5 stories that caught my eye and what I took from them.

The Magazine Cover Indicator – Brent Donnelly, Stephane Renevier

- This stock indicator is on your bedside table - Finimize

- I’m a big fan of sentiment as a trading tool. Behavioural biases are some of the few reliable drivers of markets. Contrarian sentiment signals, in particular, are great for identifying and leveraging market overreactions.

- The main challenge is that sentiment is tough to quantify accurately, and many existing indicators lack predictive power for future returns.

- I'm always on the lookout for effective sentiment indicators. The Magazine Cover Indicator is not new, but it’s timely given the bullish covers in Barron’s and the Economist. Brent Donnelly has crunched the numbers on this indicator in the past and the results have been impressive.

- The results as a ‘buy’ indicator are pretty good. The average return after a year was 13% (median 12%). Of course, the base line should be for positive returns over 12 months anyway, but the S&P 500's baseline would be around +10%.

- Its performance as a 'sell' signal is even more remarkable, given that most indicators struggle in this area. Seeing asset prices drop by an average of 8% after bullish magazine covers is significant, especially against the expected baseline.

- Bottom line: The data says the recent bullish magazine covers should make you more bearish about the 12-month outlook for equities.

OpenAI + robot = Figure 01

- Figure Status Update - OpenAI Speech-to-Speech Reasoning (youtube.com)

- Watch the video!!

- 13 days into the partnership between OpenAI and FigureAI, the robot company I mentioned last week, we've already seen some truly remarkable progress.

- Their latest demo easily clears the skepticism bar: no remote control tricks, a straightforward single-take video at regular speed, boasting that "everything in the video is powered by a neural network."

- What blew me away was how the robot's voice and its speech-to-speech interaction transformed the experience. We tend to anthropomorphise robots quite naturally, but adding the voice and natural communication was a game changer for me.

- Merging AI with robotics is proving to be an incredibly powerful accelerant.

- Bottom line: The robotics theme is gaining momentum, even more than I thought last week.

Stocks for the Long Run? Sometimes Yes, Sometimes No – Edward F. McQuarrie

- Stocks for the Long Run? Sometimes Yes, Sometimes No (tandfonline.com)

- I'm a sucker for long historical data. It bugs me when research makes bold claims about asset price behaviour with just a few decades of data. How much can we really trust findings from just a couple of market cycles?

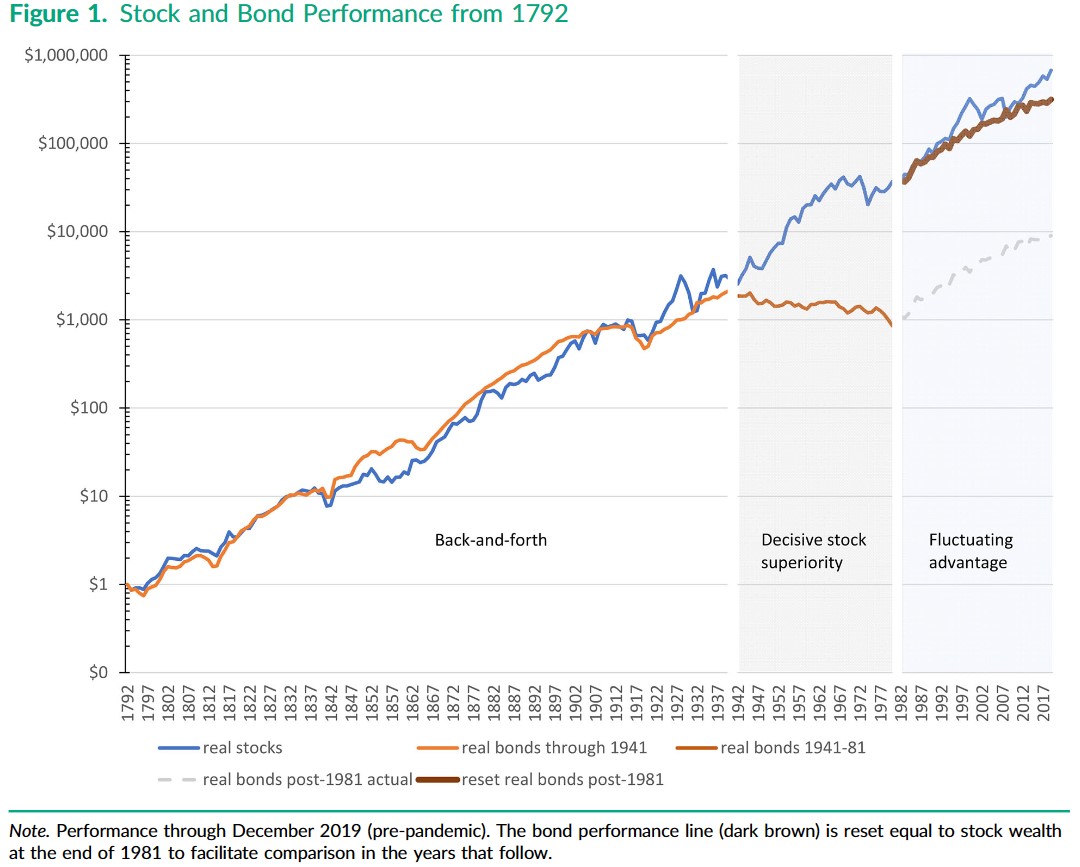

- That's why a paper stretching stock and bond return histories back to 1802 caught my eye.

- This extended history shifts the narrative on long-term returns. Suddenly, the last 40 years where bonds and equities delivered similar returns looks more normal, and the post-war era of stocks dramatically outpacing bonds looks less normal.

- Caveat: how useful is 19th century US data for predicting 21st century global data? My take is to not ignore it, but to assign a lower weight to older data.

- Going back all the way to 1792, stocks have outperformed bonds over long time horizons (5-50 years) about 2 times out of 3. Not bad, but on the ‘old’ data it was 9 times out of 10 over 30-year time horizons.

- Bottom line: Stocks have typically outperformed bonds in the long run, but the gap is smaller than it seemed.

Emerging Tech Trends 2024 – Amy Webb

- TR2024_Full-Report_FINAL_LINKED.pdf (futuretodayinstitute.com)

- Amy Webb Launches 2024 Emerging Tech Trend Report | SXSW 2024 (youtube.com)

- There are tons of reasons to dive into Amy Webb's Emerging Tech Trends talk at SXSW (and the full slide deck): it's a look at a Tech bull case, packed with intriguing insights, and honestly, it's just entertaining.

- The general thesis: We have multiple General Purpose Technologies, each powerful on their own, but they have started to converge…giving us a Technology Supercycle.

- That term makes me think of the old commodity supercycle narrative, which coincided with a big commodity bull market, but did not end well.

- It’s surely a sign of bullish sentiment. This would not be the title of a presentation in a tech bear market, say autumn 2022.

- Bottom line: Too big to read all of it, but good to watch and a great resource for getting up to speed or refreshing knowledge on specific tech topics.

Landmark study links microplastics to serious health problems - Nature

Landmark study links microplastics to serious health problems (nature.com)

We know microplastics are everywhere. We also know that they end up in the environment and ultimately in all of us.

What’s new in this paper is that it links microplastic pollution to a human health problems.

60% of the 257 people who underwent surgery had micro- or nanoplastics in a main artery. Those who did were 4.5 times more likely to experience a heart attack, a stroke or death over the next 3 years.

Microplastics had become embedded in the fatty plaque that clings to the walls of blood vessels. It appeared that micro- and nanoplastics made those fatty blobs of plaque more frail, increasing the risk that they could dislodge from the artery wall, block the flow of blood in a smaller vessel and prompt a heart attack or stroke.

Caveat: the study shows correlation rather than causation and did not control for other potential disease drivers.

Market angle: The ‘Circular Economy’ investment theme has been flying under the radar, but there is slowly growing news-flow momentum, especially on plastics.

Catalysts: A soon to be released documentary on plastic pollution could draw additional attention to the topic. And at a U.N. meeting in April there will be negotiations on a treaty that aims to curb the growth of plastic pollution.

Bottom line: First study linking microplastics to serious health problems. As public pressure grows, the Circular Economy theme will get more attention.