Equities have rallied, expectations have increased. The earnings season will be a reality check for investors.

Why it matters: OK earnings will make neither the bulls nor bears happy. But all else equal, equities drift higher.

Expect good Q2 numbers, lots of beats, cautious outlooks, no recession warnings and a lacklustre market reaction. In the end, nothing to really shift the macro narrative towards the bears or bulls. Macro data will decide the direction of the market, not the earnings season.

Before the wave of bottom-up news flow hits, let’s look at early indicators for the earnings season, set a base line of what to expect and flag what to look out for in the news flow.

Go deeper…

Early indicators

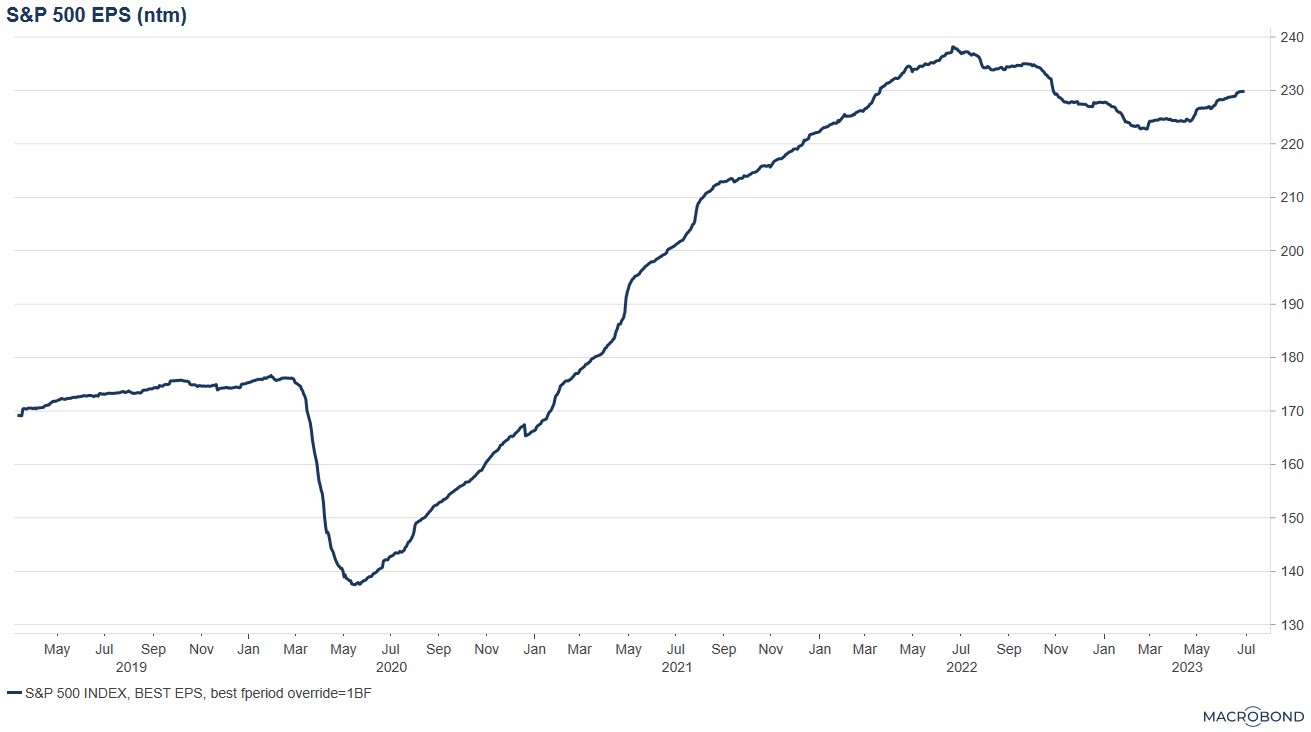

Earnings estimates have been stable. While analyst estimates for this year and the next haven't really changed much in recent months, that's actually good news. Analysts typically start out overly optimistic and then cut forecasts as reality bites. So, like the economic data, company earnings have held up better than feared this year.

Another upshot of stable earnings estimates: forward earnings (next 12 months) have started drifting higher again. About half of last year’s decline in forward earnings has reversed. Sounds good, but by historical standards these have all been small moves.

Source: Macrobond, Lars Kreckel

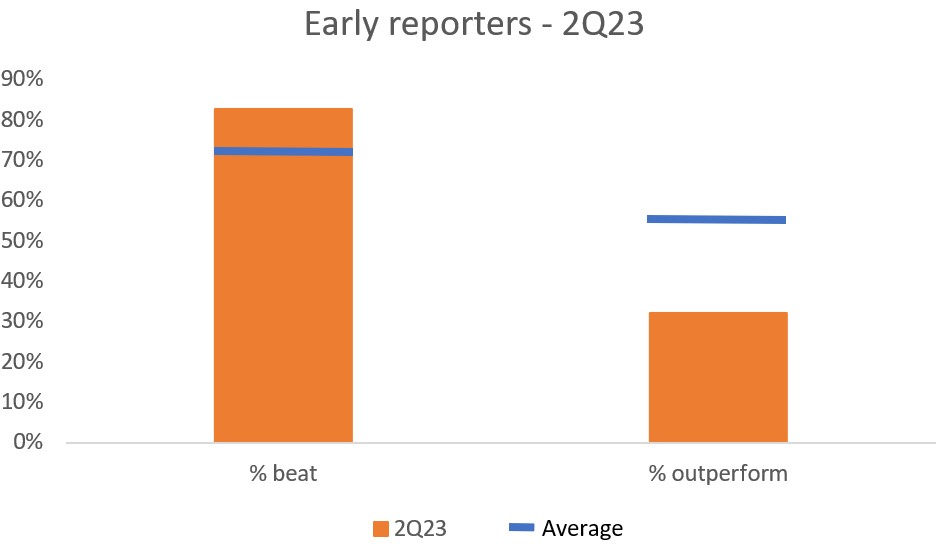

Early reporters have been beating analyst estimates. These companies with earlier quarter ends are not necessarily a representative sample, but often give a glimpse of what’s to come in the full reporting season. By my count, almost 90% have beaten analyst estimates, a number higher than normal.

But it has been much more difficult to beat investor expectations. Only 35% of companies have outperformed the market on the day following results, an unusually low number. This is an unusual mix and suggests that analyst estimates are easier to beat than investor expectations.

Source: Bloomberg, Lars Kreckel

There can be several reasons for this. Firstly, investor expectations have probably risen with the recent rally and the jump in investor sentiment indicators. But as we saw above, analyst estimates have not increased. Also, analysts and investors care about different parts of the results. Beating analyst estimates is a purely backward-looking statistic. Investor’s reaction to results, on the other hand, is much more about the future; the outlook and guidance companies give. Given the macro uncertainty it is perhaps not surprising that outlooks sound more cautious and uncertain than statements about a solid Q1 that is already in the bag.

Base line

Before the wave of bottom-up news flow hits, let’s set a base line of what to expect.

- Good Q2 numbers. Most companies will beat, probably even more than usual. It was a good quarter for economic growth and the early reporters beat at a higher rate than normal.

- Cautious outlooks. There is no incentive for companies to raise expectations with the macro environment no clearer than in the last few quarters.

- No recession warning. Companies only publicly acknowledge a slowdown when it is already obvious. While current business is good, and all indications are it is good, companies will not ring the bell on a recession.

- Lacklustre market reaction. The rally has raised the bar for companies to surprise positively. This is not a set-up for one of the rare occasions of earnings seasons changing the macro narrative.

Questions

Earnings seasons rarely move the macro narrative, but there are always a few specific questions they can give us answers to. Here’s what I will be looking for in company results and comments over the next few weeks.

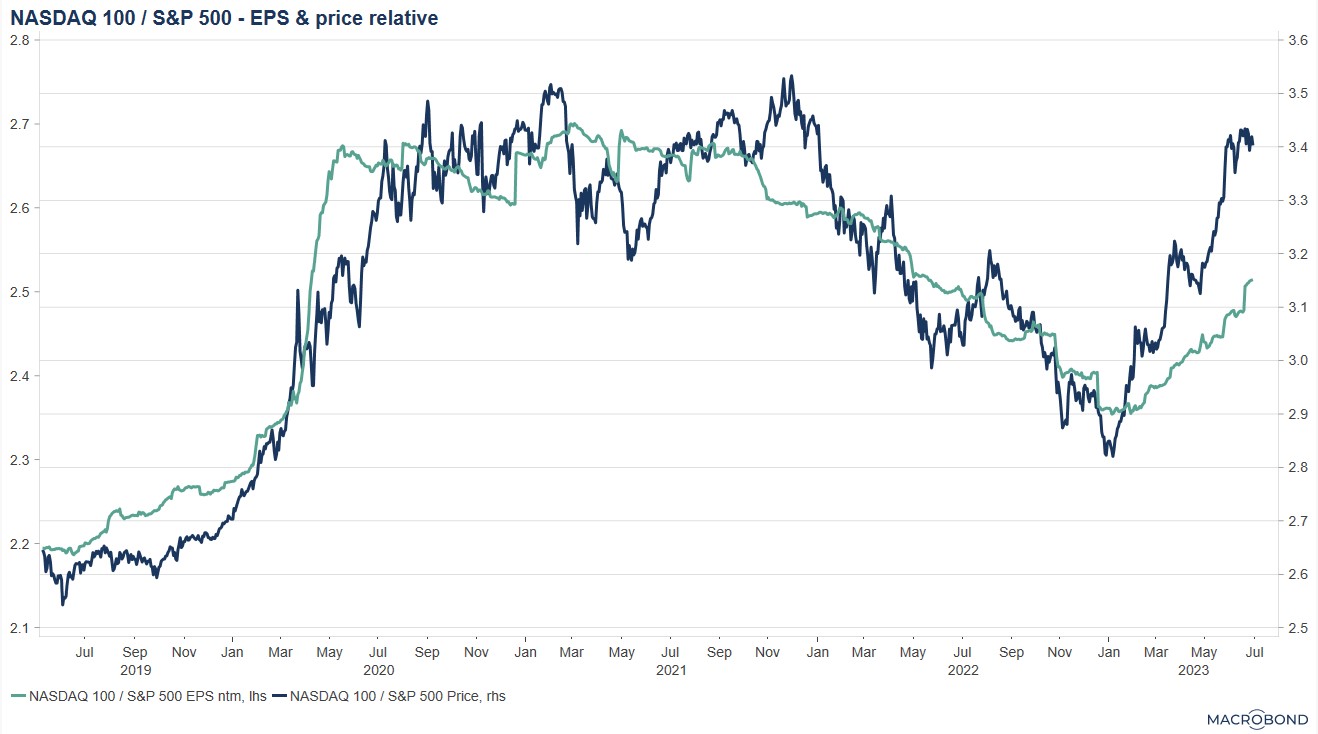

Can Tech earnings deliver against raised expectations?

It has been a very narrow market rally, with Tech leading from the front. This has resulted in a chunky re-rating of Tech, as prices have run ahead of earnings. This reporting season will be the first test of how patient investors are to wait for the earnings bounce that is priced to arrive. ‘Picks & shovels’ AI companies like Nvidia may well deliver tangible profits from the AI revolution already, but for most it will remain a promise of future profits. The market reaction to promises will tell us a lot about sentiment.

Source: Macrobond, Lars Kreckel

Will companies sound more optimistic?

The last few earnings seasons were in times of high economic uncertainty and recession fears. While most economists have not downgraded recession probabilities, the market has. Companies are incentivised to err on the side of caution with outlooks, but there is a chance more managements feel emboldened by the shift in market narrative and sound more bullish than in previous quarters. I would only put a 30% probability on this scenario, but it’s a possible positive surprise.

Any macro snippets?

This is the least market-moving question, but there are a few macro debates that company comments could add some nuance to. Some recent examples include Tesco talking about encouraging signs that food inflation is starting to ease. Fedex highlighted the weakness in transportation demand as goods demand continues to struggle. US homebuilder Lennar gave yet another strong outlook based on orders, pricing, costs and demand.

Bottom line

No fodder for the bears or bulls. Macro data will decide the direction of the market, not the earnings season. All else equal, equities drift higher.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.