- European equities and the rubber band effect. While Tech has run ahead of earnings, European equities have lagged earnings. A good set up for some catch up performance.

- Return of the Political Risk Premium? Populists are gaining ground across Europe. Not a market mover today, but one to watch. 2015/16 taught us that this can suddenly become THE market driver.

- Earnings update. Earnings season starts next week with mostly Financials. Recent results have continued the trend: 81% have beaten analyst estimates, only 27% outperformed the next day. Good numbers, but not good enough to boost shares after the rally.

Go deeper…

European equities & the rubber band effect

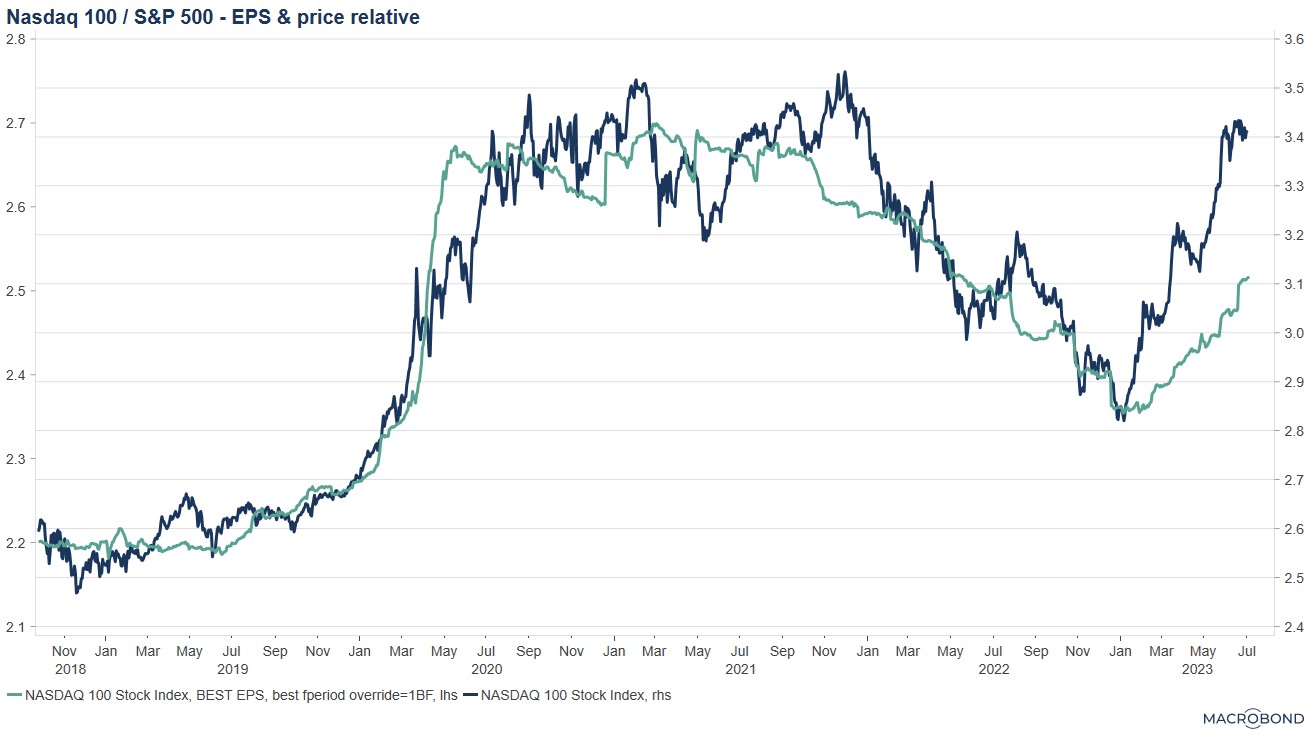

I like Tech. I’m long Tech. I expect it to deliver superior earnings growth over the medium-term and that will be a powerful tailwind to relative returns, given valuations that are not excessive. But there’s a ‘but’.

Tactically speaking, the Tech rally has exceeded the improvement in relative earnings by such a degree that the rubber band connecting the two looks stretched. Earnings need to grow into prices. I expect that to happen, but it will take time, perhaps a few quarters. In the interim, this process should weigh on returns. Tech treading water relative to the market for a while would be a positive outcome from here.

Source: Macrobond, Lars Kreckel

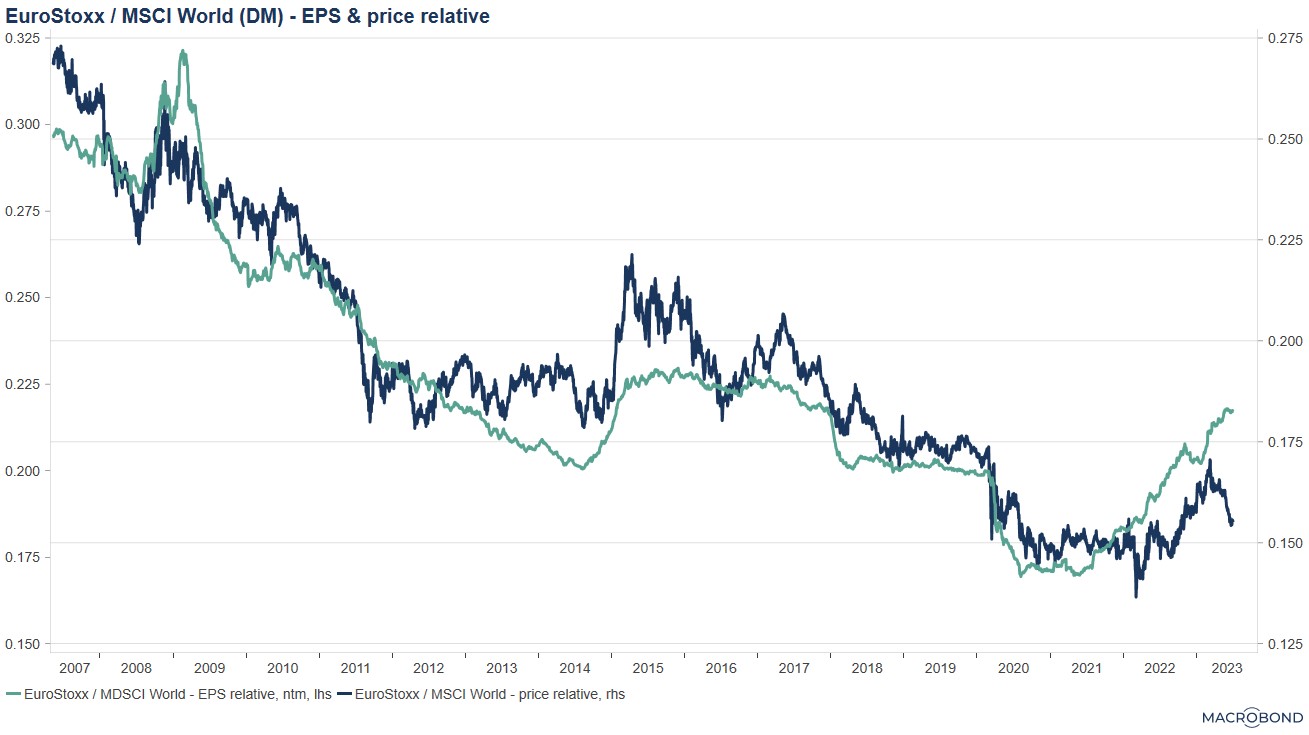

That made me think whether there are any stocks where the opposite is the case, where earnings have outgrown returns recently, where the rubber band could pull prices up rather than down. I’m sure the list is longer, but European equities caught my eye.

European earnings have outgrown other DM continuously since the end of pandemic, even when markets worried first about the Ukraine war and then about an energy crisis. But prices have not kept pace, with Europe underperforming since March. From the middle of 2021 relative earnings are up 28%, but relative prices only 4%. The PE has fallen to multi-decade lows. In a recession scenario, Europe should have a safety buffer; in a no landing scenario there is catch-up potential…a good risk/reward ratio.

Source: Macrobond, Lars Kreckel

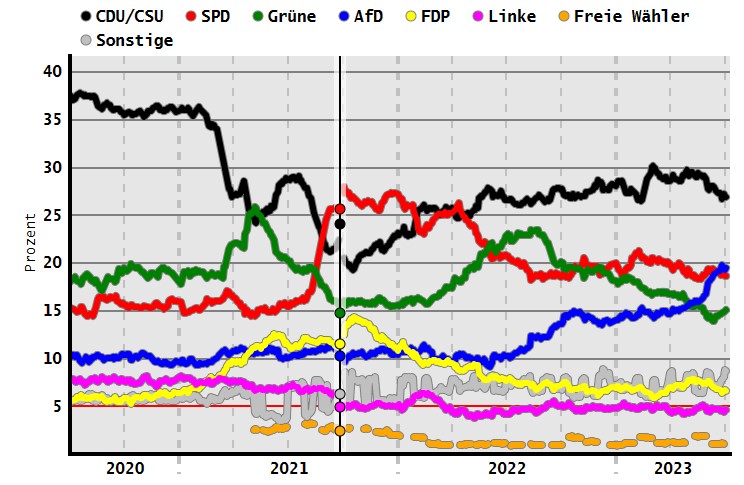

Political Risk Premium

Right-wing parties are doing well across Europe. They received 12% of the vote in the Greek election, polls suggest they may be part of the next Spanish government and in Germany the AfD has consistently been polling in second place nationally. Strikes in Britain and riots in France complete the picture of an unhappy populace and highlight that it’s not just about the right wing.

Chart: Average general election polls

Source: DAWUM

Why are people so angry? It would be too easy to blame inflation and immigration. These may be the culprits du jour, but populist right and left parties have been increasing their vote share since the 1960s. The causes run deeper. It was only a few years ago that globalisation, the financial crisis, inequality, automation and rapid social change were blamed for the rise of populism. I tend to think they all play a role, albeit to varying degrees for different individuals.

This matters to markets because anger drives voting behaviour, which drive politicians, which drive policy responses, which drive markets. The market impact has so far been minimal and it can stay that way for some time. But, at the margin, expect policymakers to be more fiscally irresponsible, anti-immigration and anti-globalisation with a risk of undermining institutions. 2015 and 2016 taught us that such a setup can suddenly become a dominant market driver (e.g. Trump, French election, Brexit).

Earnings update

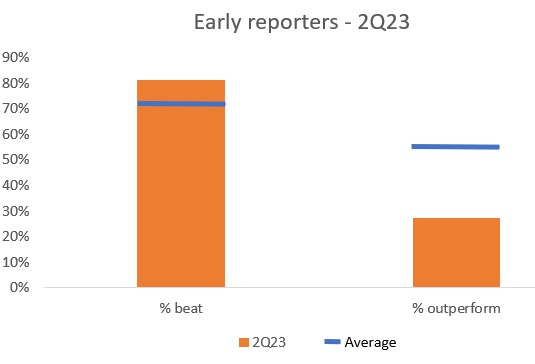

The proper earnings season kicks off next week. As always, the first results skew heavily towards Financials, so be careful extrapolating the early statistics.

The holiday-shortened week has had fewer results from early reporters to digest, but the overall pattern has remained the same as in previous weeks. More companies than normal have beaten analyst estimates, but an extremely low proportion of stocks managed to outperform the market after results.

Source: Bloomberg, Lars Kreckel

Analyst estimates are too low, but the rally has driven investor expectations up to levels that leave no room for upside surprises.

With little earnings news ahead of next week, the passage of time is continuing to gradually push up forward earnings.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.