Chinese equities have halved since 2017, but so have earnings.

Why it matters: ‘Long China’ was the most consensus equity view in 2023 Outlooks, but with macro momentum waning there is very little to get excited about.

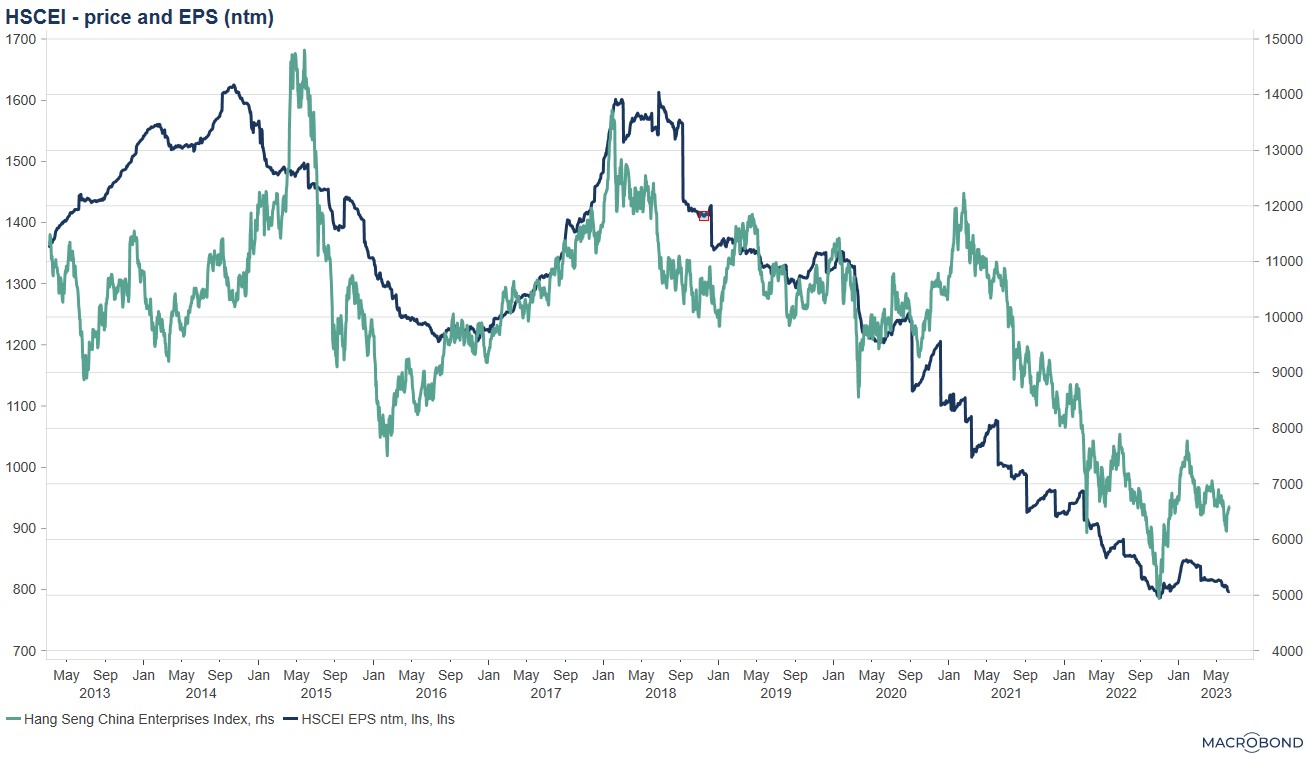

The biggest problem of Chinese equities is earnings, or a lack thereof! HSCEI earnings have halved since 2017. This earnings decline has been so long and steady that it cannot be explained with the cycle, COVID, regulation or geo-politics. And there’s no sign of improvement: earnings estimates are back at last year’s lows, despite all the re-opening hype.

That means valuations have not improved even though the structural issues around Chinese equities (Taiwan, power concentration, US-China tensions) demand a higher risk premium or a valuation discount.

What would make me buy Chinese equities? 1) Very bearish sentiment, 2) valuations back at the lows or 3) the most difficult: a view and evidence of earnings turning up.

Go deeper…

It’s all about earnings

The China Tech trade has become a China-only trade. That was last week’s story. So, what what about the bigger question? What to do with Chinese equities? HSCEI is down around 50% from where it traded in early 2021. Bargain?

The price decline makes HSCEI seem cheap. But it is not. Behind the poor performance is a structural earnings problem that shows no sign of being resolved. From the peak in 2017, prices have halved, but so have earnings.

Earnings have been cut for so long and over so many different macro environments that there is no obvious culprit. It’s clearly not cyclical, or COVID-related or even driven by the regulation crackdown. Earnings estimates picked up a bit with the re-opening enthusiasm after the lockdowns ended, but they have given back all those gains. Forward earnings are back at the October 2022 lows!

I have not come across a good explanation of this structural problem yet. It will have shot to pieces anyone’s macro earnings model. But without understanding the source of the earnings problem, it’s very difficult to get to a longer-term buy case for Chinese equities.

Source: Macrobond, Lars Kreckel

As a result, obviously, the price decline has not given us a big drop in valuations. The forward PE is around the 10-year average both in absolute terms and compared with the EM index. Things look only marginally better on other valuation multiples. Chinese equities looked cheap last October, but they don’t today.

Source: Macrobond, Lars Kreckel

We need a discount

If the 12-month outlook for Chinese equities boils down to earnings, the long-term outlook features several structural risks. These are known and have been well-covered, but that makes them no less problematic for equity investors. And they all require a discount.

The near-term invasion of Taiwan seems highly unlikely, but when the investment horizon extends to 5 years it starts to become a non-negligible risk. It is difficult to say whether this scenario has become more or less likely with the invasion of Ukraine, but the potential implications for investors have become much clearer. Jump-to-zero risk is not something equity investors come across often, but when it comes to Chinese equities, it is a risk that cannot be ruled out. We need a discount.

How do you take risk in a market whose fortunes are dependant on the decisions of one person. Power concentration is not a new challenge for investors in China, but the magnitude of the challenge has continued to grow. The greatest drivers of Chinese asset prices over the past few years have been fiscal policy, Tech regulation, property market rules, COVID response and geo-politics. All of these are difficult to navigate in any country, but when policies are decided by one person alone in a room, it is nigh on impossible. We need a discount.

Whether you call it the West’s de-coupling from China, US-China tensions or Thucydides trap, the geo-political direction of travel has been clear for some time and there is no reason to expect it to reverse anytime soon. There is very little in US politics that gets bi-partisan support these days, except for being tough on China. And as the various episodes of the last few years have shown, there is an impact on Chinese equities. We need a discount.

Investors love warning of structural risks. It makes you sound wise and responsible. It’s good marketing. But it also has its pitfalls. The debate often reflects past experiences more than what lies in the future, recency bias. If we’re all talking about it, arguably it is priced. Secondly, structural risks can lie dormant for extended periods of time and without incremental news flow other forces drive markets.

Given current valuations (see above), it’s difficult to argue that ‘it’s all priced in’. But it’s true that the Taiwan and power concentration issues could well be in the background until the day when they are the only thing that matters. On US-China tensions, however, I expect more negative headlines in the next two years than in the last two years. With the US election approaching there is an incentive for both parties to ramp up the rhetoric towards China.

Signposts – every asset has its price

Every asset, every structural risk and every macro scenario has a price at which it is a ‘buy’. But with structural risks like those above it is important to be picky on entry points and to not be greedy on reducing exposure on rallies.

Here is what I would want to see to buy Chinese equities:

- Very bearish sentiment is my number one criteria. Sentiment swings from panic to euphoria relatively quickly. In October there was not a China bull to be found anywhere, but by the end of the year China was the most consensus long recommendation in 2023 Outlooks. The former was a great time to buy, the latter marked the peak of the rally. Today, I would describe sentiment as bearish, but still far from recent extremes.

- Valuations close to past lows would also make me consider a long China position. We need a discount to historic valuations to account for the structural risks. This is not the case today (see above), but low valuations improve the longer-term return outlook and reduce the downside in negative scenarios.

- Chinese earnings turning up would be the most fundamental signpost. A macro view of an inflection point in the Chinese economy would go a long way towards this, but it would take hard evidence to firm up the view. Beyond a cyclical boost, though, it is difficult to have a strong view on Chinese earnings without a better understanding of the causes of the structural earnings decline.

Bottom line

- Chinese equities look cheap, but they are NOT cheap

- Underperformance has almost exclusively been driven by falling earnings

- There’s no clear catalyst to reverse the earnings decline

- The structural issues with Chinese equities require a discount, which is not priced today

- US-China tensions are likely to be worse the next 2 years than the last 2 years

- A tactical long requires bearish sentiment, low valuations or a positive earnings view. None of these boxes are ticked today

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.