The Russell 2000 has lagged the S&P 500 by ~25% over the past two years. Ouch!

Why it matters: Is that underperformance enough to make it as recession-proof as in 2001?

It is easy to build a bear case on US small caps. They do badly in recessions, are particularly exposed to rising wages, are disproportionately hit by a credit crunch and have a large weight in regional banks.

But they have already done poorly, very poorly. Lots of risks, but lots priced in. So, the question should not be ‘What could go wrong?’, but instead ‘Are the problems overpriced?’ and ‘What could go right?’.

After all, after underperforming a lot in the late 1990’s, US small caps were the place to be in the recession and bear market of the early 2000s. Is it time to buy US small caps again?

I think it’s too early to buy, but three things would change my mind.

Go deeper…

A lot to dislike

There is no reason to linger on the headwinds for small caps, they have been well covered, but we do need to set a base line.

- Sharply rising wages = badUS small caps are particularly sensitive to rising wages and labour costs. They have more labour-intensive business models, a higher proportion of workers in the US and lower margins so the impact of rising labour costs goes straight through to the bottom line.

- Recession = badThough not obvious from looking at the sector weights, small caps have a cyclical bias compared with the S&P 500. Over the past decades Russell 2000 has persistently underperformed with falling ISM and Treasury yields.

- Credit crunch = badSmall caps are much more financially geared than the S&P 500, which makes them more vulnerable to a credit crunch scenario and is why they have been negatively correlated with high yield spreads.

- Regional bank weight = badRegional banks have a weight of ~8% in the Russell 2000 compared with ~1% for the S&P 500.

Deep Value?

Can any of these get better? Of course, they can! Anything is possible.

These problems for small caps also give an indication of what a positive scenario for small caps would look like: No landing, so avoiding recession and a credit crunch, especially if it comes without the labour market tightening again.

But the more interesting way to think about small caps is whether prices have fallen enough to account for the negatives. Are there signs of an overshoot? Are they Deep Value?

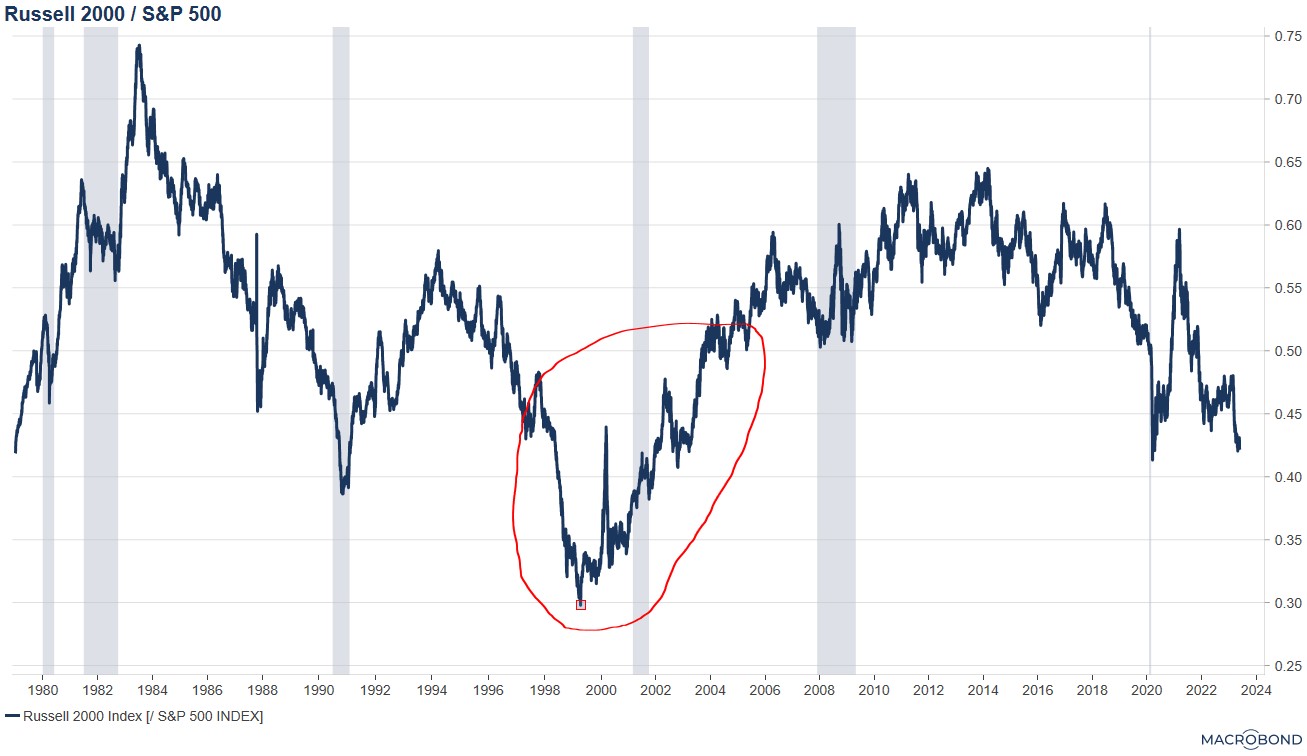

After all, the Russell also underperformed and de-rated a lot in the late 1990’s and was then a surprising safe haven in the recession bear market that followed. How close are we to a similar set-up?

Source: Macrobond, Lars Kreckel

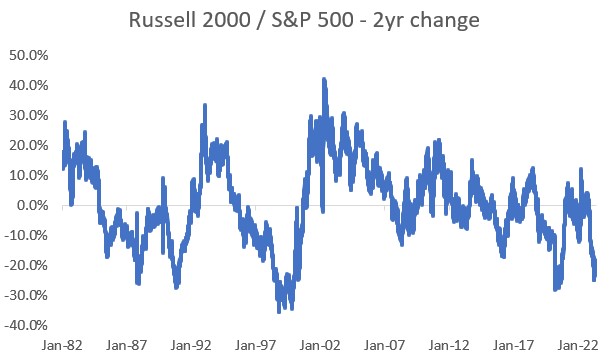

Sharpest underperformance in 50 years…almost

If we’re looking for something extreme being priced in, then an extreme price adjustment is a reasonable place to start looking. Prices are back at the pandemic lows and the decline over the past two years is the fourth largest two-year declines in the past five decades. But the one instance where Russell 2000 underperformed significantly more sharply than today was in the late 1990’s TMT bubble.

Source: Bloomberg data, Lars Kreckel

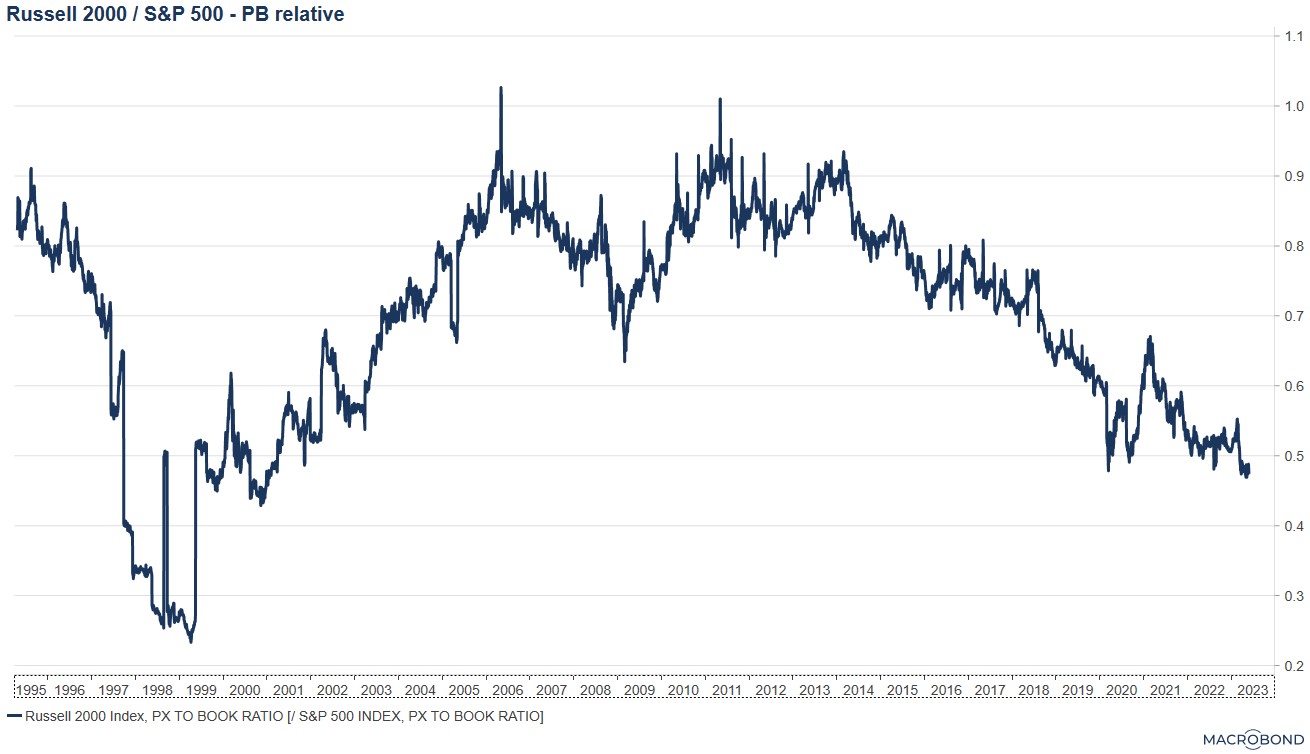

The valuation case looks strong

The PE relative is below the 10-year average, which is good, but far from historic extremes. But PEs are arguably not the best way to measure ‘cheap’ in times of large earnings swings. Multiples like dividend yield and price-to-book ratio are more useful at this stage in the cycle and paint a very positive picture. Russell 2000 offers a dividend yield higher than that of the S&P 500 and trades on a price-to-book ratio less than half that of the S&P 500. Both are at the most attractive levels in at least 30 years, except, once again, for the TMT bubble extremes.

Source: Macrobond, Lars Kreckel

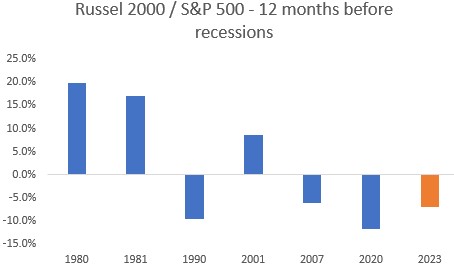

Recession priced?

The underperformance before this recession is already greater than average before past recessions.

Source: Bloomberg data, Lars Kreckel

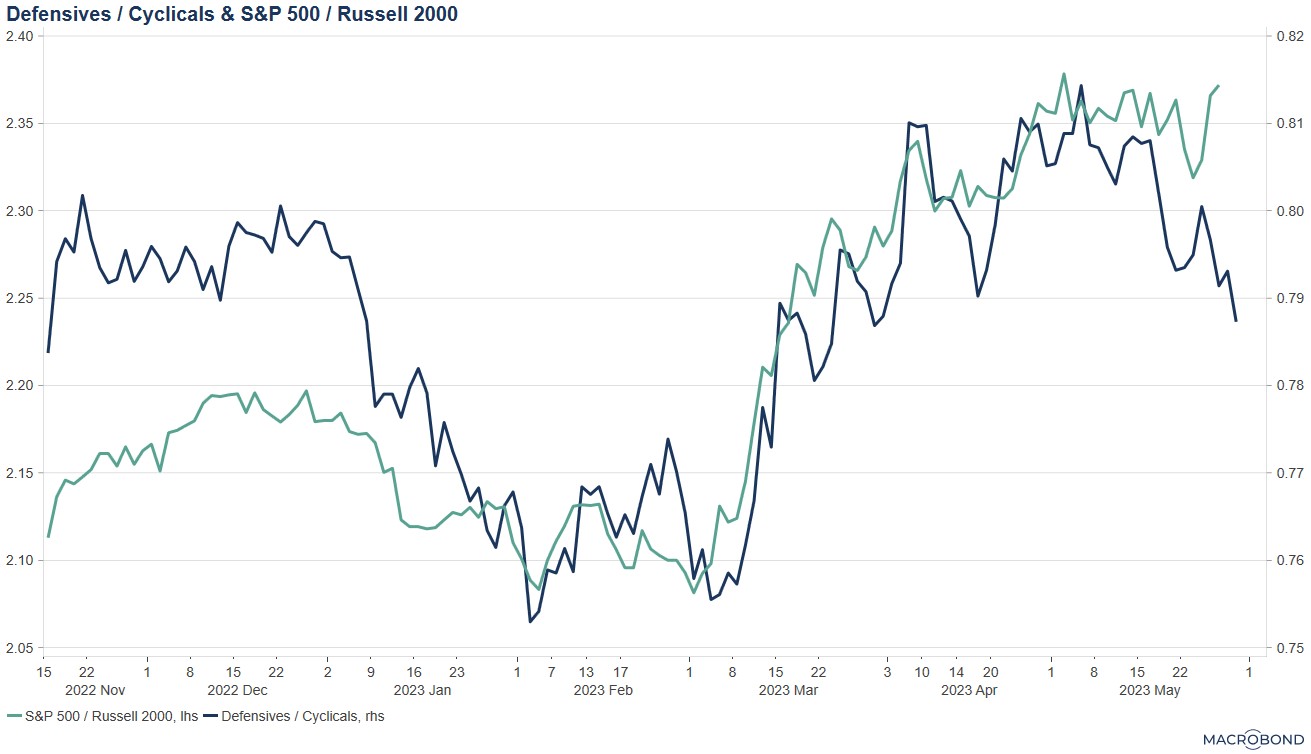

Less impressive is that the last 6 months of underperformance is ‘only’ roughly in line with what you would expect given the decline in the ISM Manufacturing index. No obvious overshoot to see here. But we know that other recession proxies like Cyclicals have performed unusually well despite the PMI decline. So compared with Cyclicals, US small caps are pricing in more recession risk.

Source: Macrobond, Lars Kreckel

On the earnings front, the decline in relative forward earnings of -22% still lags both the financial crisis at -25% and the pandemic at -47%. But, earnings are a lagging indicator, so less useful in determining what is priced in. I would put a greater weight on valuations.

Source: Macrobond, Lars Kreckel

The final test - behaviour

US small caps tick a lot of Deep Value boxes, even if they are not at the extremes of 2000 on any of them.

But the final test for me is to see evidence of Deep Value giving some protection against bad news and recession. I want to see Russell 2000 outperform or at least not underperform in a period where markets price in greater recession risk, outperform in a falling market or shrug off bad news on regional banks.

This is what happened in 2000. The low in small caps (relative) was before the peak in the S&P 500. In the last stage of the bull market, small caps started to outperform. We saw a similar pattern when Cyclicals started to outperform in the last stage of the financial crisis bear market.

But this has not yet happened with small caps this time round. When recession pricing increased in markets from February to April, Russell 2000 underperformed alongside other economically sensitive assets like Cyclicals.

When this pattern changes, I expect to change my mind in favour of small caps.

Source: Macrobond, Lars Kreckel

Conclusions

- A lot of risks and a lot already priced. But not enough to ‘buy and forget’.

- 3 things would make me want to buy small caps

- My view changing to ‘no landing’…not imminent

- We reach the extremes of 2000 on valuations and/or sentiment

- Evidence that Deep Value is changing macro sensitivities

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.