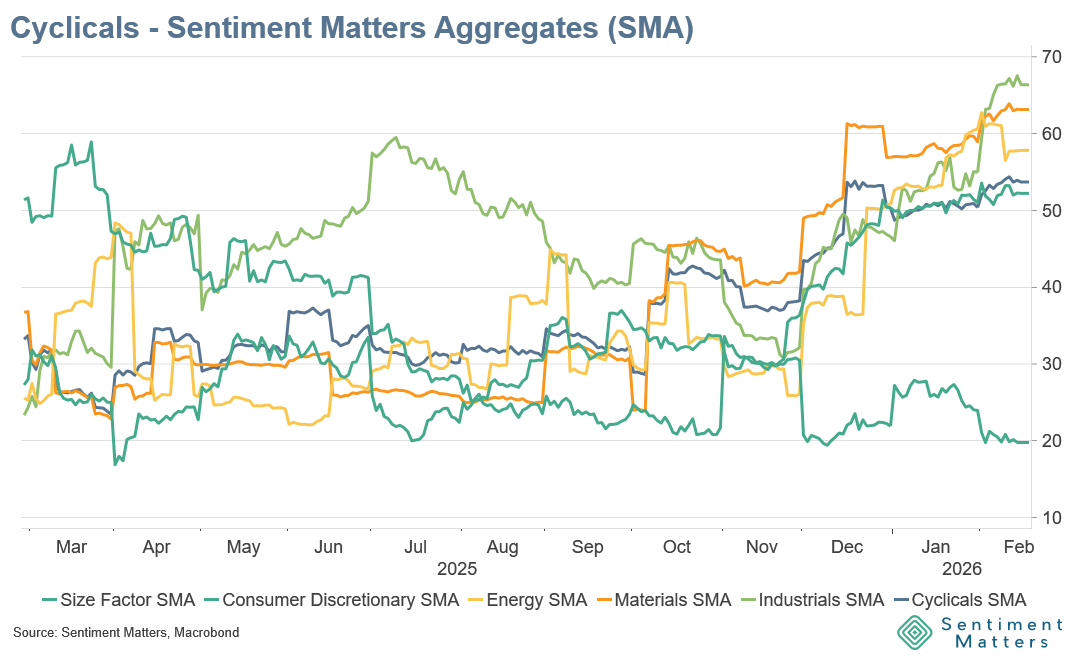

This recovery is broad-based — not driven by a single sector or indicator.

A snapshot across the cyclical complex highlights the breadth of the shift:

- Industrials: sentiment at a 2½-year high

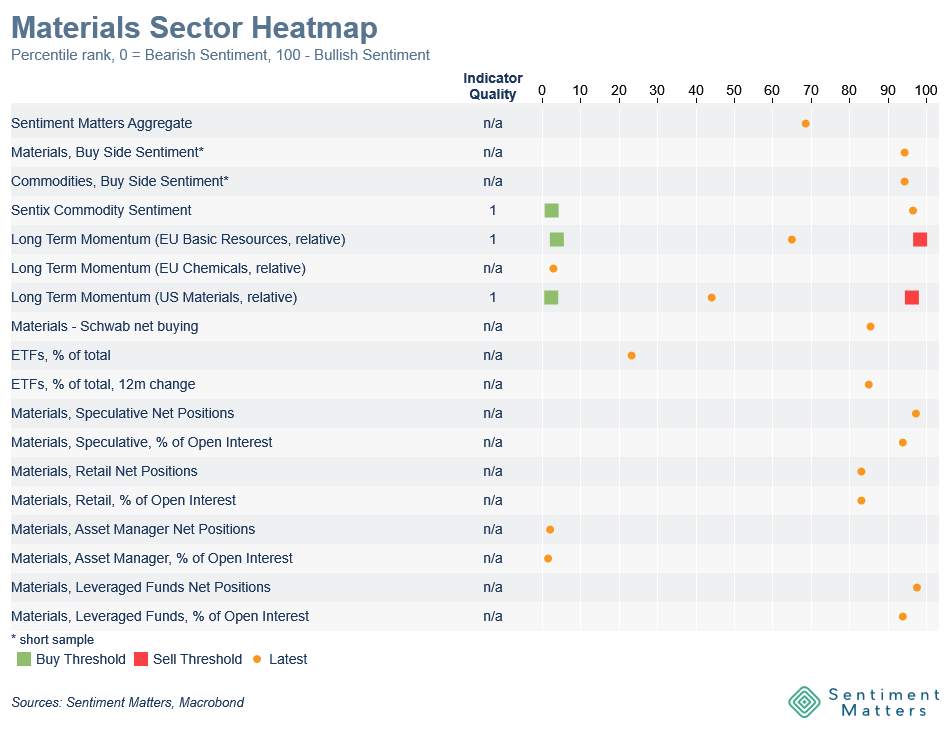

- Materials: sentiment at a 5-year high

- Energy: sentiment at a 2-year high

- Consumer Discretionary: still the laggard, with sentiment only modestly improved

Small Caps show a similar pattern:

- Small Cap sentiment troughed at the 25th percentile in August

- It has since rebounded to the 53rd percentile, a one-year high

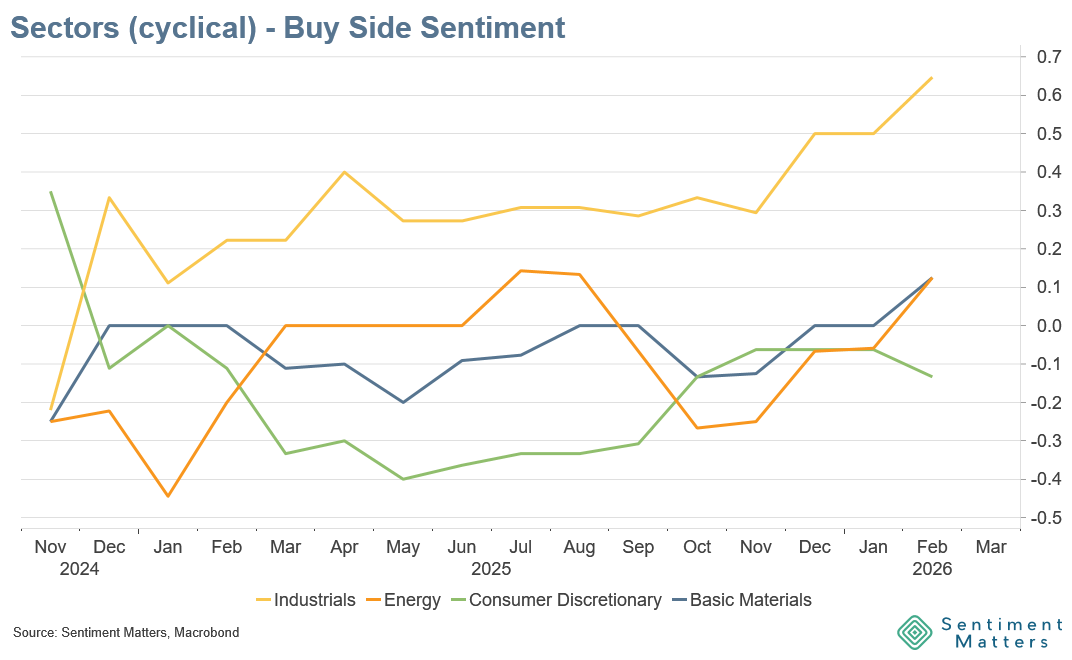

Institutional positioning confirms the shift.

In our latest Buy-Side Sentiment Tracker, Cyclicals led the upgrades, with broad-based increases across:

- Industrials

- Materials

- Energy

- Small Caps

- and Financials

The message is clear: the rotation into Cyclicals is not just a price story — it is reflected across sentiment, positioning, and investor allocation decisions.

Performance has followed sentiment higher

This improvement in sentiment has been accompanied by strong performance.

Over the past four months, the six best-performing sectors across the US and Europe have all been Cyclicals.