Seven stories I read this week and what I took from them.

The Age of AI and the Great Upshift – James Pethokoukis

- 🤖⤴ The Age of AI and the Great Upshift: 2024 hopes (substack.com)

- We are still in the early innings of the debate on how AI will impact productivity, labour markets, growth and the economy in general.

- I count myself as an optimist on the topic, but no one really knows.

- This article is a collection of quotes and comments on the topic from experts of various backgrounds. A great qualitative addition to the more quantitative expert predictions from Metaculus.

- Bottom line: the only consensus on the impact of AI on the economy is that it will take many years to materialise. For an exponential technology that seems to be a vulnerability of expectations.

Why carbon emissions are associated with higher stock returns – Atligan et al

- Why carbon emissions are associated with higher stock returns | CEPR

- The debate about ESG rages on, so this paper caught my eye.

- They find that higher carbon emissions, both in terms of level and change, have been associated with bigger earnings surprises.

- Related studies have shown a similar association with stock returns. Higher emissions, higher returns.

- This is not what you want to see if market forces are to bring about a shift to a low-carbon economy.

- Bottom line: The data around ESG, earnings and returns remains mixed at best. Market forces alone are unlikely to be enough to change corporate behaviour. There is a role for government.

Is Kim Jong Un Preparing for War? – Robert Carlin & Siegfried Hecker

Is Kim Jong Un Preparing for War? - 38 North: Informed Analysis of North Korea

Financial markets have been right to stay relaxed about North Korean headlines, but this article argues that the consensus on North Korea is missing a structural shift.

The well-rehearsed pattern has been to interpret any actions as sabre rattling designed to gain attention and perhaps some concessions around sanctions.

Carlin and Hecker make the case that the consensus has become complacent on North Korea and that something has fundamentally changed. Kim Jong UN has made a strategic decision that he will eventually end up at war.

They argue the following

Decades long attempts to normalise relations with the US have proved futile and have ceased. North Korea has turned towards China and especially Russia.

War preparation themes in North Korean media have ramped up.

The language towards South Korea has materially shifted and has made South Korea a ‘legitimate’ military target.

Bottom line: In the spirit of ‘don’t predict, prepare’ it’s a topic worth including on the radar screen to see if events corroborate the path Carlin and Hecker lay out.

Doomsday Clock at 90 seconds to midnight amid nuclear and AI threats – Washington Post

- ‘Doomsday Clock’ at 90 seconds to midnight amid nuclear and AI threats - The Washington Post

- There are not many ways to quantify systemic risks outside of the financial sphere. The Doomsday Clock is attempt at this. Though it is not perfect, it is worth a look when the Bulletin of the Atomic Scientists updates their work every year.

- One thing in the Doomsday Clock’s favour is that it has not been a one-way street in the past. In 1991, after the Cold War ended, the clock was wound back to 17 minutes to midnight.

- The bad news: it’s only 90 seconds to midnight

- The good news: it’s still 90 seconds to midnight, no change from last year

- Two of the risks highlighted were outside the ‘obvious’ category: 1) increased military use of AI and lethal autonomous weapons; 2) deterioration of nuclear arms reduction agreements.

- Bottom line: a year where the Doomsday Clock does not move closer to midnight is a good year, or least better than most years.

Toward the eradication of medical diagnostic errors – Science – Eric Topol

- Toward the eradication of medical diagnostic errors | Science

- Some amazing stats: ‘We estimate that nearly 800,000 Americans die or are permanently disabled by diagnostic errors each year.’ And ‘a conservative estimate that 5% of adults experience a diagnostic error each year, and that most people will experience at least one in their lifetime.’

- If physicians had more time, diagnostic errors would likely be reduced. System 2 thinking vs System 1 thinking. Physicians are unlikely to have more time to spend anytime soon, so AI is the more likely solution.

- There has been lots of evidence that AI can help reduce diagnostic errors, but it seems generative AI has even greater potential. The article cites examples and several research papers with impressive stats.

- As everywhere with AI, two things to note. Studies found that human biases were passed onto the AI via the training data. And, though the results may be impressive, they are for the use of general-purpose AI. Systems will continue to improve and become more domain specific, which should lead to even better results.

- Bottom line: Healthcare has remained relatively undisrupted by technology so far, thanks to many structural hurdles. But AI offers potential for this to change with broad implications, including several market effects, e.g. inflation.

The F.T.C. Takes on M&A Deals – The New York Times

- Lina Khan’s FTC Takes On AI Deals like Microsoft-OpenAI - The New York Times (nytimes.com)

- Lots of Tech M&A news recently and none of it good (for Big Tech)

- Amazon pulled out of the iRobot acquisition. Adobe is no longer buying Figma. The FTC is starting to ask questions about the deals between Big Tech and AI startups (e.g. Microsoft, Google, Amazon and OpenAI and Anthropic)

- The acquisitions may have been stopped, but if that was intended to spur competition the early signs are not encouraging. Adobe has shut down development of its Figma competitor. And iRobot is cutting a third of its workforce and is pausing development of several products after the deal fell through.

- In extremis, if the Big Tech and AI deals were to be unwound, it would challenge the current narrative that Big Tech will be the dominant winners in AI, but that is a very big “If”.

- Bottom line: My base line is that a true escalation in Tech regulation is limited by the law and courts and that a divided Congress is unwilling or unable to change those laws for the foreseeable future.

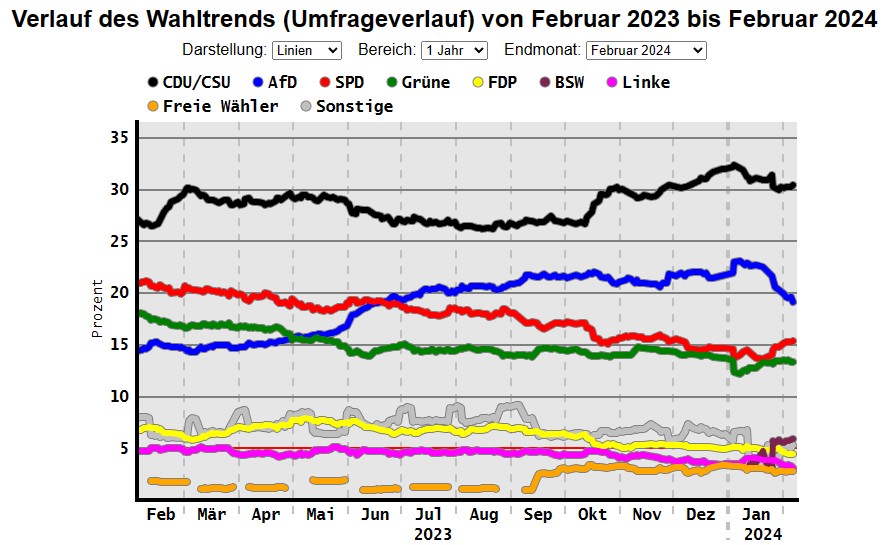

Chart of the week – DAWUM

Bundestagswahl: Neueste Wahlumfragen im Wahltrend | Sonntagsfrage #btwahl (dawum.de)

The downard trend of the AfD (blue line) in German polls is now very visible. One to watch as we head into a busy election year.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.