Five stories that caught my eye this week and what I took from them.

Trump and Biden are tied in 538's new election forecast – 538

- Who Is Favored To Win The 2024 Presidential Election? | FiveThirtyEight

- Trump and Biden are tied in 538's new election forecast - ABC News (go.com)

- With 5 months to the US election, election models are being released. There has been much change at 538, but they remain the leader on evidence-based election modelling.

- Polls are good, models are better, but neither is perfect.

- The consensus narrative suggests Trump is the likely next President, with a modest polling advantage and a lead in most prediction markets like PredictIt, Manifold, and Polymarket.

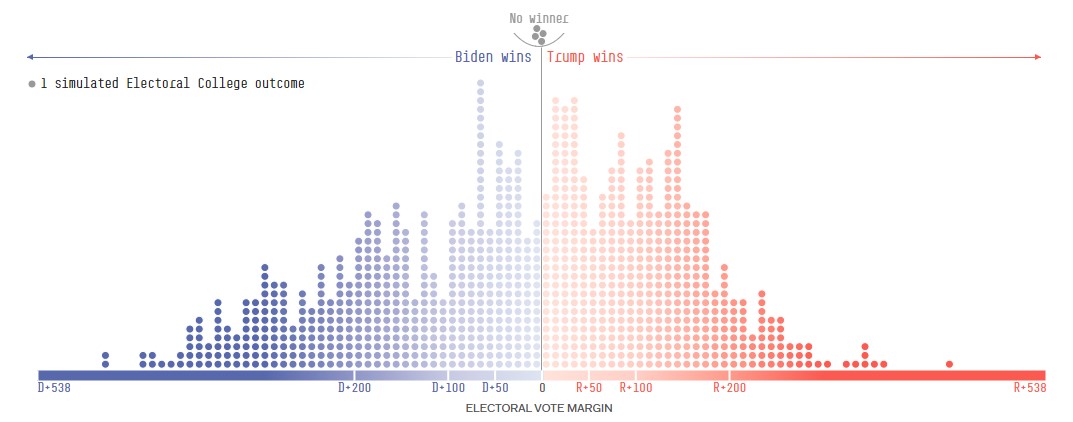

- Interestingly, 538’s model shows Biden slightly more likely to win, predicting Biden 52 times out of 100 and Trump 47 times

Source: 538

- Why the difference? Polls dominate the narrative. They are high-profile, readily available, released regularly and easily digestible. But focussing on polls ignores other factors: polls still have much time to change, there is a tendency for voters to ‘come home’ to their party at the election, we don’t know who is going to turn out, polls can systematically underestimate support of a candidate, the economy matters too, as do demographics and approval ratings.

- Bottom line: The election is too close to call. I’d be tempted to take the other side whenever the consensus narrative shifts to favour a specific candidate.

AI is promoted from back-office duties to investment decisions – Financial Times

- AI is promoted from back-office duties to investment decisions (ft.com)

- Aside from early adopters like Klarna the rollout of AI tools in most workplaces is still in its early stages.

- Asset Management isn’t lagging, but it’s also not leading in AI adoption. This does not come as a surprise to anyone who has worked in the industry and witnessed the reluctance to move on from outdated technology.

- This FT article gives a good overview of first-generation AI use cases in investment management.

- Everyone has an AI project; you cannot afford not to. But having closely followed this topic and having worked with a startup innovating in the space, my impression is that the efforts listed here only scratch the surface of what is and will be possible.

- The hurdle for AI to autonomously make investment decisions is high. To me the greatest business opportunities lie in tools that make human analysts and portfolio managers better. Just like copilot helps you write better code faster, AI can help analysts digest more information and make better forecasts. It can help portfolio managers avoid biases, make fewer mistakes and spot more potential opportunities.

- Bottom line: We’re only in the first inning of AI adoption in investment management

Procyclical Stocks Earn Higher Returns – Goetzmann et al

- w32509.pdf (nber.org)

- Equity factors like Value, Size, Min Vol and Momentum have been around for decades and form the basis of many funds.

- The idea is that stocks that have certain characteristics offer a risk premium and deliver superior risk-adjusted returns over longer time horizons.

- This paper argues that there is also a procyclicality premium that is “statistically significant, economically large, long-lasting over a few years, and independent of other equity factors”. In short, Cyclicals could be another equity factor.

- If you want to narrow it down further, the procyclicality premium is largest among large cap value stocks and momentum winners.

- Equity factors should be explainable. This premium exists because cyclical stocks offer less protection against drawdowns in recessions and therefore require higher average returns to attract risk averse investors.

- It would be great to get a view from an equity factor expert on this @AndrzejPioch

- Bottom line: A procyclical risk premium?

‘Alarming’ Ocean Temperatures Suggest This Hurricane Season Will Be a Daunting One – The New York Times

- Ocean Temperatures Suggest a Daunting 2024 Hurricane Season - The New York Times (nytimes.com)

- Sea temperatures, like air temperatures, have been breaking historic records. From personal experience, last year, swimming on the Gulf Coast of Florida felt like being in a bathtub.

- Last year was hot, but so far this year, sea surface temperatures have exceeded last year’s records every single day.

- This is bad news for coral reefs, but also makes for a potentially record-breaking hurricane season.

- Colorado State University predicts nearly twice as many named storms as usual, with a “well above-average probability” of at least one major hurricane making landfall in the US and Caribbean. They consider their forecast conservative!

- A possible La Niña pattern increases the likelihood of more hurricanes making landfall.

- Don’t take comfort from last year’s relatively quiet hurricane season. 2023 was an outlier.

- Bottom line: Expect more hurricanes. Equity market strategy: short reinsurers ahead of storms and long after storms.

Estimating Long-Term Expected Returns – Ma et al

The expected return on the equity market over multiyear horizons is one of the most important variables in finance.

This paper runs a useful horse race of the various frameworks and proxies used to generate long-term equity return forecasts to see which ones have worked best.

Encouragingly, the winner of the horse race is the approach I have always used. A three-component model where the expected return is the dividend yield + long-term earnings growth (usually assumed to match historic earnings growth) + mean reversion of valuations.

I have looked at which valuation multiple is the best to use in these calculations. The rather boring answer was that your choice of valuation multiple has very little bearing on the model’s forecast accuracy.

Life is so much easier for government bond investors. The expected 10-year return of a 10-year government bond is its yield to maturity, which we can observe on the screen. Easy!

Bottom line: Predicting the future is difficult, but for equities the best approach uses dividend yield, earnings growth and mean-reverting valuations.