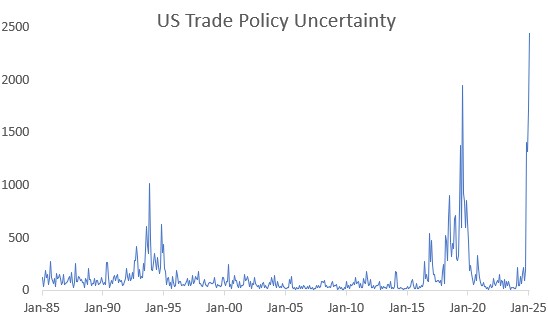

US Trade Policy Uncertainty has surged to all-time highs. Measured monthly, the index likely understates the true level of real-time uncertainty. But what does this mean for markets? In short — probably nothing.

Key Points:

- What it is: A sub-index of the broader Economic Policy Uncertainty dataset, focused solely on US trade policy.

- Current reading: At a record high, and likely higher in real time given recent developments.

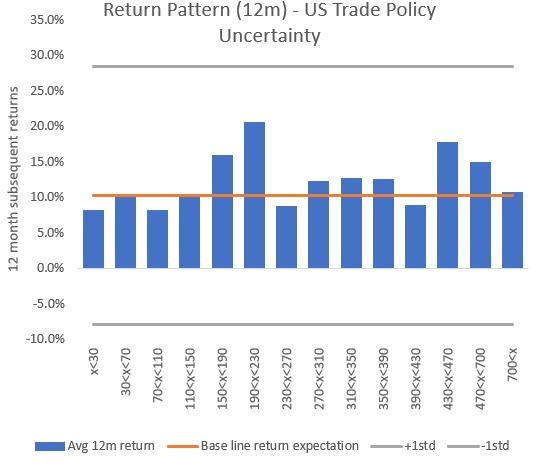

- Contrarian case? You might think extreme uncertainty could be bullish — with bad news priced in and sentiment due to mean-revert. Or bearish — due to potential drag on growth and rising recession risk.

- Track record: Neither. Historically, extreme US trade policy uncertainty has not been followed by strong or weak equity returns. Market performance has been roughly average, with returns above or below average about 50/50 across short- and medium-term horizons.

Conclusion:

Despite record highs, US Trade Policy Uncertainty has no consistent impact on future equity returns. So, whatever happens on Liberation Day tomorrow, this isn’t a reason to be long or short. Look elsewhere for your edge.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.