7 August 2025

Bottom lines

- Buy-the-Dip lives on. With sentiment neutral, path of least resistance remains higher

- Dark Index tracks dark pool momentum—not investor fear

- STAX: a retail sentiment indicator that is still cautious, contrary to the market narrative

- Pound sentiment plunges—CFTC data shows a sharp turn, with bearish momentum building

1) Sentiment Today: Buy the Dip Lives On

- Friday’s sell-off was sharp—but sentiment says: keep buying the dip.

- Friday’s drop triggered a bearish sentiment shift, but it was short-lived—most losses were erased within a day.

- The VIX spiked to ~22, which historically implies slightly below-average S&P 500 returns and a 50/50 outcome—not close to a contrarian buy signal.

- Friday’s equity drop (-2.5%) followed data that raised recession risks, the equity market’s kryptonite.

- Sentiment remains muted, with most indicators near the middle of their historical ranges.

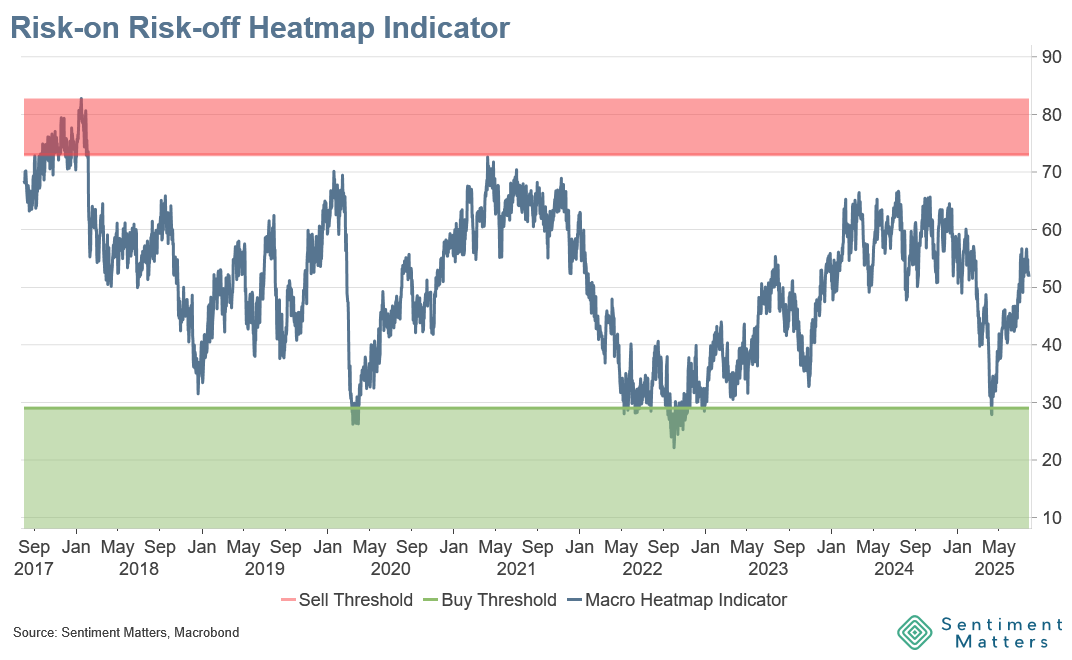

- Our Risk-On/Risk-Off Heatmap sits near the 50th percentile

- With sentiment neutral, the path of least resistance is higher—equities can grind higher unless growth expectations are materially repriced.