8 stories that caught my eye this week and what I took from them.

Behind closed doors, Trump eyes second round of corporate tax cuts – Washington Post – Geopolitics

- Trump tax cuts: GOP front-runner weighs abandoning long-held goal - The Washington Post

- ‘Trump has told allies that he is keenly interested in cutting corporate tax rates again’

- As long as there is hope of corporate tax cuts in a second Trump term, equity markets will not sell off on a Trump 2.0 scenario.

How Trump Plans to Wield Power in 2025: What We Know – New York Times – Geopolitics

- How Trump Plans to Wield Power in 2025: What We Know - The New York Times (nytimes.com)

- Much to worry about in terms of ‘Institutional Degradation’, but most (not all!) of the concerns are only minor drivers of equity returns.

- Institutional Degradation matters to markets, but only over the medium-term.

A New Tax on Imports and a Split From China: Trump’s 2025 Trade Agenda – New York Times - Geopolitics

- Trump’s 2025 Trade Agenda: A New Tax on Imports and a Split from China - The New York Times (nytimes.com)

- Return of the Trade War theme with a new Universal Baseline Tariff on most or all imports and an accelerated decoupling from China.

- Both are drags on equity returns, but not enough to make Trump 2.0 a clear net negative for equity markets.

Transformative AI, existential risk, and asset pricing – Chow, Halperin, Mazlich – Technology & Markets

- agi_emh.pdf (basilhalperin.com)

- Two interesting questions: 1) what would extreme AI outcomes mean for asset prices? 2) Can asset prices predict extreme AI outcomes?

- The extreme AI outcomes in the paper are truly extreme. Misalignment leading to extinction and alignment leading to hypergrowth, by which they mean ~30% GDP growth p.a.

- The interesting conclusion is that either extreme outcome would lead to higher real interest rates. People will save less and spend more, though for very different reasons.

- The authors argue that the signals are more ambiguous for oyther assets like equities, commodities and real estate: alignment bullish, misalignment bearish.

- Bottom line: all AI tails lead to higher real rates. But my caveat is that research at these extremes and this far out into the future will very likely miss many other factors that can also materially impact asset price outcomes.

Record opposition to climate action by UK’s right-leaning newspapers in 2023 – Carbon Brief – Technology

- Analysis: Record opposition to climate action by UK’s right-leaning newspapers in 2023 - Carbon Brief

- Decarbonisation is becoming less bipartisan. Green Tech has been one of the few topics that both sides of the political spectrum have been able to agree on. The IRA passed in the US because it was pretty much the only thing Democrats could build a majority around.

- Bottom line: this makes it less likely that future policy decisions will skew as much ‘more green’ as they have the last few years. A challenge for the many ‘long Decarbonisation’ investment themes in portfolios.

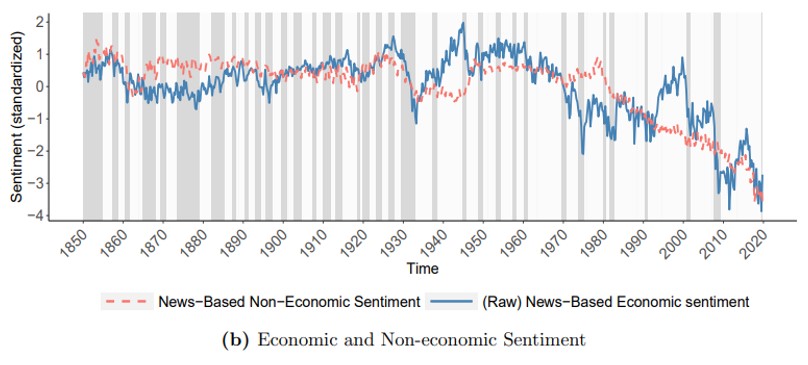

(Almost) 200 years of news-based economic sentiment – Binsbergen et al – Markets

- w32026.pdf (nber.org)

- Great work extending economic sentiment series by around a century. Another great use cases of AI in investment research.

- The authors argue their measure has some predictive power for GDP growth (especially employment, consumption and services) and monetary policy. So, one for economists to look into? Perhaps a complement for consumer sentiment surveys like the Michigan survey.

- Another interesting finding is that general sentiment, not just economic sentiment, has been on a declining trend since the 1970s. The negativity bias in news isn’t surprising, but it’s interesting to zoom out beyond one’s own experience of the last few years, maybe decades. Clearly, not enough people have read Steven Pinker’s ‘The Better Angels of our Nature’.

- The last point reminds me of John Burn-Murdoch’s argument that words matter for society’s progress and of the e/acc movement’s efforts to create a counter-balance to techno-pessimism. A theme to dig deeper into.

Economic and Non-economic sentiment - heading south for 50 years

Source: Binsbergen et al

Big Tech not done with layoffs as Google, Amazon announce cuts in 2024 – The Washington Post – Tech & Markets

- Big Tech isn’t done with layoffs as Google, Amazon announce cuts - The Washington Post

- Tech cost cutting was the story of late 2022 and early 2023. It helped put a floor into Tech’s 2022 sell-off and amplified the 2023 rebound.

- But despite the reversal of stock market fortunes, the efficiency focus remains in place, even if the urgency of the efforts will naturally decline as external pressures subside.

Duolingo cuts workers as it relies more on AI - The Washington Post – Tech & Markets

- Duolingo turns to AI, laying off some language app translators - The Washington Post

- More evidence of AI reshaping businesses.

- Duolingo is cutting writers and translators due to AI efficiency gains.

- In a separate story, part of Google’s job cuts have also reportedly been driven by AI efficiency gains.

- This is just the beginning, even if it does not ultimately result in net job losses in the economy.