5 stories that caught my eye this week and what I took from them.

Robot wars & robot hype– Tech Crunch

- Figure rides the humanoid robot hype wave to $2.6B valuation | TechCrunch

- The robotics theme has been getting more attention recently, but has been a laggard in equity markets

- It was on OpenAI’s ‘request for startups’ list. Bill Gates published a list of robotics startups he’s excited about. Tesla releases regular videos of Optimus’ progress. And Figure’s big funding round in terms of money and partners made a lot of headlines.

- It’s a theme that has been accelerated by the progress in AI.

- Robotics is changing: from single purpose robots (think robot arms in a car factory) to general purpose robots that can quickly pick up different tasks the way humans do. This is an ambition rather than today’s reality.

- Humanoid general-purpose robots make sense. Our world is built by humans, for humans. If we want robots to operate in our environments, those robots should be modeled after people.

- One thing to remember: be careful with the videos. They look impressive, but are often heavily edited.

- Bottom line: Robotics is one of the themes that can be accelerated by AI progress. The TAM of a theme targeting ‘disrupting labour’ is certainly big and it’s a theme that hasn’t rallied.

Net Zero Will Be Harder Than You Think…And Easier – Michael Liebreich

- Liebreich: Net Zero Will Be Harder Than You Think – And Easier. Part II: Easier | BloombergNEF (bnef.com)

- The Bull Case for the Net Zero transition

- 5 Superheroes of the transition

- Exponential growth. Solar wind and batteries have been on a steady path of price declines for decades, which have resulted in enormous absolute declines in costs. They are technologies, not commodities, this is ‘normal’ and will continue.

- Systems solutions. A smart grid that integrates the many components of the transition: renewables, CCS, nuclear power, demand responses, different storage solutions, hydrogen, biogas, interconnections…

- Great power competition. There are no longer any hard-to-abate sectors. There are only some sectors in which clean solutions are not projected to undercut their fossil-based alternatives. They will require a carbon price, but in the affordable range of $75 to$250 per ton of CO2 equivalent rather than $500 to $2,000 estimated a few years ago.

- Disappearing demand. Estimates of critical mineral demand from clean energy technologies have been substantially over-estimated. Thought experiment: suppose your battery has a life span of 15 years, and together collection and recovery rates exceed 90%. Then as long as battery energy density improves by 10% every 15 years – and remember it doubled in the past decade – your initial battery minerals will continue providing the same storage services forever.

- Ignore the Primary Energy Demand statistics. They grossly exaggerate the challenge of decarbonisation.

- Bottom line: Decarbonisation is challenging, but achievable. 5 reasons for optimism.

Tech War or Phony War? America’s Flimsy Controls on Semiconductor sales to China – Douglas Fuller

- delivery.php (ssrn.com)

- This paper challenges the ‘China-US decoupling’ narrative. Could there be more noise than action, even in semiconductors?

- “The looming dramatic decoupling in semiconductors has turned out to be a very tentative and partial disruption.”

- It seems that despite the rhetoric, in practice controls have not been strictly enforced, licensing has been looser than expected and loopholes have not been closed.

- At the same time, the paper argues China has not made much progress switching to domestic equipment.

- Bottom line: ‘Tough on China’ remains one of the few bipartisan views in Washington, so more tough rhetoric seems a given. But the lesson from semiconductors has been that actions have been less aggressive than words.

ARK, AI and GDP – ARK Invest

What to make of ARK Invest’s research? As with all investment research, you should consider the source. But there are some things about their research I like.

It is different and non-consensus, which makes reading it more useful than reading yet another consensus report.

It is also transparent, so you can decide whether you follow the arguments and assumptions, or not.

Here are two recent charts of theirs I liked

AI & GDP

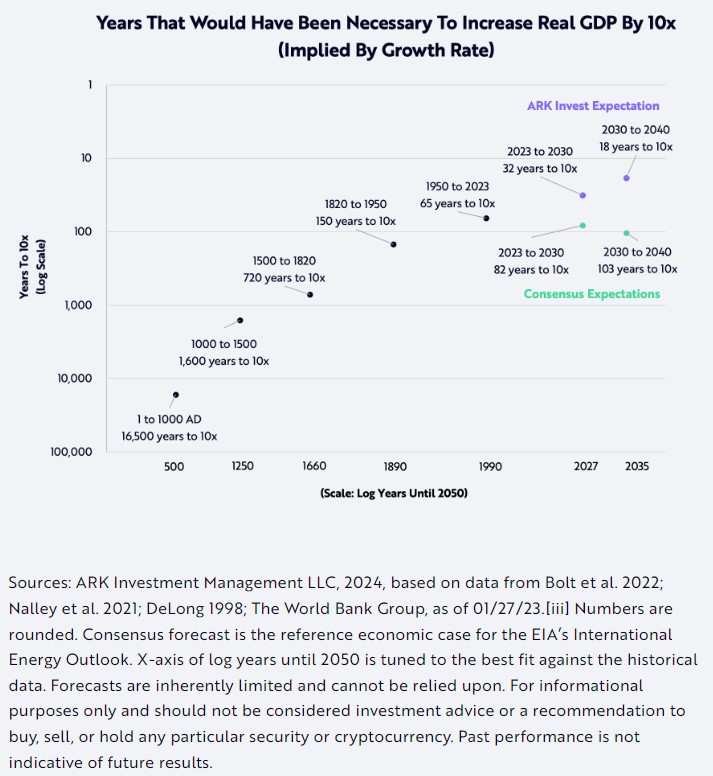

- A few weeks ago, I wrote about an academic paper laying out how transformational AI could lead to explosive GDP growth. It seems Cathie Woods’ ARK Invest have also been reading the paper.

- Their chart, though there’s some creative scaling going on, highlights how unusual a steady slowing of growth rates would be in the long arc of history.

- AI acceleration

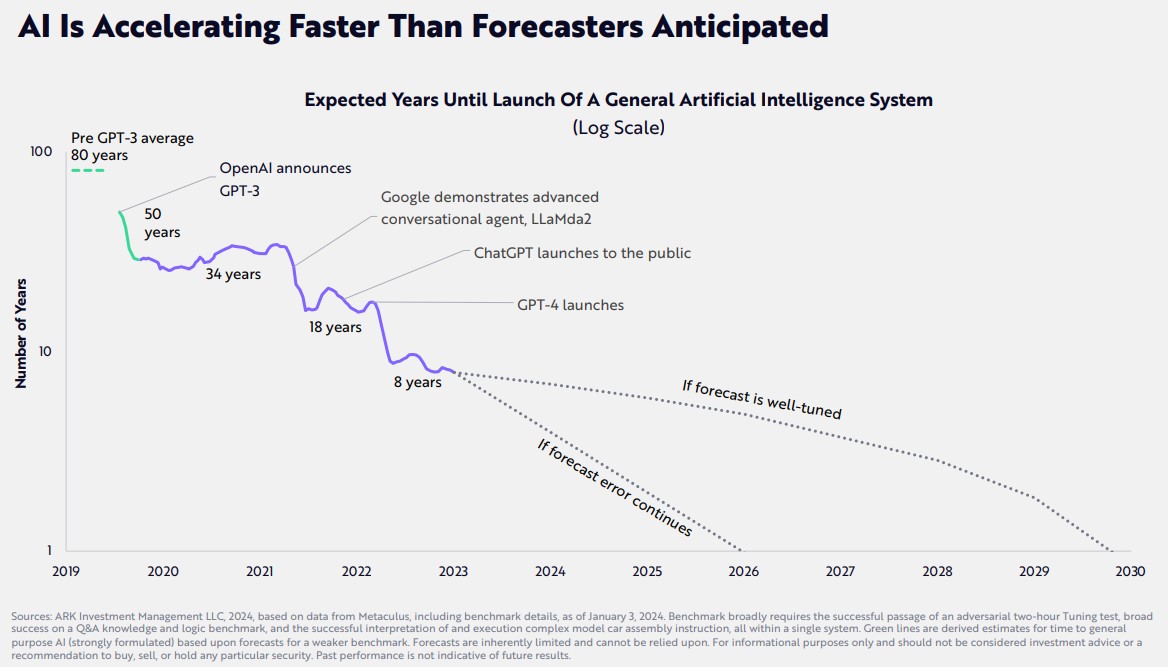

- I’ve shown Metaculus expert predictions many times before. This chart shows how expected timelines to Artificial General Intelligence have accelerated. It also shows that if the recent acceleration in timelines continues apace, AGI may be closer than it seems.

- This reminds me of how renewable energy cost curves have repeatedly been underestimated. The human brain does not cope well with estimating the long-term effect of exponential growth…or compound interest.

- Caveat: again, there is some optimistic drawing of trendlines in the chart, but the overall point remains

Trump is stronger than you hope– Nathaniel Rakich / FiveThirtyEight

Super Tuesday Brings A Couple Surprises | FiveThirtyEight Politics Podcast (youtube.com)

A lot of people who don’t want Donald Trump to win seem to be taking comfort from Nikki Haley outperforming the polls in many of the GOP primary races. Does this mean polls overestimate support for Trump? Will that carry over to the general election?

FiveThirtyEight’s Nathaniel Rakich makes a good case that this hope is misplaced. Starts 8 minutes in.

The reason for the polling error was that the electorate looked different from what pollsters expected. More independents (and Democrats) participated in GOP primaries than expected. But this error does not carry over to modelling the general election electorate.

You can’t use past polling error to predict future polling error.

Bottom line: Haley outperforming the polls tells us nothing about the general election.