4 August 2025

Sentiment Overview

- Friday’s sell-off triggered a bearish shift in sentiment—but as always, high-frequency indicators pick up changes first. It will take time for this to filter into daily and weekly aggregates.

- The VIX spiked to ~22 on Friday before easing slightly. That’s not a “buy-the-dip” level. Historically, VIX at 22 is linked to slightly below-average S&P 500 returns and a 50/50 chance of outperforming or underperforming over the next 12 months.

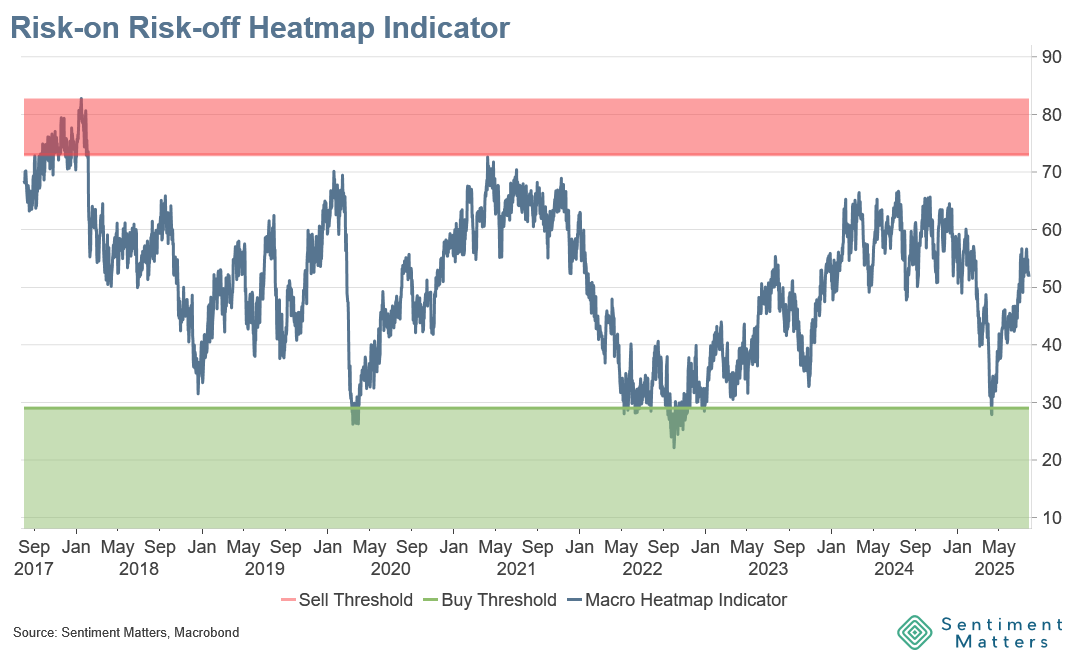

- Our Risk-On/Risk-Off Heatmap Indicator remains neutral, near the 50th percentile—above April’s lows but below last year’s high-60s.

- The AAII Bull-Bear survey continues to drift more bullish, though still far from a sell signal. (Note: the survey predates Friday’s decline.)

- Overall, sentiment was mixed:

- Equal number of indicators moved in bullish and bearish directions

- Fund flows were the most bullish shift this week

- Options and geopolitical risk indicators drove the most bearish movement

Equities

- Most bullish sector: Communication Services

- Most bearish sector: Consumer Discretionary

- Energy sentiment turned more bullish, led by speculative positioning

- Tech sentiment was mixed:

- High-frequency put/call ratios turned more bearish post-Friday

- But speculative positions became more bullish ahead of key earnings

FX & Crypto

- USD sentiment remains bearish, but has ticked up slightly—still ranking just above the Canadian dollar

- Leveraged Funds are the most bullish on USD—typical of short-term contrarian trades

- Retail positioning turned more bullish this week

- CFTC Asset Manager positions remain deeply bearish and near historical buy signal levels

- GBP was the biggest FX sentiment mover—bearish across all groups

- Most bullish FX sentiment: Euro, Yen, and South African Rand

- Bitcoin sentiment cooled as prices dipped. The Fear & Greed Index fell from the 85th to the 59th percentile

Commodities

- Oil: Positioning declined, and none of the previous sell thresholds were triggered this week (unlike the last few weeks)

- Gold & Silver: Both saw a rebound in positioning and remain firmly in bullish territory, but no historical sell signals were triggered

Hope this is helpful.

Have a great week—and good luck out there.

—Lars

Risk Asset Heatmaps