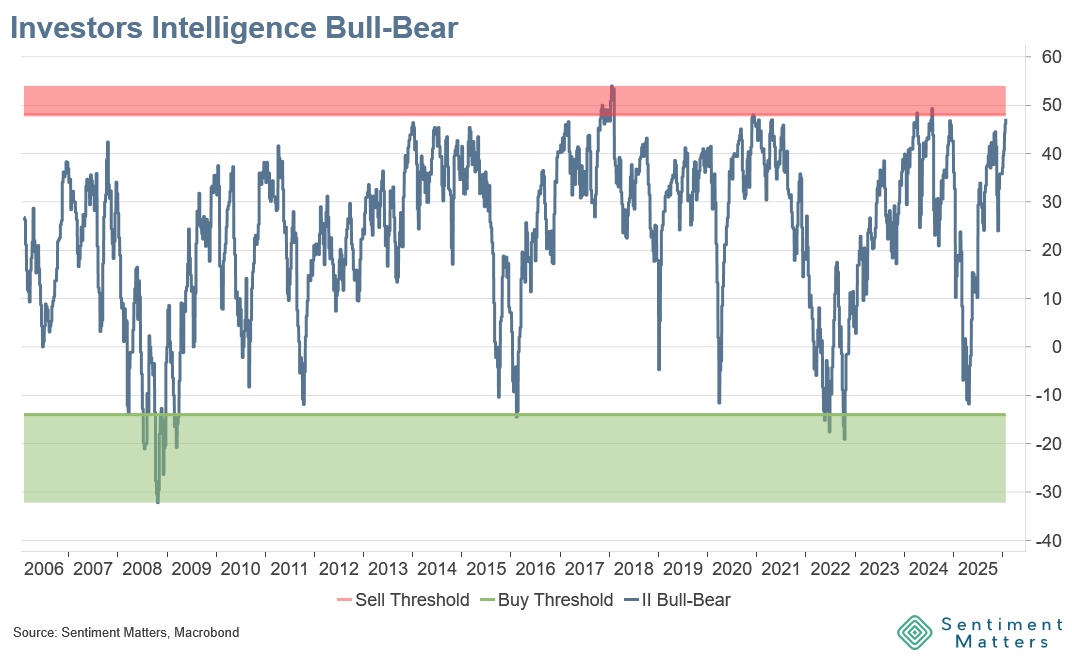

Investors Intelligence Bull–Bear is creeping higher — and it’s now closing in on its historical “sell-zone”.

The survey has swung from net 12% bearish after Liberation Day to net 47% bullish last week. That puts it at the 98th percentile — in other words, it’s only been higher 2% of the time in the survey’s 36-year weekly history.

What is the Investors Intelligence Bull–Bear survey?

It’s a long-running weekly read of newsletter-writer positioning: Investors Intelligence classifies a large sample of independent market newsletters as bullish, bearish, or expecting a correction, and publishes the shares. The Bull–Bear spread is simply the % bulls minus the % bears — a classic “what are advisors saying?” sentiment gauge.

Why do people watch it?

Because it has a decent track record as a contrarian sentiment indicator.

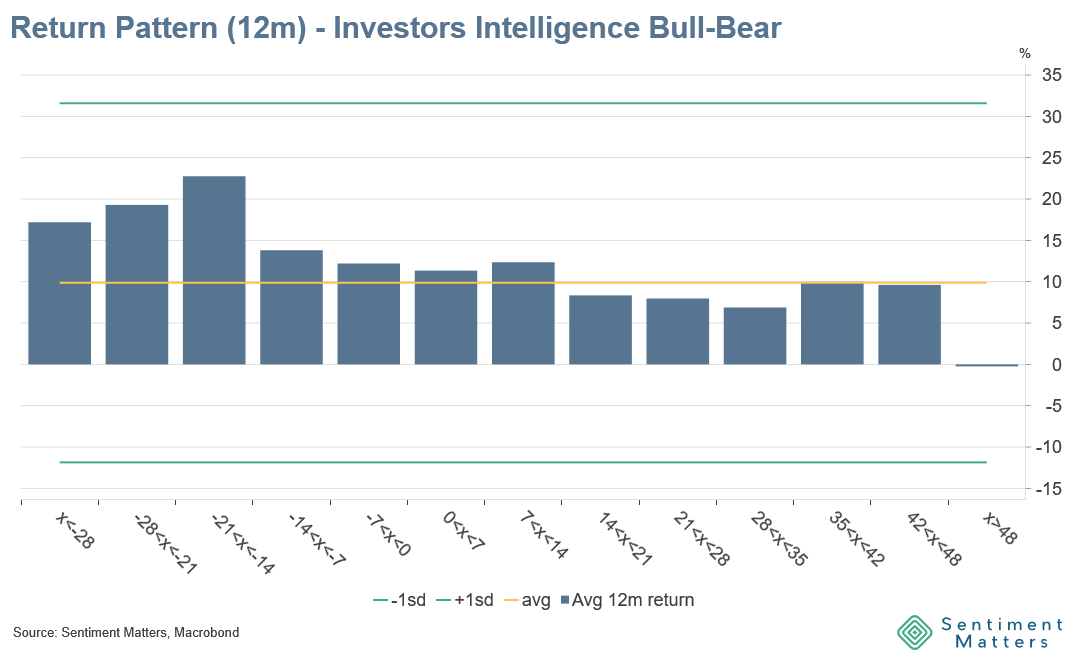

Historically, returns have been weakest after extreme bullishness and best after extreme bearishness.

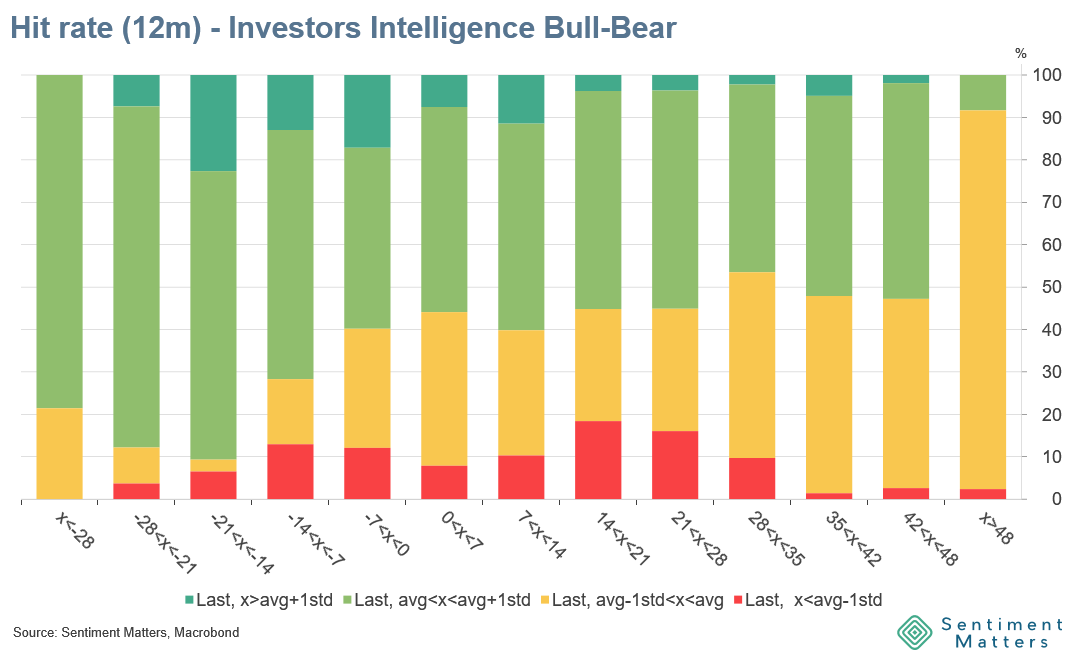

Returns have been weakest when the indicator has exceeded ~48% net bullish. The sample size is modest, but the pattern is striking: when II Bull–Bear has been above 48%, the average 12-month S&P 500 return has been ~0% — around 10% below normal — with below-average returns 92% of the time.

Worth noting: the signal has worked best over 12 months, both on buy and sell signals. Over 3–6 months, returns have also been below average, but the effect is smaller and less consistent.

Bottom line

Another indicator is approaching warning-flag territory. In isolation you could shrug it off — but it’s not an outlier right now. Like our Risk-On/Risk-Off SMA, II Bull–Bear is saying sentiment is clearly bullish — not quite at “red alert”, but getting closer. And as sentiment becomes more bullish, the bar for “good news” to keep pushing markets higher rises.