Stocks that trade on the hope of profits in the future rather than today have had a good run, but they’re still cheap.

Why it matters: Unprofitable Tech, or Future Tech as I’d like to rebrand it, has had a great few weeks: +18% against a marginally up S&P 500. That’s way more than its beta of 2 would suggest. Now what?

It’s still cheap, not just compared with the pandemic bubble, but also compared with the pre-pandemic period, with the last year and in relation to real rates.

But it’s not so cheap that a recession bear market won’t matter. It’s not a great place to be in a recession, but the rally has not moved the needle on valuations. Too early to buy for my taste, but maybe you’re ion the ‘no landing’ camp.

Go deeper…

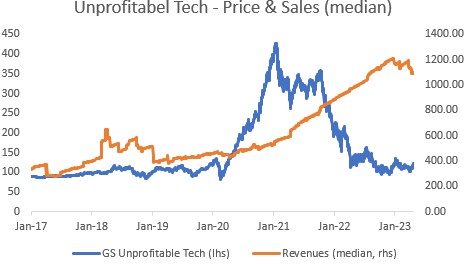

It’s been a nice rally, but still tiny in a historical context. These are volatile stocks! They’re still down 73% (relative to the S&P 500) from the high, -24% from summer 2022 and -10% from February.

Source: Lars Kreckel, Bloomberg

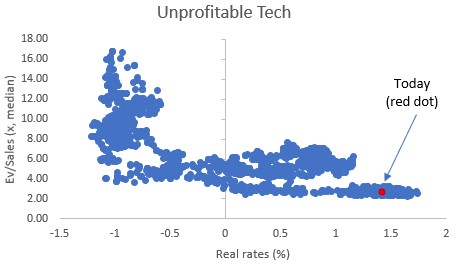

Valuations are still near the lows. You can have a long debate how to value stocks like these, but (median) Ev/Sales is my preferred multiple. At 2.7x the median Ev/sales ratio is below the pre-pandemic average of 5x and the 12m average of 2.8x. Obviously it’s below the 16.7x multiple it traded on at the pandemic (bubble!) peak.

Source: Lars Kreckel, Bloomberg

Valuations are in line with the real rates backdrop. The link between both makes fundamental sense. These are some of the stocks with the longest duration, where the expectation or hope of profits is sometimes in the distant future. Valuations peaked when real rates were at their most negative and have come down alongside the rise in real rates. But even after the recent rally, Ev/Sales sits well within the range.

Source: Lars Kreckel, Bloomberg

Valuations have been falling, fact! But they have not only fallen because prices have nosedived. Revenue estimates have continued to rise and rise. It is not the future that has changed, but the price investors are willing to pay for that future. From the all-time high, the price is down 72% while revenue estimates have doubled.

Source: Lars Kreckel, Bloomberg

Even if the valuation case is good and you believe in the longer-term prospects of Future Tech, this is not a good place to be in a recession bear market. Valuations are not extreme enough to offer protection against sharp downward revisions. The lack of current profits makes them vulnerable to a recession and a credit crunch. Low liquidity is a dangerous characteristic in a bear market when the liquidity premium spikes.

Bottom line

For Future Tech stocks it comes down to your market view. They are painful to own in a recession bear market, regardless of the de-rating. But having de-rated and de-hyped they’ll be great to own in the recovery that follows. So too early for my taste, but the recent rally does not move the needle on the debate in either direction.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.