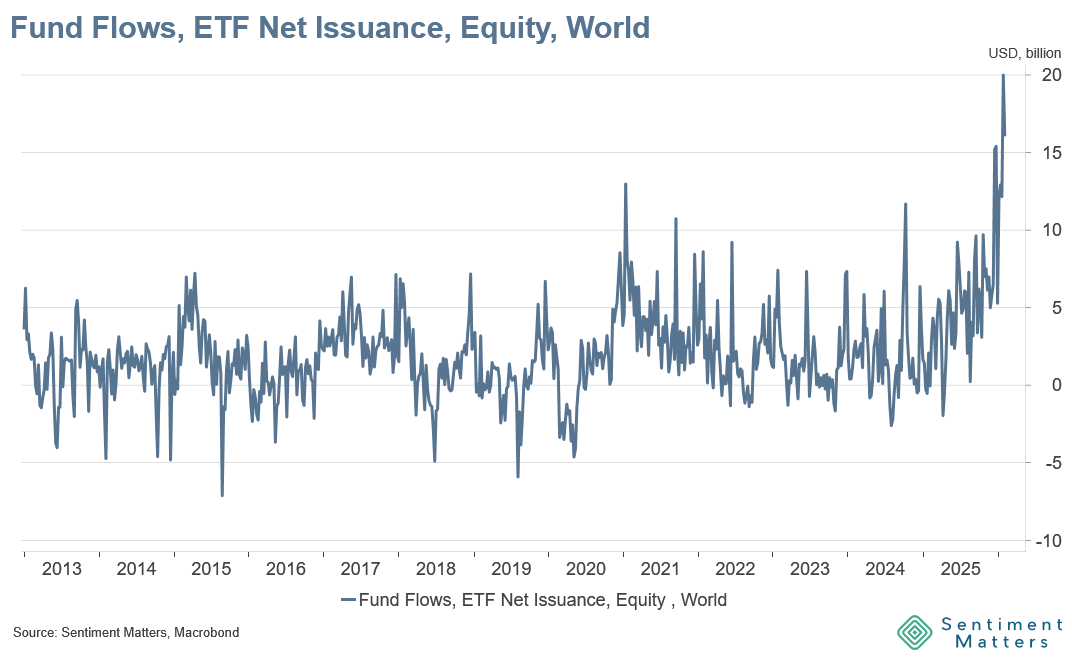

The exodus from US assets is accelerating.

The latest ETF flow / net issuance data from the Investment Company Institute (ICI) shows record net issuance into world equity ETFs. The last two weeks’ issuance were the two highest weekly numbers on record

What is this data?

ICI publishes a weekly “Estimated ETF Net Issuance” release for US-listed ETFs, split into broad categories (including domestic equity and world equity). “Net issuance” is essentially shares created minus shares redeemed (a flow measure). These weekly numbers are estimates of industry totals, and ICI notes they can be revised; the “actual” collection is done monthly.

ICI also defines world equity as ETFs investing primarily in equities traded worldwide (global, international, regional, single-country, EM), versus domestic equity focused on US companies.

What we’re seeing

Weekly data is noisy, but the trend is hard to miss:

- World equity ETF issuance has been trending higher through 2025, and last week’s spike takes it to a new extreme.

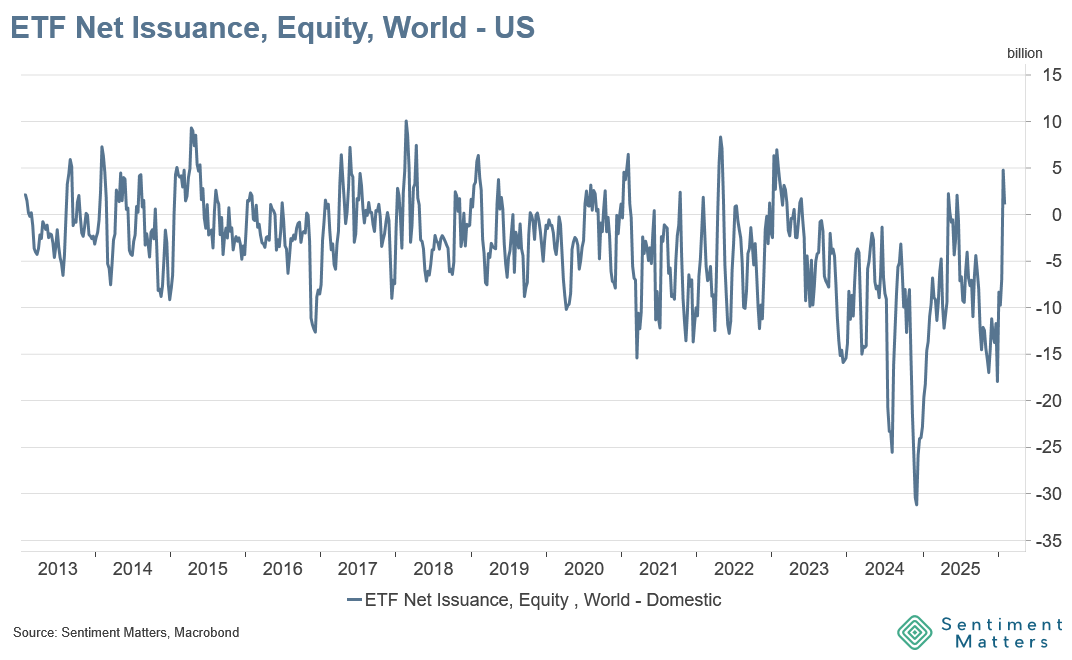

- US domestic equity issuance has been soft, with the last few weeks running below average.

How far can this go?

If history is a guide, there’s room for more.

Yes, the gap between world and domestic issuance has swung sharply in favour of world ETFs — but it’s also the first two weeks in almost a year where that gap has really flipped. And it comes after a long stretch in 2023–2024 (the AI-led rally) where domestic issuance dominated by an unusually wide margin.

So some of what we’re seeing is probably mean reversion, not necessarily a clean “structural rotation” away from US equities. But it’s also true that history includes multi-month stretches where world flows exceed domestic flows — so the trend doesn’t have to stop here.

Bottom line

US ETF issuance has turned decisively in favour of world over domestic equities — and it’s been accelerating.

Some of this looks like catch-up after the 2023–24 domestic-heavy surge, but history suggests the rebalancing can run for longer.