Today we’re introducing the latest addition to our sentiment analysis toolkit — the Sentiment Dashboard.

The Dashboard offers the fastest way to get a complete overview of where investor sentiment stands across more than 400 indicators and 60 asset classes. If speed and clarity are what you need, the Sentiment Dashboard delivers both.

Go Deeper

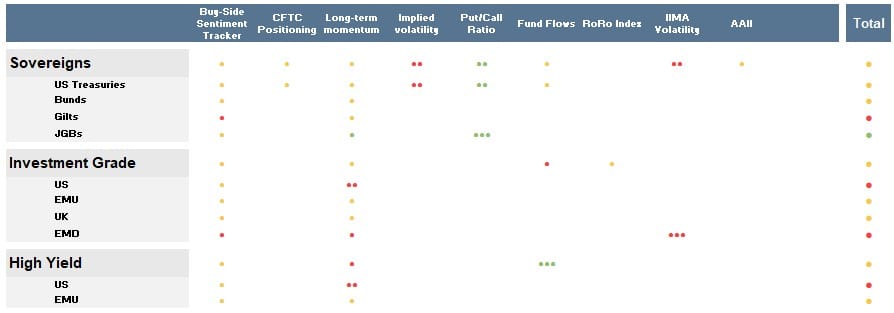

The Sentiment Dashboard aggregates data from over 400 indicators into an intuitive interface and a single, easy-to-interpret score. It combines input from our proprietary Buy-Side Sentiment Tracker, CFTC positioning data, long-term momentum, a variety of options metrics, fund flows, and multiple asset-specific indicators.

Each indicator type is translated into a score ranging from –3 (very bullish) to +3 (very bearish), providing a consistent scale for comparison.

The Dashboard covers 62 assets spanning equities, fixed income, cash, commodities, and crypto. Within equities, users can drill down by region, sector, and factor. In fixed income, coverage includes sovereigns, investment-grade, and high-yield bonds across major regions. The commodities section features oil, industrial metals, soft commodities, and gold, while sentiment is also aggregated across Alternatives and twelve major currencies.

How It Fits

The Sentiment Dashboard complements our existing tools. It’s designed for those situations when you need a clear, high-level view of global sentiment — a quick “500-foot” perspective.

For those who want to go deeper, our Heatmaps provide the next layer of insight. They show the breadth of indicators behind each asset, where current sentiment sits in a historical context, and how close it is to past buy or sell levels.

And if you want to analyse sentiment at the most granular level, our Indicator Intelligence charts let you explore every single indicator in detail — complete with historical time series, return patterns, and hit rates.

Live Now

The Sentiment Dashboard is live now. It’s the fastest route to understanding how investors feel — across every asset class, all in one place.

We hope you enjoy exploring this new tool. Try it out and let us know what you think — your feedback is invaluable in helping us keep improving and building the most useful sentiment tools possible.