Bullish Sentiment has been washed out, but there’s no strong bearishness to lean against. This sets up a neutral start for 2025, with potential equity gains if macro newsflow remains supportive.

Go deeper:

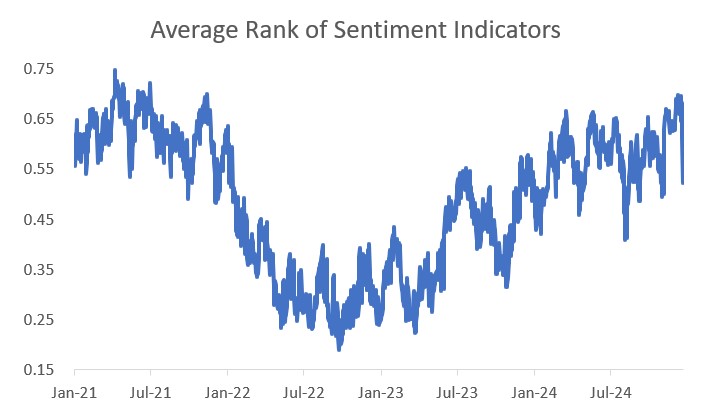

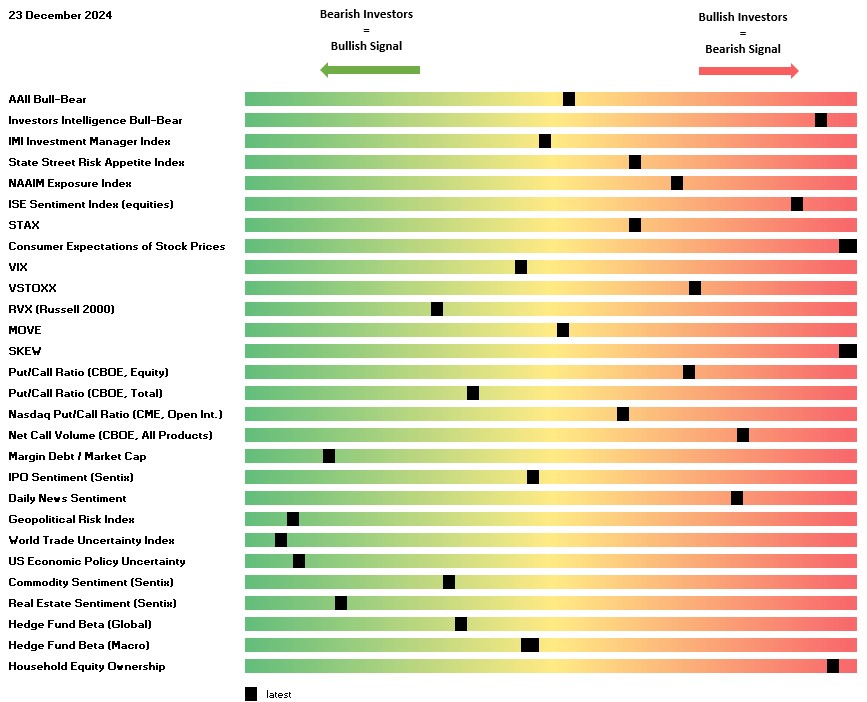

- Cooling sentiment: Last week’s correction removed the election-driven froth. The average sentiment indicator in the Heatmap has dropped from its 2024 high (70th percentile) to the 56th percentile, close to pre-election levels.

- AAII Bull-Bear Survey: A top-tier indicator, it remains firmly in neutral territory for weeks now, making the bullishness in the II Bull-Bear indicator less concerning.

- Retail sentiment: STAX, a good retail sentiment gauge, shows no signs of bullish excess. At the 64th percentile, it’s far from levels historically linked to poor equity returns. This contrasts with other retail indicators like Household Equity Ownership and Consumer Expectations of Stock Prices, which suggest more optimism.

- Geopolitical risk sentiment: Still very bearish, setting a low bar for positive reactions to favourable tariff news in 2025.

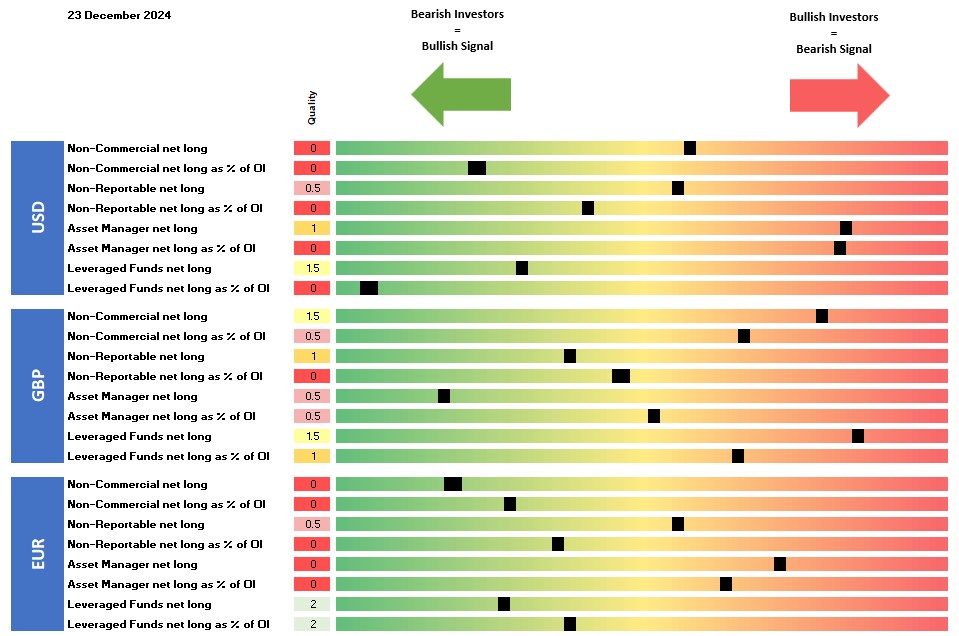

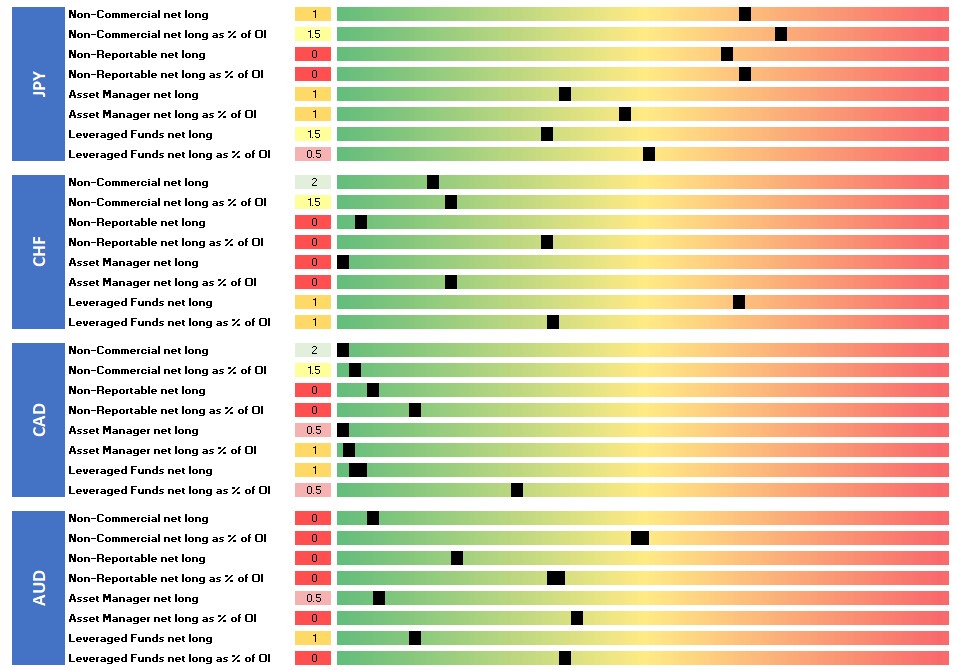

FX sentiment

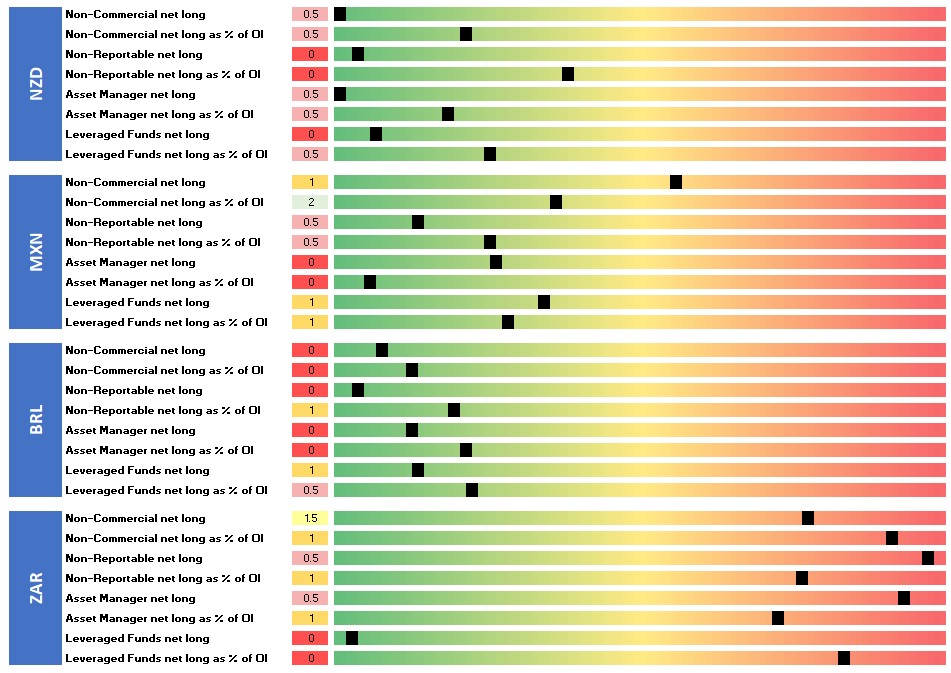

Bearish CAD and BRL

Bullish ZAR

Neutral USD, GBP, JPY and EUR

Conclusion

Bullish Sentiment has been washed out, but there’s no signs of much bearishness to lean against. This gives a neutral setup for 2025, leaving room for equity gains if macro newsflow stays supportive.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.