- Buying the dip in China Tech looks tempting, but it’s not a Tech trade. It’s all about China!

- It’s been a tough few weeks for the recession bears. The pressure is on! But if the macro conviction holds, then this is the worst time to capitulate since the start of the bear market.

- "Disney vs. Netflix” - not just a streaming war, but a surprising indicator of Tech sentiment swings.

Go deeper…

China Tech vs US Tech

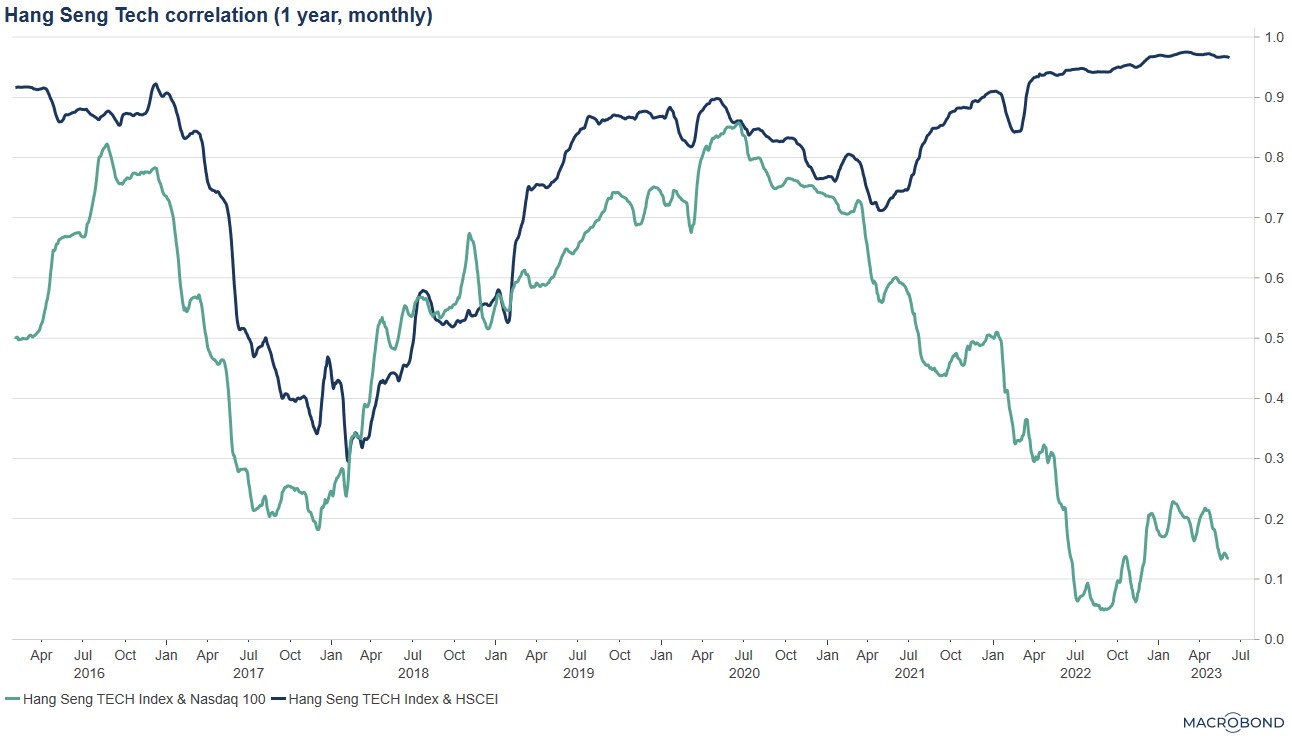

Are Chinese Tech stocks the bargain of the decade or a value trap? Since the start of 2021, the Nasdaq 100 is up 16% and the Hang Seng Tech index is down 52%.

My short answer is: Buy the dip only if you also like Chinese equities.

The performance gap gives an exaggerated impression of the potential upside. Poor fundamentals can explain most of the underperformance, so it’s not all about an excessive overshoot of prices. Two thirds of the underperformance has come from earnings, one third from valuations. Regulation-induced earnings weakness and add a dose of deteriorating sentiment about China macro to the mix.

On the plus side, compared to US Tech:

- It trades at valuation discounts that are close to the 2022 lows when Xi’s power grab and fears of extended lockdowns took sentiment on Chinese equities to extreme lows.

- Relative earnings vs Nasdaq have been stabilising for a few months with even a bit of upward momentum.

- Sentiment is bearish, which is good.

But the main thing to understand is that China Tech isn’t really about Tech anymore. It used to be about Tech AND China, but over the past two years it has been ONLY about China. So if you want to buy the dip in China Tech, you first need a view on Chinese equities. That’s a question with a longer answer for another day.

Source: Macrobond, Lars Kreckel

Under pressure bears

It’s been a few tough weeks (that probably felt like months) for those in the recession and bear market camp. The kind that makes you doubt your convictions and, even with prices going against you, makes you wonder at what point you will get stopped into the market.

It’s easier to say this from the side-line, but now seems a terrible time to capitulate!

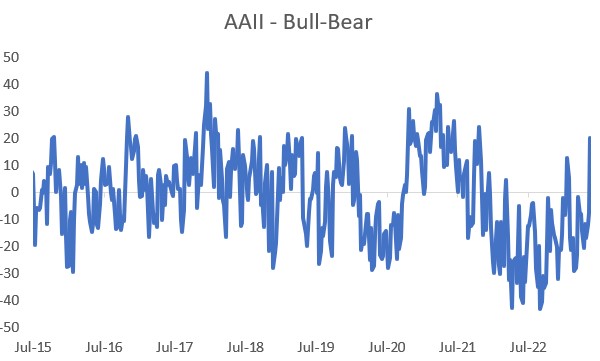

- Sentiment is the most bullish since the start of the bear market. AAII Bull-Bear jumped to 20% net bullish this week, though not yet at outright ‘sell’ levels.

Source: Bloomberg, Lars Kreckel

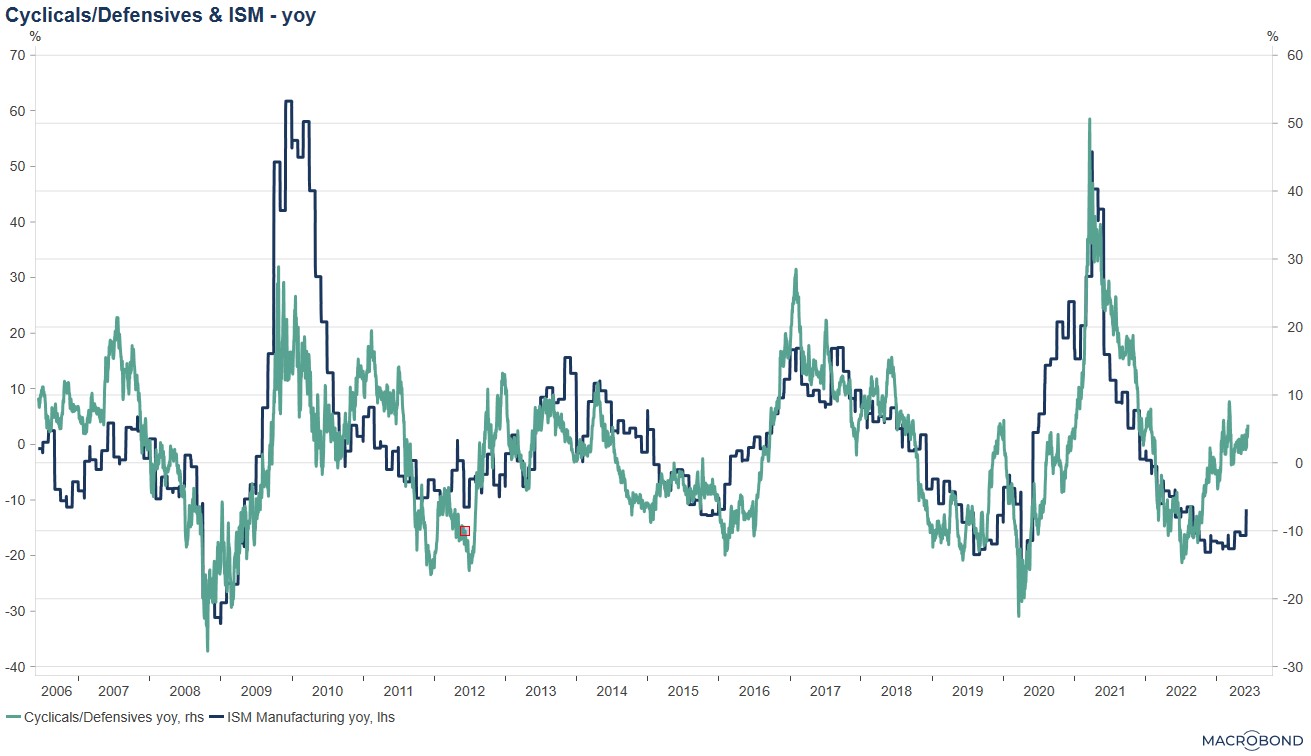

- Equities are already pricing a recovery. Cyclicals are my favourite gauge of economic optimism priced into equities and they have been on a tear. On this basis the market is pricing an ISM Manufacturing rebound to the mid-fifties rather than today’s 47 or a recession drop to the low 40s.

Source: Macrobond, Lars Kreckel

- There’s limited upside. Equity upside can come from two sources: earnings and valuations. If we avoid recession and stay in late cycle for longer you should assume mid-single digit earnings growth as a base line. It’s difficult to see a path to double digit growth. And if this is also an environment of higher for longer interest rates, then a re-rating back to PEs north of 20x is also difficult.

Disney vs Netflix

"Disney vs. Netflix” - not just a streaming war, but a surprising indicator of Tech sentiment swings. Tech optimism is visible in many places: surveys, social media, returns and valuations. And the chart below struck me as another place where Tech bullishness has shown up.

Netflix and Disney are in many ways direct competitors. Netflix used to be part of the FAANG acronym, and still trades a lot like a Tech stock, but the questions that drive the success of Netflix are not Tech questions, but media questions: subscriber numbers, subscription pricing, hit shows, etc. Not that different from Disney.

The relative return of these two shares tracks the swings of the COVID cycle very well. Netflix wins in the pandemic (Spring 2020), Disney does well on the vaccine news (end 2020), but gives it back on Delta & Co (mid 2021), Netflix sells off sharply on the full re-opening. Both fared poorly in the 2022 bear market and cost of living pressures, but recently Netflix has returned to the pandemic highs compared with Disney.

Source: Macrobond, Lars Kreckel

I’m a macro guy and not a stock picker, so I have no strong view on Disney vs Netflix. But it’s another unusual place where the re-rating and optimism about Tech compared with the rest of the market has become visible. I still like Tech long-term, but prices have run ahead of fundamentals.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.