The latest views from 35 top asset managers offers insights into consensus positioning across 70 assets, with 890 individual views. Here are the highlights:

Let me know if you would like a more detailed breakdown.

Conclusions:

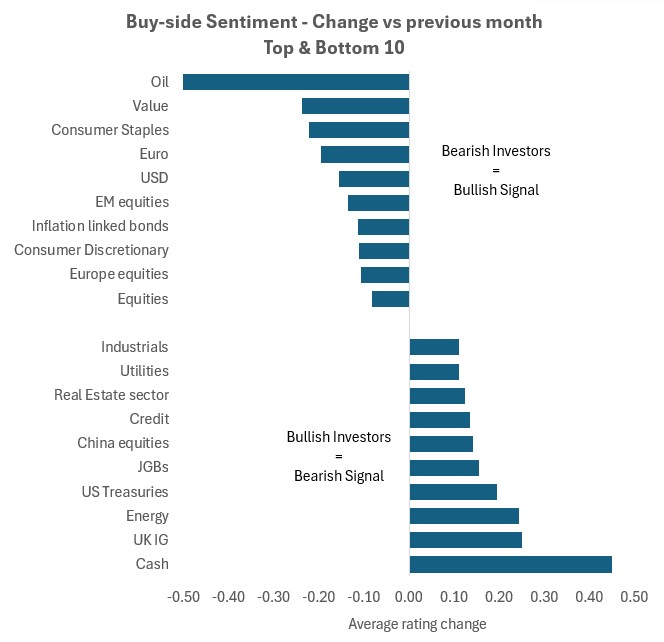

- Small dip in Bullishness: Sentiment remains bullish but has softened. Equities saw a small downgrade, landing in the Top 10 bearish shifts, while Cash saw the biggest upgrade across all assets.

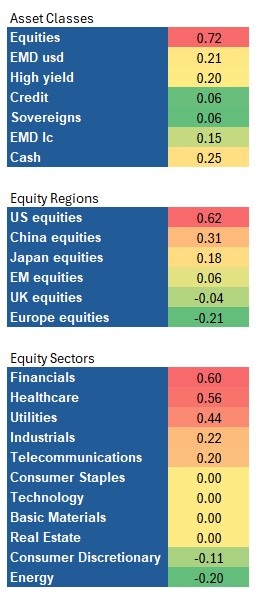

- Tech Sentiment Neutral: Overweights and underweights are balanced. Tech has been lagging the market despite its high beta, so some of this being reflected in performance.

- Europe Capitulation: Fund managers have turned bearish on Europe just as it starts to outperform. It ranks as the least popular region and 7th least popular asset, and the euro is also out of favour. Expect potential upgrades ahead.

- Factor shift: Sentiment for Value and Small Caps dipped, though both remain relatively popular compared to past lows.

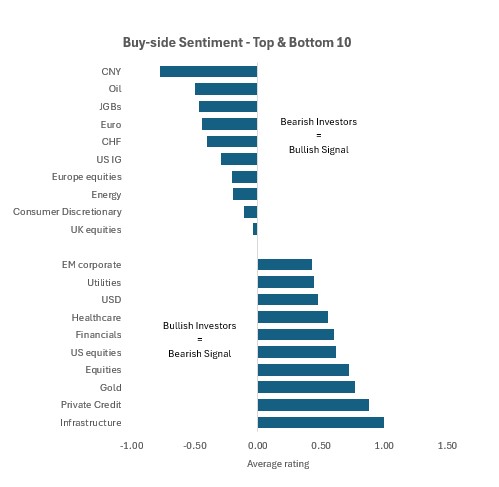

- Most popular: Infrastructure, private credit, and Gold stay very consensus long positions. Financials and Health Care are the most favoured sectors. US equities remain popular despite a weak start to the year.

Least popular: Oil, JGBs, and most non-USD currencies are the least favoured assets. Europe ranks lowest among equity regions; Energy is the least popular sector.

Biggest movers: Cash, Treasuries, and JGBs gained popularity, all risk-off assets. Energy rose slightly from low levels. Oil, Value, Consumer Staples & Discretionary, and Linkers declined in popularity.