Markets ended 2024 quietly, with sentiment remaining neutral as we enter the new year. The bar for economic and earnings growth, along with macro newsflow, to drive further equity gains is not particularly high. If growth meets expectations, equities are likely to grind higher.

Go deeper:

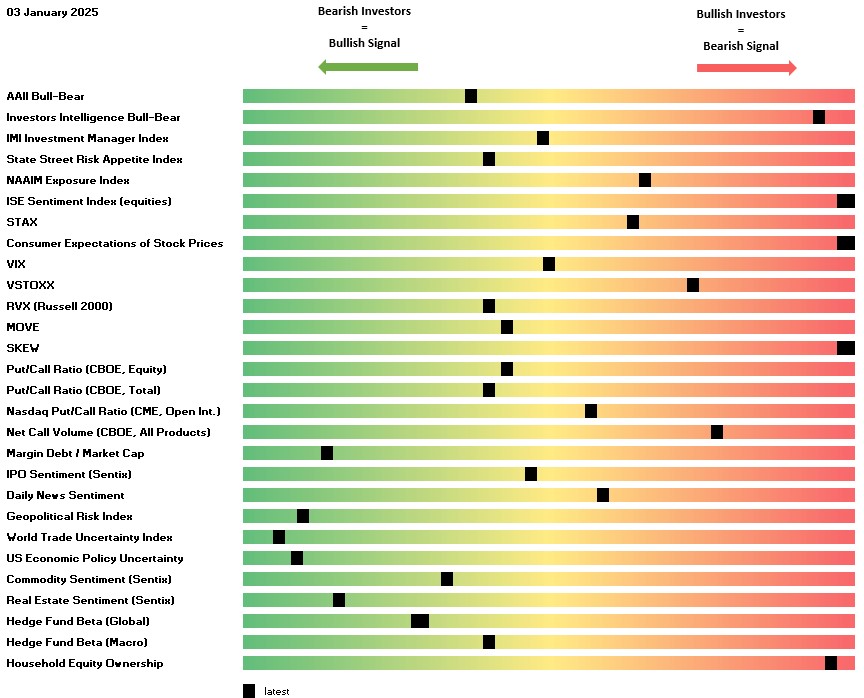

Neutral sentiment: The excitement of 2024 has subsided, taking the bullish froth out of markets and leaving sentiment neutral. The average Heatmap indicator is now at the 55th percentile, near pre-election levels and the average of recent years

AAII Bull-Bear Survey: A top-tier indicator, it remains firmly neutral and has been drifting lower for several weeks. With equal numbers of Bulls and Bears, it is consistent with average equity returns over the next year. This contrasts with the still-bullish II survey, which has a weaker track record.

Lingering bullishness: Five indicators remain near peak bullishness, but all have caveats:

SKEW: Poor at predicting equity returns.

Household Equity Ownership and Consumer Expectations: Monthly data that’s somewhat outdated.

ISE Sentiment and II Bull-Bear: Contradicted by the more reliable AAII survey

Geopolitical risk sentiment: Geopolitical Risk Index, World Trade Uncertainty and US Economic Policy Uncertainty are around the 95th percentile. As the new administration settles in, some uncertainty should subside. This is one of the areas where the risk is skewed towards an equity-market positive outcome.

Conclusion

Sentiment remains neutral. Economic and earnings growth meeting expectations should be enough for equities to grind higher in 2025.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.