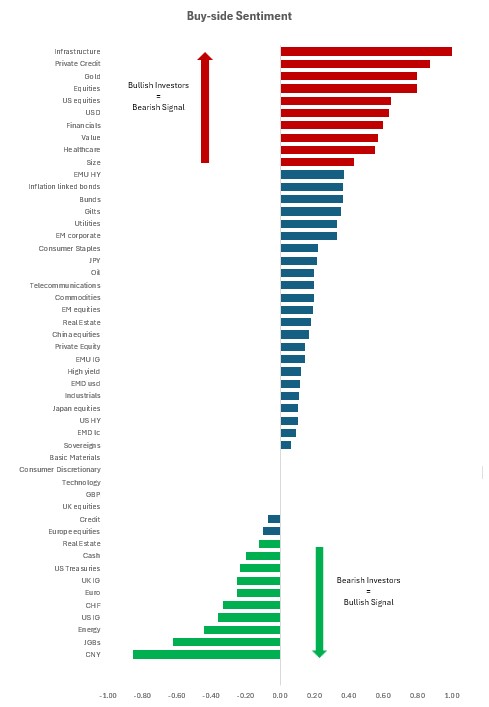

The latest views from 34 top asset managers offers insights into consensus positioning across 70 assets, with 830 individual views. Here are the highlights:

DM me if you want more details.

Conclusions:

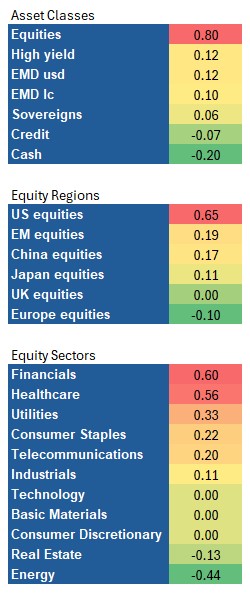

- Bullish consensus: As we head into 2025, 25 managers are overweight equities, 4 are neutral, and only 1 is bearish. High yield ranks second in popularity, reinforcing a risk-on sentiment.

- Surprising Tech sentiment: Despite the AI buzz and Mag7 focus, Tech has fallen in popularity, now showing as many underweights as overweights. Maybe Tech sentiment isn’t as bullish as it seems.

- EM unwinding: The long EM trade from autumn continues to fade, with 3 of the Top 10 decliners in popularity being EM assets. Despite this, EM and China equities remain more popular than European equities.

- Private credit mania: Private credit is widely loved, but I’m not sure if this reflects genuine conviction or serves as a marketing narrative, similar to how ESG was once viewed.

- Most popular: Infrastructure, private credit, Gold, the US dollar, Value, and Financials are at the top.

- Least popular: JGBs, US investment-grade credit, most non-USD currencies, and Energy (the least popular sector).

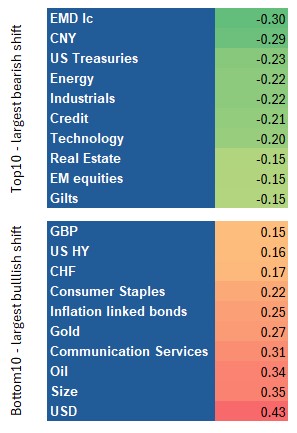

- Biggest movers: The US dollar and Gold saw the largest jumps in popularity. Small Caps (possibly tied to the "Trump trade") and Oil also gained, though from low levels. EM assets and sovereign bonds (Treasuries and Gilts) lost popularity, even before recent market turbulence.