Economists are still debating whether the Fed will hike one or two more times in this cycle. But is an end to the hiking cycle really good news for equities? The answer is, as so often, ‘it depends’.

More details in this thread

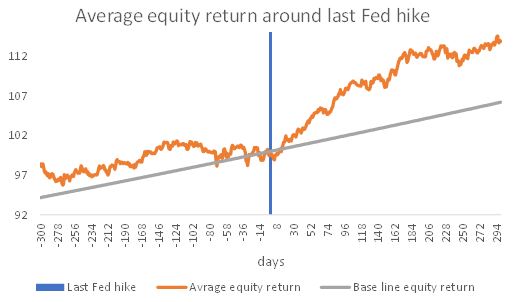

Empirically, equities have done well after the last hike of a Fed tightening cycle. The average return after three months has been +7% and +12% after six months, both well above the average equity returns over these time horizons.

And the averages don’t hide any outliers. Equities were up on all six occasions since the early 80s after three months and on five out of six occasions after six and twelve months.

Fundamentally, easier monetary policy is good for equities…all else equal. But that’s a crucial qualifier. It’s not so much that equities are driven by the Fed funds rate, but rather that both are driven by a common factor: the economic cycle.

Both respond to the macro environment and ultimately the ‘why’ of Fed rate hikes or cuts is more important than the action itself.

- If the Fed stops hiking because of a change in its reaction function, say lower rates for a given amount of growth, that’s great news.

- If the Fed stops hiking because policy has hit the sweet spot of ongoing trend growth without overheating, that’s good news.

- But if it stops hiking because it has overtightened, recession risk is rising and therefore the risk of an earnings collapse is rising, that easily nets out to bad news.

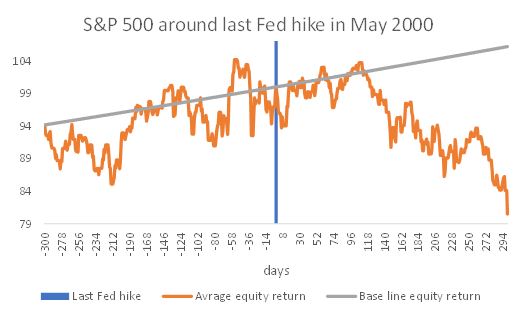

This fundamental link also comes through in the empiric data. In most cases there was no recession within at least a year of the last Fed hike. But the one time when there was, in 2000, is also the occasion where equities did (very) poorly after the last hike.

There’s a similar theme around the first Fed rate cut, but let’s save that one for when we’re closer to it.

Bottom line: The end of a Fed hiking cycle has been good for equities, but it does not help you get around the bigger question, which was and is ‘recession or no landing?’ Regional PMIs have been mixed, but to me the weight of the evidence still says recession is coming, so better to be cautious on equities.