Commodities have had a great run. At least some of them have.

This is a very bifurcated story. Gold (and silver) and industrial metals — especially copper — dominate the performance leaderboard across multiple horizons, while other parts of the complex lag well behind.

There has been plenty of commentary on the rally (and correction) in precious metals. But from a sentiment perspective, if sentiment in gold is hot, sentiment in copper is hotter.

When sentiment becomes broad, extreme, and unusually unanimous, an asset can start to feel invincible. But that feeling of invincibility is often what creates the vulnerability: the hurdle for further upside quietly rises, and the distribution of outcomes shifts toward asymmetric reactions to “less-good” news.

This note follows up on last week’s look at the broader commodity complex — and the deep dive into gold — with a deep dive into copper.

As always, this is not a call to “sell copper” or to pick a top. It’s a sentiment note. And sentiment analysis is best used to do two things:

- Spot when the hurdle for further upside is rising and downside reactions become sharper.

- Identify the prevailing narrative — and stress-test it. What assumptions does it rely on, and what could realistically force a rethink?

Sentiment & positioning

We always start with the data.

Our Sentiment Matters Aggregates (SMAs) show a commodity market split down the middle:

- Net bearish sentiment in Softs/Agriculture and Oil

- Net bullish sentiment in Precious Metals and Industrial Metals, with Copper the clear standout

If sentiment in gold is hot, it’s hotter in copper.

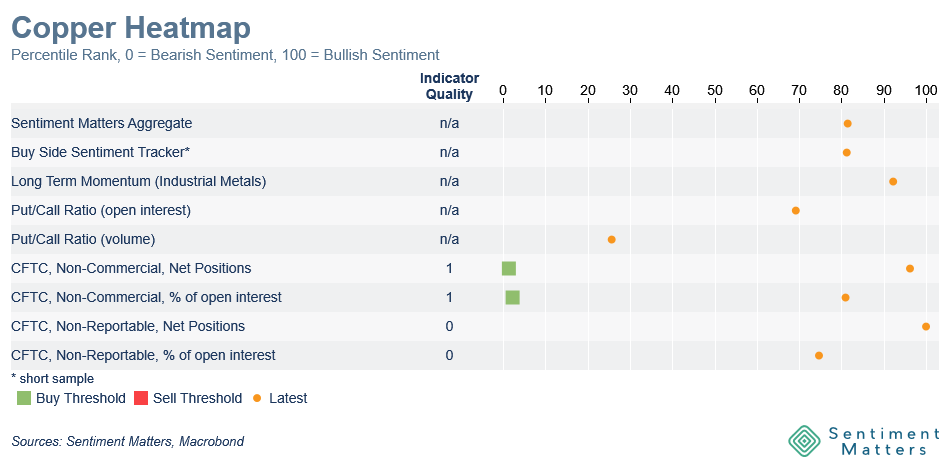

Copper: unusually broad-based bullishness

Copper is not just bullish. It is unusually and broadly bullish.

Across indicators, investor types, and datasets, conviction is remarkably aligned:

- 7 of 8 are above the 70th percentile

- 3 of 8 are above the 90th percentile

Positioning is especially stretched:

- CFTC speculative net positions: 96th percentile

- CFTC retail positioning: 99th percentile