5 stories that caught my eye this week and what I took from them.

The curse of the thematic ETF – Ben-David et al

- delivery.php (ssrn.com)

- I’m a fan of thematic investing. It has a long time horizon, where it is easier for equity investors to have an edge. And it offers a more targeted way to slice the equity universe than Level 1 sectors or regions.

- ETFs can be a good way to implement thematic views, despite often high fees.

- But thematic ETFs are also prone to retail and marketing hype. Products only get issued for themes that are hot and therefore easy to sell.

- The suspicion is that this also means that the issuance of thematic ETFs is a sign of very bullish sentiment for the theme, that a very optimistic outlook is already priced in and that return risks are skewed to the downside, even if the theme fundamentally plays out over the medium term.

- But, as always, it’s good to see some data rather than relying on gut feeling.

- This paper finds that thematic ETFs have tended to underperform significantly after inception, delivering negative annual alpha of -6% per annum in the first 5 years.

- Bottom line: Think twice (or even three times) before buying thematic ETFs on the launch. Thematic ETF launches are often a sign of peak optimism. Wait until the froth has evaporated.

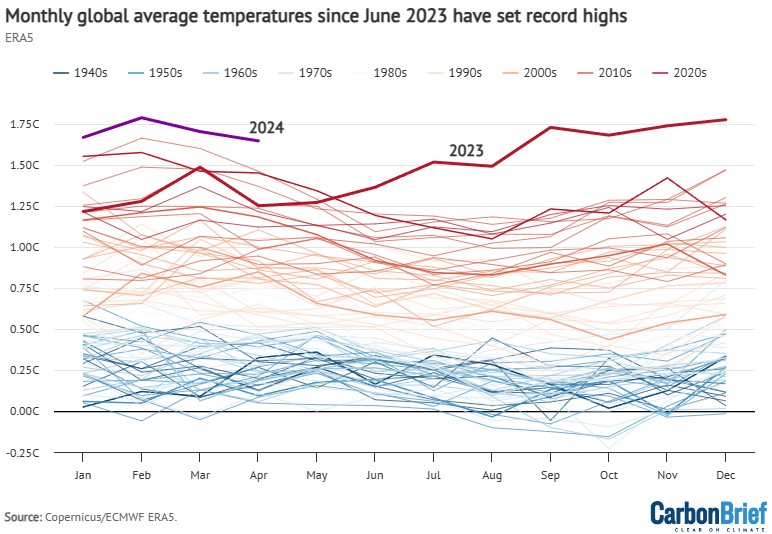

State of the climate: 2024 off to a record-warm start – Carbon Brief

- State of the climate: 2024 off to a record-warm start - Carbon Brief

- 2023 was a record year for temperatures. And 4 months into 2024 the records keep coming.

- The first three months of 2024 have each set a new record.

- The good(ish) news is that El Nino peaked at the start of the year, so the base case is for some moderation of temperatures from that side.

- But based on the year so far and the incorporating the current El Niño forecast, Carbon Brief estimates that global temperatures in 2024 are likely to average out at around 1.5C above pre-industrial levels.

- Carbon Brief’s projection suggests that 2024 is virtually certain to be either the warmest or second-warmest year on record.

- Potential for a narrative change: 2023 was highly unusual in that temperatures rose so much before the El Nino peak. At this stage it can be seen as an outlier. But if post El Nino temperatures also remain unusually high, it strengthens the case that a warming planet has fundamentally altered how the climate system operates much sooner than expected.

- Some great visualisations in the paper, so do have a look.

- Bottom line: There is more to do on Decarbonisation. The investment theme ebbs and flows, but the broad trend remains supportive.

Eli Lilly’s weight loss drug shows promise as a sleep apnea treatment - CNBC

- Eli Lilly weight loss drug Zepbound effective in sleep apnea trials (cnbc.com)

- Zepbound was more effective than a placebo at reducing the severity of obstructive sleep apnea in patients with obesity after a year.

- Eli Lilly plans to present the preliminary trial data at an upcoming medical conference and submit it to the FDA and regulators in other countries in mid-2024.

- The list of use cases for GLP-1 drugs keeps growing. Potential additional use cases include Parkinson’s and Alzheimer’s diseases.

- The first order benefits of GLP-1 drugs have been well flagged. The Novo Nordisk share price says it all.

- But there is still much to learn about the potentially far wider implications. At a simple level, figuring out where weight loss and food spending goes (fitness, experiences, clothes?).

- But what if it’s an anti-craving drug? Then the macro impacts become greater. What about gambling, alcohol, ice cream, coffee, fizzy drinks, cigarettes, etc.? What about healthcare costs and inflation?

- Bottom line: Obesity drugs have another superpower. The more superpowers, the greater the macro impact.

At Moderna, OpenAI’s GPTs are changing almost everything – Wall Street Journal

- At Moderna, OpenAI’s GPTs Are Changing Almost Everything - WSJ

- GenAI adoption takes another step into the real world

- Moderna and OpenAI’s partnership aims to ‘automate nearly every business process at the biotech company’.

- Tangible results? Guidance upgrade ahead? ‘Further integration of AI into more of its processes could help Moderna outpace its plan to roll out 15 new products within the next 5 years.’

- The CEO’s goal is for employees to ‘use it no fewer than 20 times a day.’ How do you measure up against that benchmark?

- Bottom line: AI integration is only beginning. Learn to use it! AI won’t take your business, but a company that uses AI will.

China Approves US Listing for Self-Driving Firm in Easing Sign – Bloomberg

China Approves US Listing for Self-Driving Firm in Easing Sign - Bloomberg

A rare sign of thawing in US-China relations at the corporate level.

China has greenlit a US listing by autonomous driving startup Pony.ai and given an indication that more such approvals could follow.

But will investors bite? The pain of taking big losses on US-listed Chinese companies as they were threatened with forced de-listings is still fresh in investors’ minds. And the uncertainty around Bytedance/TikTok also does not help.

With the above in mind, you would expect the shares to trade at a discount to peers.

The listing will make for an interesting test case for sentiment towards Chinese equities.

The best case is that we are heading for a pragmatic and transactional relationship between the US and China.

Bottom line: Rare good news on US-China relations, but no change to the medium-term outlook: elevated tensions between US and China irrespective of who is in the White House.