The bear market started over a year ago, but we still haven’t priced much of a recession.

Why it matters: Equities have been rangebound over the last six months. Waiting for a meaningful shift in probabilities on the answer to the big question: recession or no landing?

I’ve seen some Bulls argue that even if we get a recession, it’s fine because it will be mild and is already largely priced. I don’t buy that!

The evidence that even a mild recession is priced is very thin. I would argue that from current levels you don’t need to get particularly aggressive on your recession assumptions to get to more than 20% downside risk and a lot of rotation within equities.

Go deeper…

A Small Bear for a Mild Recession?

Here’s a very simple way to think about it: Recessions cause bear markets, and it takes a recession to cause a bear market, with few exceptions. The average bear market has been roughly -32%. If we assume a smaller than average recession, perhaps a smaller than average bear market is appropriate. The 25% drawdown at the October lows arguably fits that bill.

But it’s not that simple!

It’s been about rates, not growth

It would be wrong to assign all the drawdown from the all-time high to recession fears.

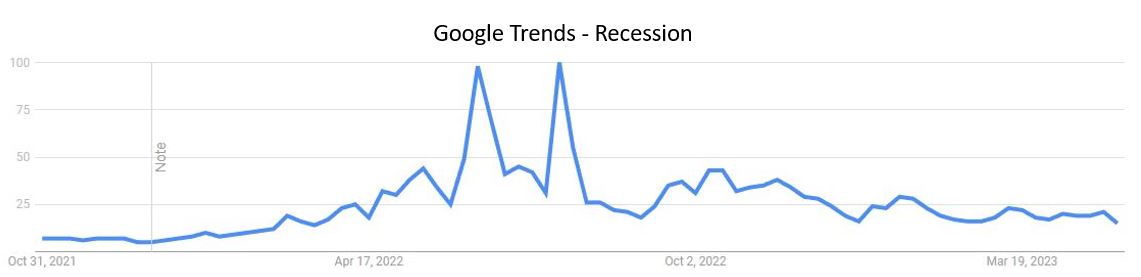

Firstly, it simply does not fit the timeline of events. Recession was not at all top of mind going into 2022. I first heard it uttered as a growing risk after the Russian invasion of Ukraine, but it only really gained traction as a topic into the summer of 2022.

Source: Google Trends

Secondly, market behaviour was much more consistent with worries about inflation, the sharp rise in rates and the re-pricing of the Fed reaction function. We see that in the bond/equity correlation, in the poor performance of rates proxies, in the decent performance of economic growth proxies, in the equity decline being driven exclusively by valuations rather than earnings, and broadly speaking in the fact that equities stopped falling when the 2yr started to stabilise.

So, unfortunately the simple maths from above does not add up and we can’t count much of the drawdown as ‘pricing in recession’.

Though we also should not add recession downside on top of last year’s rates downside. That would be double counting. Some of last year’s pain should unwind in a recession.

How low is low enough?

A slightly more sophisticated approach is to estimate how much equities should fall in a recession scenario and compare that with the decline so far. We have to make multiple assumptions for this, but as long as you are conscious of the assumptions you are making it is a very worthwhile exercise.

The starting point for estimating a bear market drawdown must be the magnitude of the earnings decline. I would put that at -20-25% peak to trough. That may sound like a lot, but is far from the historic extremes and consistent with a mild recession. Earnings declines are typically just as underestimated as earnings recoveries are. Blame operational leverage.

Other factors that matter include starting valuations (above average), starting sentiment (below average), the fiscal response (above average), monetary response (below average), corporate vulnerabilities (average), unusualness of the recession (below average), length of the recession (below average), credit crisis risk (average) and a few more.

Overall, this takes me to a guesstimate of ~3,300 for the S&P 500 as a level that would be consistent with a mild recession. I would see the risks around that to be balanced.

That leaves potential downside of 20% from today’s levels…a bit much to say ‘it’s largely priced in’.

Cyclicals are nowhere near to pricing recession

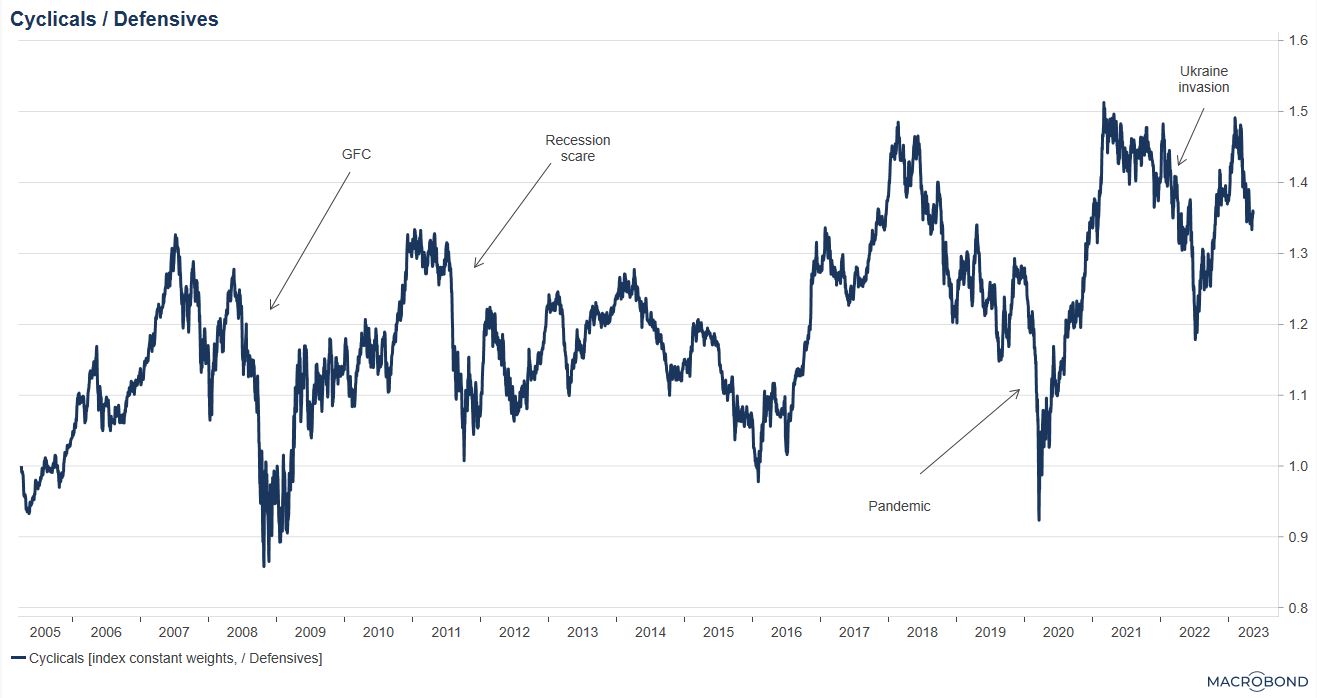

My favourite gage of how much recession risk equities have priced is the ratio of how the most economically sensitive stocks have performed compared with the least economically sensitive stocks: Cyclicals / Defensives.

And Cyclicals / Defensives is saying equities are a bit more worried about recession than they were a few weeks ago, but really not that much. Regardless of whether you put the start of recession fears at the invasion of Ukraine or closer to the summer, Cyclicals have only slightly underperformed Defensives since then, a world away from the behaviour ahead of and during past recessions.

Source: Macrobond, Lars Kreckel

Sentiment offers no protection

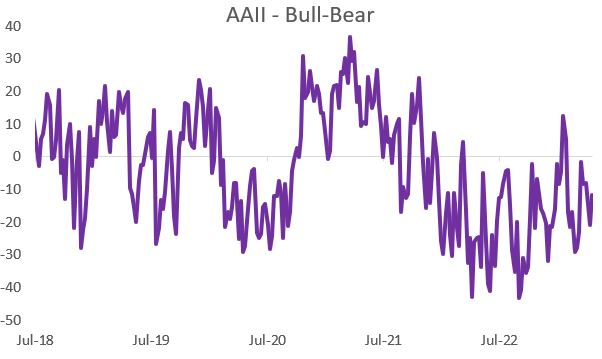

Sentiment is at most slightly bearish at the moment.

I don’t buy the message coming from some institutional investor surveys for almost a year now that investors are as bearish as they have been since the financial crisis. It does not match market behaviour (see Cyclicals above) or sentiment indicators that have historically been better predictors of future returns like AAII or VIX. Perhaps institutional investors are feeling more bearish than they are actually positioned.

So, there is little protection against downside from positioning. It would be brave to expect sentiment and positioning to not become much more bearish than this on the way into and during a recession.

Source: Bloomberg, Lars Kreckel

Bottom line

- A mild recession is not already priced in. It could take another 20% off equities.

- The market has not repriced the growth outlook much. Most of the 2022 bear market was about inflation, rates and repricing the Fed.

- The best recession proxy in equities, Cyclicals/Defensives, has at most done 20% of a ‘normal’ recession

- Sentiment and positioning offer no protection against recession