Christmas markets are open, Outlook Season is in full swing and investors are busy implementing their 2026 views before liquidity dries up. Against that backdrop, our big picture read on sentiment hasn’t changed: it remains a supportive setup for risk assets into year-end.

Rising markets have pushed sentiment a bit deeper into bullish territory, which means the “runway” before sentiment becomes a headwind is getting shorter. Equities are back near the highs, but sentiment hasn’t fully followed — the gap has narrowed, yet sentiment still sits well below previous peaks.

You can see this in our Sentiment Matters Aggregate, which has climbed to 60 from the mid-50s post-correction. That’s constructive, but still shy of the October high of 65. Historically, this zone maps to slightly below-average 12-month returns, but without a strong directional message.

This relatively neutral sentiment backdrop sets the stage for the rest of this week’s update:

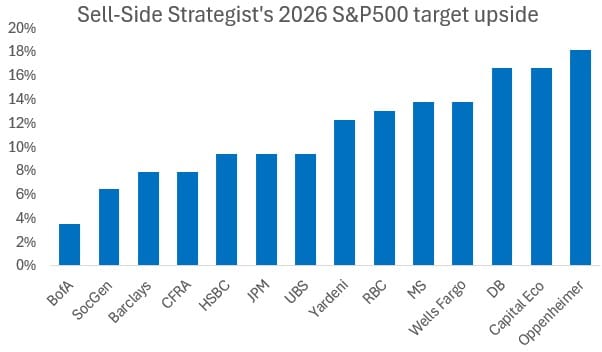

- Sell-side strategists are releasing their 2026 targets, and the good news is that they’re reassuringly boring. Despite a multi-year bull market, there’s little sign of exuberance in the forecasts.

- Retail investors, however, tell a different story: the AAII Asset Allocation Survey is starting to flash orange, with equity allocations near extremes and cash near 25-year lows.

- But before we conclude retail is euphoric, the Schwab Trading Activity Index (STAX) offers a useful counterbalance — showing positioning that’s far more cautious and contrarian.

Taken together, sentiment into year-end looks supportive but not stretched, with pockets of bullishness (retail allocation), pockets of neutrality (STAX), and broadly grounded expectations on the sell side.

Sell-Side Strategists’ 2026 Index Targets Are Reassuringly Boring

It’s Outlook Season, when every sell-side desk releases its annual tome. Cynics say these reports are mostly noise — repeating familiar lines, missing real surprises, and offering little insight into what will actually drive markets.

But pragmatic investors view Outlook Season differently.

Once a year, every sell-side institution goes through the same forecasting ritual at the same time — and publishes it.

That makes it a rare chance to measure consensus and sentiment, rather than a search for clairvoyant predictions.

As a former sell-side equity strategist who once had to publish my own index targets, I’m always curious to see where my former colleagues and competitors land.

And from a contrarian perspective, this year’s targets look… reassuringly boring.

The average upside from yesterday’s close to 2026 targets is 11%, almost exactly in line with the ~10% historical average baked into past Outlooks.

To me, that says something important: despite several years of strong equity markets, the sell side isn’t displaying excessive exuberance. Sentiment looks fairly neutral — and this far into a bull market, neutral is a quietly constructive signal.

There is one caveat: timing matters. Targets are published at different points, and what was a 10% upside at launch may look like 5% or 15% today. But across a dozen outlooks, those differences likely average out.

Bottom line

This year’s Outlooks suggest a market that is optimistic but grounded — a consensus that hasn’t drifted into froth. That’s exactly the kind of backdrop that can extend a bull market rather than end it. Sometimes, “boring” is bullish.

Retail Investors Are Getting Very Bullish

The AAII Asset Allocation Survey Is Starting to Flash Orange