Tech is not as recession proof as the bulls claim, but also not an obvious recession loser as the bears claim.

Why it matters: Tech has had a great start to the year, almost enough to forget about last year’s pain…almost. But recession seems likely and Tech has a high beta. ‘How would it do in a recession?’ is a question you need to answer for every equity position.

There seem to be lots of views on this and it feels a bit like where you come out is correlated with your age. In the early 2000s it was the worst place to be; in the 2020 pandemic it was the best place to be.

The truth and base line is somewhere in between: Tech should be an average performer in a recession; neither a basket case nor a safe haven.

Go deeper…

Empirically speaking

The first thing to check, always, is the empirical data. How has Tech performed in past bear markets? Answer: not as badly as you think.

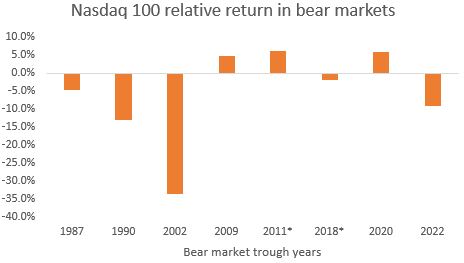

The Nasdaq 100 underperformed in five of the last eight bear markets, on average by 5.7%.

That is not a particularly strong pattern to start with, but a closer look, makes it even weaker. One of those instances was the 1987 crash, which only half counts. It was not followed by a recession, though some of the drawdown was arguably associated with growing fears of a recession.

But the bigger caveat is that the average is skewed by the TMT bubble outlier. Without the Tech bubble the average bear market return of the Nasdaq 100 has been only 1.7% underperformance; not great, but pretty decent for a sector that has had an average beta of ~1.2.

Another detail. Bear market ≠ recession, but almost. It’s a pretty tight relationship with 12 of the last 14 bear markets having been associated with recessions.

Source: Bloomberg data, Lars Kreckel

*not quite a bear market, but almost

Recession details matter

So there is no simple rule that says buy or sell Tech in a recession. We need to look deeper, at fundamentals. What kind of recession is it?

It’s really just a reminder that relative returns are driven by relative earnings. Relative earnings tend to move a lot in a recession, more than in any other period. But for individual stocks and sectors the move in relative earnings can depend on the type of recession.

The pandemic is a great example. The shutdown of the global economy hurt everyone, but Tech fared relatively well in a stay-at-home and online world. Market forward earnings collapsed by 22%, but Tech forward earnings fell ‘only’ 11%. Tech ended up being a safe haven in that particular bear market and recession despite starting with bullish sentiment and despite its beta of 1.25 going into the pandemic.

Fundamentally speaking

Fundamentally, Tech is neither extremely cyclical nor defensive; it’s neither like Autos nor Utilities. It’s such a broad sector that some companies have business models that are very sensitive to the economy, like advertising. But others are less so or still in earlier stages of a secular growth phase, arguably AI.

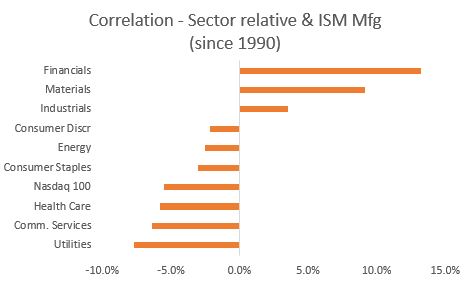

This mix also comes through in market behaviour. The correlation of Tech’s relative performance with the ISM has bounced around zero over the past few decades.

Source: Macrobond

It ranks roughly in the middle of the sector pack in terms of cyclicality. As expected, Financials and Cyclicals like Materials and Industrials have been most closely correlated with the ISM; Defensives like Utilities, Health Care and Telecoms the least…and Tech somewhere in the middle.

Source: Bloomberg data, Lars Kreckel

What about this cycle?

If the type of recession matters, it does not look like this recession would be one of the outliers for Tech (famous last words). But there are a few Tech specific factors to consider for this cycle, some positive, some negative.

If a credit crunch were to be a feature of this recession, and recent events suggests that’s not a crazy concept, then Big Tech is relatively well positioned. Companies with low financial gearing and strong cash generation are the place to be and Big Tech ticks both boxes. We have seen this in action during the bank run fears: the Nasdaq was a star performer in March.

Tech has more self-help levers to pull than most. Meta’s ‘year of efficiency’ has been emblematic of a sector-wide trend. It has been a theme for a couple of quarters, but share prices are still responding positively to the news flow. And there is still a lot of room for more, if needed, to catch up with where the rest of the corporate world has been for many years.

Buybacks are another lever for self-help. Also not new, but another factor where Big Tech has more room to act than most companies, even in a recession.

Sentiment and valuations are on the high side, but neither are extreme, so unlikely to be a dominant negative in a recession scenario.

Bottom line

- Tech is not a recession play in either direction

- Good: little debt, very cash flow generative, lots of self-help potential

- Bad: sentiment and valuations are on the high side

- Other factors should drive your Tech position…a topic for another day