Peak earnings season is behind us and it’s time for macro investors to move on. We have a representative sample and from here there is very little incremental macro information in the rest of the earnings season. Before we move back from micro to macro, what have we learned?

Earnings are OK for now

We came into the earnings season with bottom-up consensus looking for -6% yoy growth. That number was always likely to end up less negative as companies beat lowballed estimates and that’s how things have been tracking so far. Bloomberg shows -2.6% yoy growth for the companies that have reported so far.

For all practical purposes that’s around the flat earnings, that I thought were likely as the economy decelerates but stays out of recession.

But there have been no signs of an imminent earnings collapse. The Q1 numbers are clear: flat earnings, but revenues are still growing at a healthy clip (+6%). While a good chunk of that comes from prices rather than volumes, it is difficult to engineer a true earnings collapse while revenues are growing at such rates.

Outlooks and guidance have by and large been cautious, but the remarkable thing is that there have still been quite a few companies that have raised guidance. This suggests a lot of confidence at least in the near-term outlook despite the inescapable narrative of recession risk.

Having said all of that, an earnings season is not where you would expect to first see an imminent earnings collapse. It is not a leading indicator!

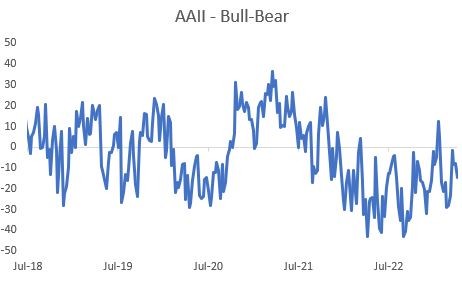

Sentiment is not super bearish

Some institutional investor surveys will have you believe that investors are extremely bearish, not far off the financial crisis extremes, and have been for about a year.

Most other (and historically more reliable) sentiment indicators have looked like sentiment is at best slightly bearish.

The earnings season is another indication that the extremely bearish surveys are off the mark and that sentiment is closer to neutral. Results have been OK, neither great nor terrible, but certainly good enough that extremely bearish investors would likely show some relief. Instead, equities are down 1% since the start of results.

Tech sentiment is not excessively bullish

If there was an argument that market sentiment was very bearish going into earnings, the opposite could have been the case for Tech. The Nasdaq 100 outperformed the S&P 500 by 13% in Q1! Even if Tech gave back a bit of the gains in April, the base line assumption had to be that Tech sentiment had become much more bullish and expectations had been raised.

But you can’t argue with the tape. The positive reaction to good but not great results from this week’s group of Big Tech companies means sentiment was clearly not excessively bullish. I would add to that the benefit of the doubt that companies were given on the many AI-driven promises about the future. To me that’s fair enough, but the market is not always that generous about pricing distant promises; it certainly wasn’t last year.

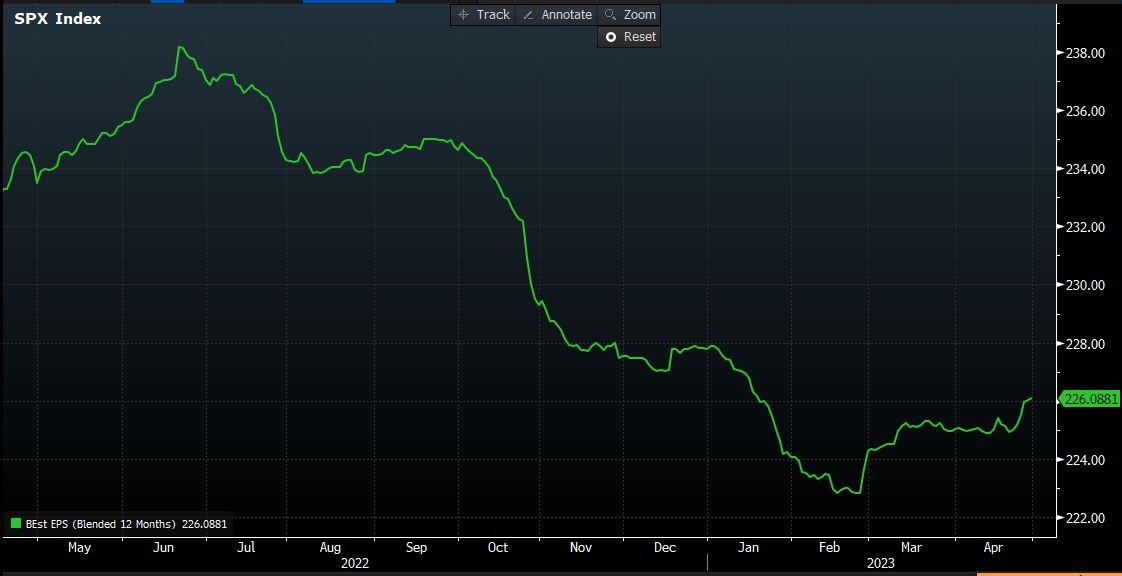

Analyst earnings forecasts are reasonable for now

Over the past year of varying degrees of recession worries, analyst downgrades have been a constant backdrop. Never of the speed and magnitude of an actual recession, but always fastest in the first month of an earnings season. That is when analyst forecasts about the past quarter are measure against reality and future forecasts are re-set with new company guidance. For the past few quarters this process has resulted in a re-setting of analyst forecasts downward.

But not this time. Earnings forecasts (next 12 months) have drifted higher over the course of April, as more results and outlooks have come in. This suggests that analysts estimates are roughly in line with how companies the rest of the year panning out. Unless the macro outlook deteriorates from here, there’s no immediate downward pressure on earnings forecasts.

The important caveat here is that sell-side analyst consensus is NOT a leading indicator on a recession and neither are company comments. So this is a marginal positive at best.

Bottom Line

Earnings season is done for macro investors. It was decent, but did not move the needle on the macro debate that really counts: recession or no landing. There was nothing in it to make you significantly more or less bullish on equities.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.