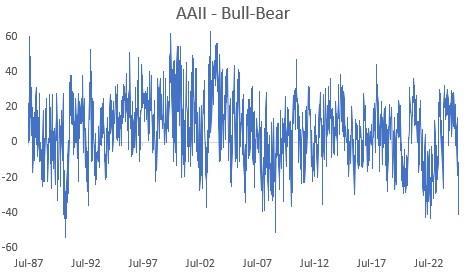

AAII Bull-Bear drops to -41.2%! Only a small dip in equities, but a huge hit to Sentiment.

This week’s Bull-Bear spread is extreme. It’s the lowest since the 2021 recession scare, more bearish than at any point during the pandemic and the 8th most bearish reading (Bulls-Bears) in its 35-year history. Also one of the largest increase in Bears in a single week (17th largest).

Given the only modest pull-back in equities so far, it’s tempting to put this survey off as an outlier. But what do the numbers say?

The AAII survey has been an exceptional sentiment indicator and consistently provided valuable signals. Ignore it at your own risk.

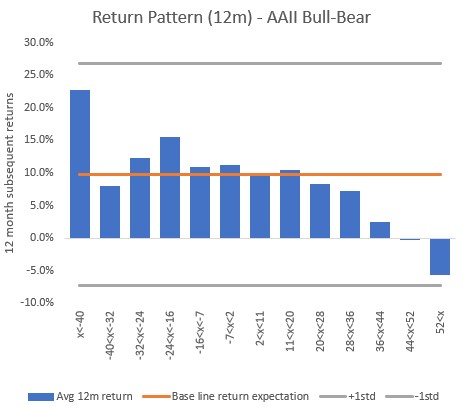

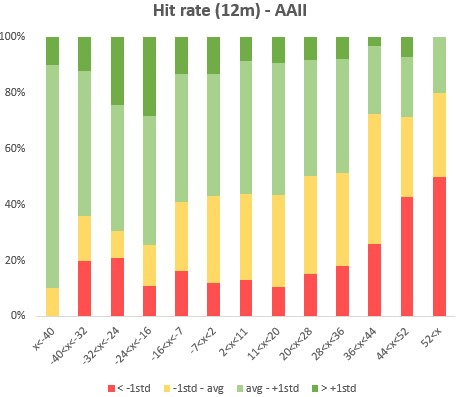

1) Proven track record: The AAII has the most important characteristic of a sentiment indicator: it has consistently delivered useful signals. Equities have performed best after low AAII levels and worst after high levels.

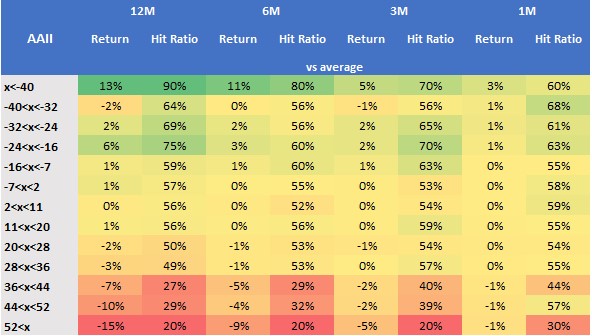

2) Buy signals: An AAII below -40% (where it stands today) has historically led to an average S&P 500 return of 23% over the next year, with a 90% hit rate of above-average returns.

3) All horizons: While results are strongest over a 12-month horizon, even shorter horizons, like one month, show significant positive returns following an AAII below -40%, though the hit ratios suffer.

Conclusion: Buy signal from the AAII. Yes, it’s an outlier and the equity draw-down is modest, but it shows Sentiment has swung firmly into bearish territory, improving the equity risk/reward.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.