The latest views from 35 top asset managers offers insights into consensus positioning across 70 assets, with 900 individual views.

Main message: The shifts in buy-side popularity look like rotations rather than risk-off. No buy-the-dip arguments in this data.

Here are the highlights:

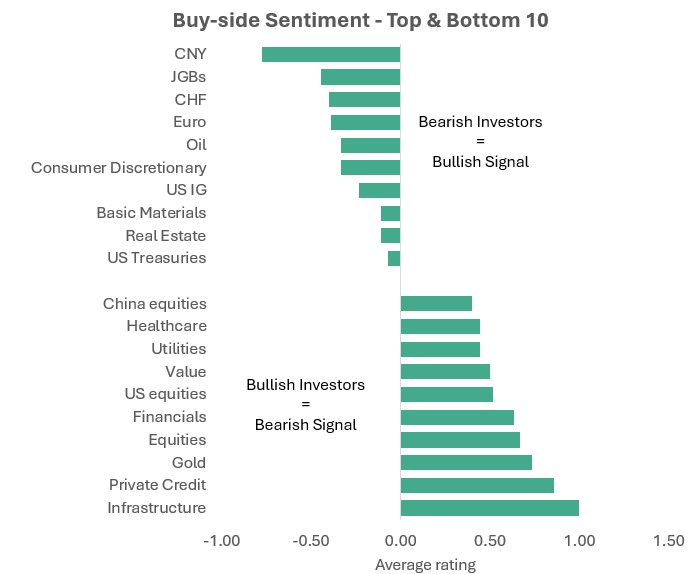

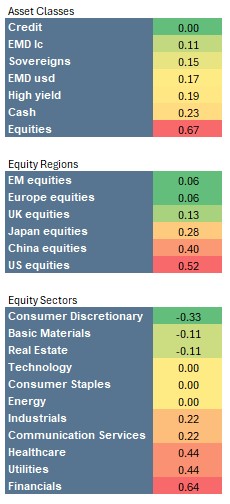

- Less Bullish, but not Bearish: Equity sentiment has declined for the 4th consecutive month, but remain far and away the most popular asset class. On cash there are still more bulls than bears. Overall, the bearish shift is much less extreme than in the AAII Bull-Bear survey.

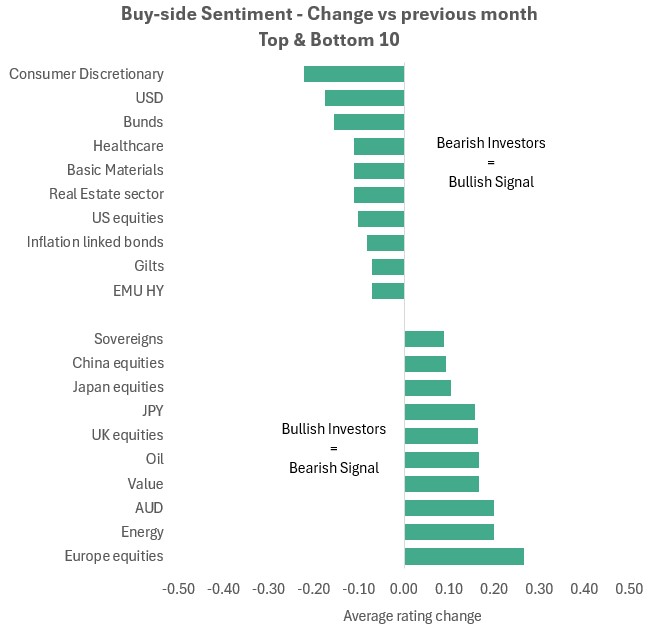

- European Rebound: The most predictable change has been the jump in popularity of European equities from last month’s extreme low. But it comes from a low base: after the biggest popularity jump across all 70 assets, it remains the joint least-popular equity region.

- Love for Financials & Value: With Tech’s leadership struggling and bond yields staying high, it’s perhaps no surprise that Financials and Value have become more popular. This trend has been going on for a while, but they are now the most popular sector and factor.

- From Dollar to Yen: The US dollar’s drop in the popularity rankings has been one of the biggest of the past couple of months with the Japanese yen now taking the top spot in FX.

- Most popular: Infrastructure, private credit, and Gold stay very consensus long positions. Financials are the most favoured sectors. US equities remain popular despite a weak start to the year.

- Least popular: JGBs, the euro and Swiss franc are the least favoured assets. European equities still rank joint-lowest among equity regions; Consumer Discretionary is the least popular sector.

- Biggest movers: The biggest gainers in popularity are mostly rotation stories, rather than risk-off assets and include European equities, Energy sector, Value and Japanese yen. Likewise, some of the biggest losers in popularity include risk-off assets like the US dollar, Bunds, and the Healthcare sector.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.