February 2026 - Views from 44 top asset managers across 73 assets, based on 1,300+ individual views

Main takeaways

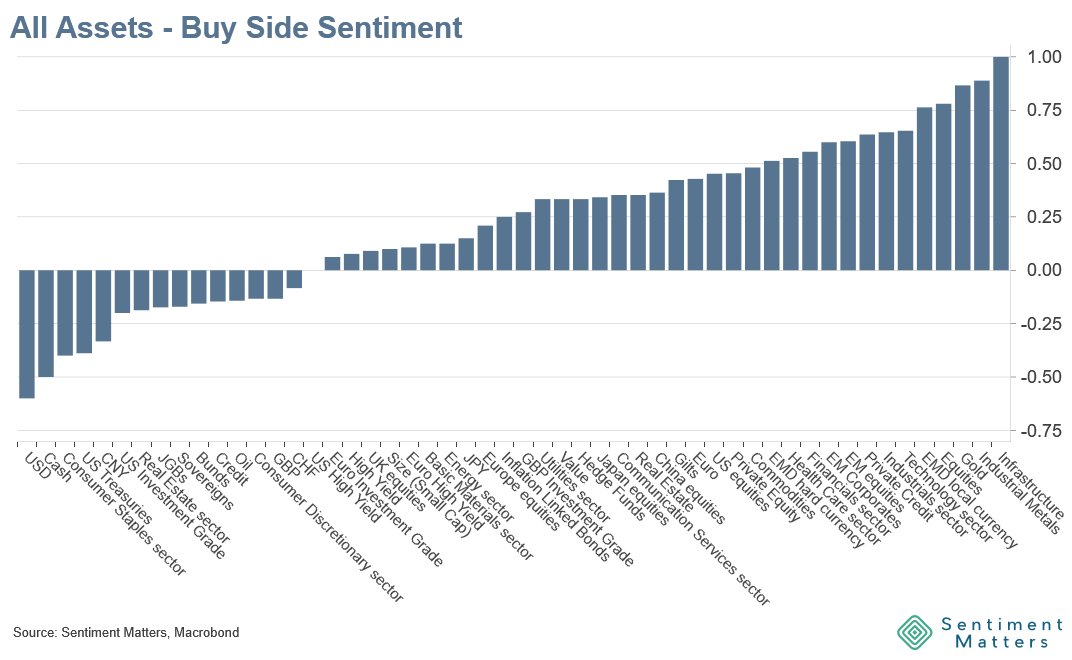

- Overall sentiment: the most bullish reading since we launched the BSST in 2024 (new high, above Dec-2024)

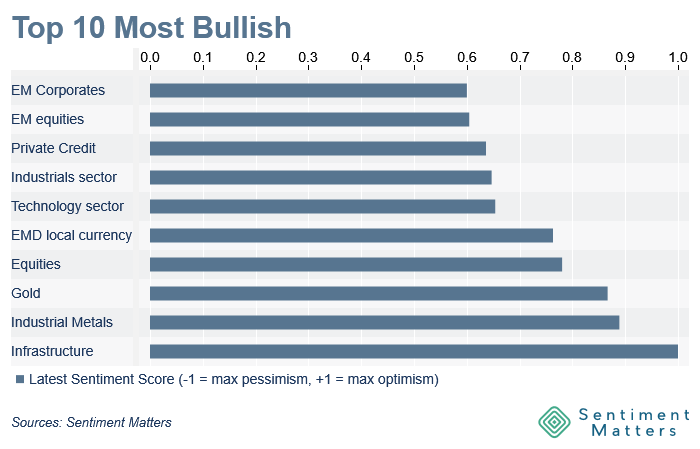

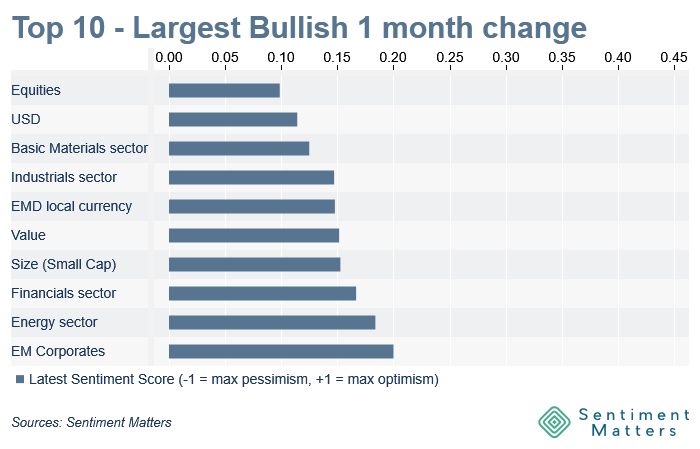

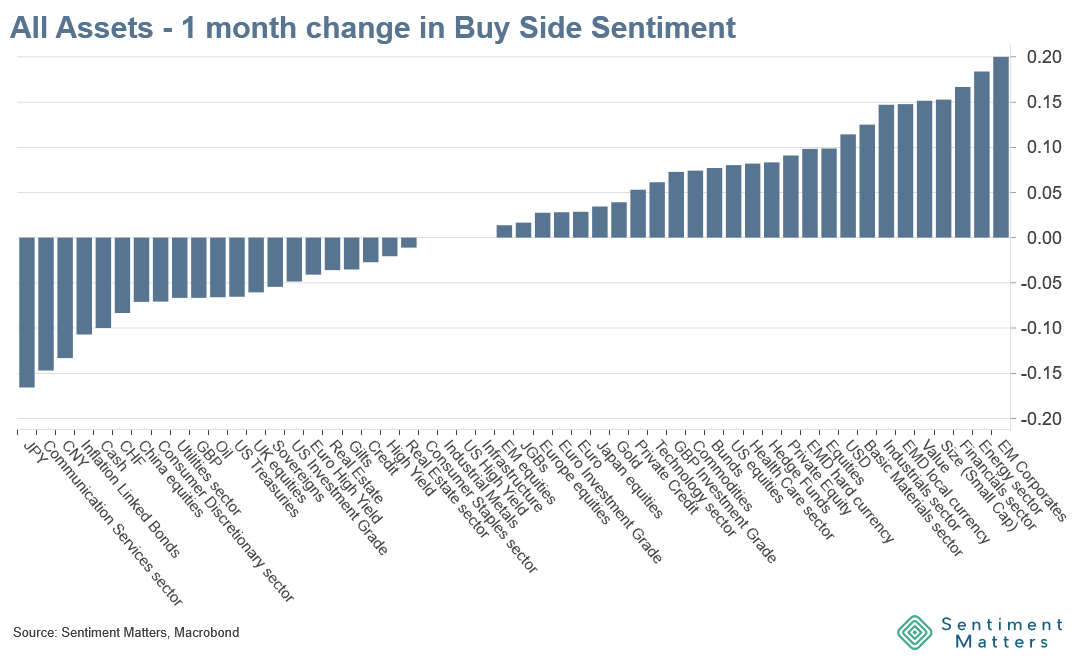

- Cyclicals: the clearest message across assets is “Buy Cyclicals” (sectors + factors)

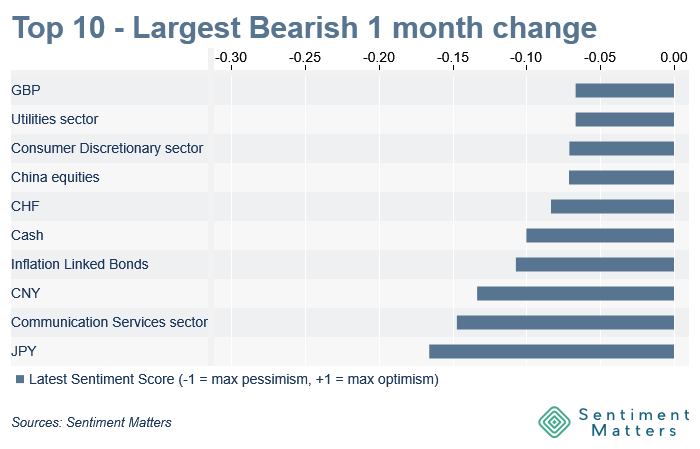

- Emerging Markets: divergence is widening — EM equities & EM debt loved, while China equities downgraded for a 4th straight month

- Tech: loses its #1 spot (or is barely clinging on), but remains far from unpopular

Sentiment: Record Bullishness

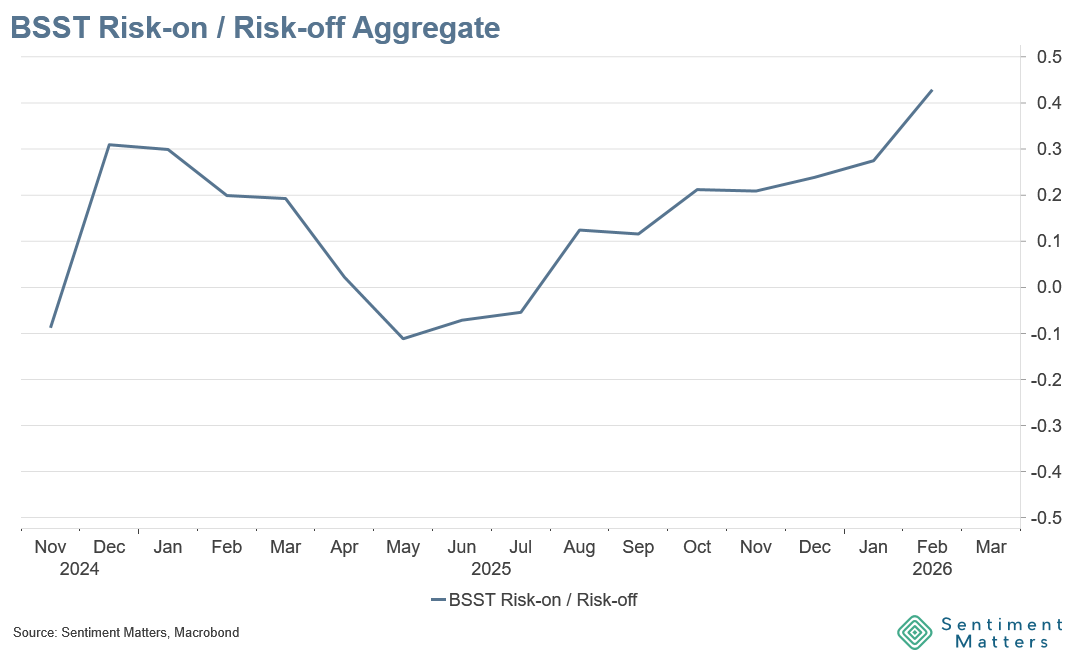

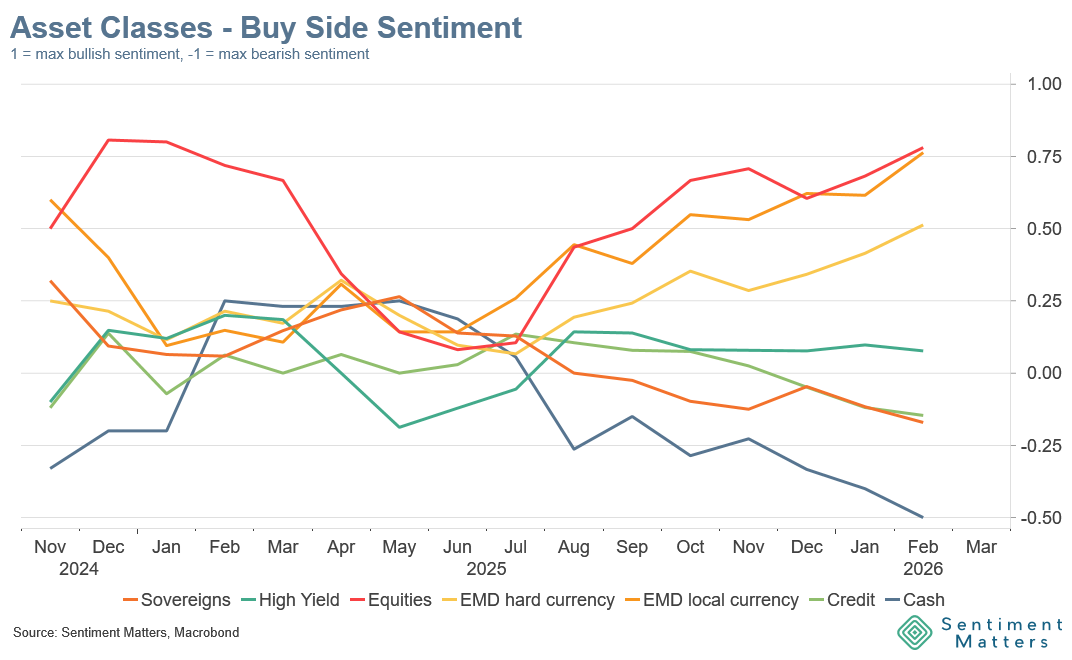

Buy-side sentiment took another step higher — to a new BSST high, exceeding the December 2024 peak.

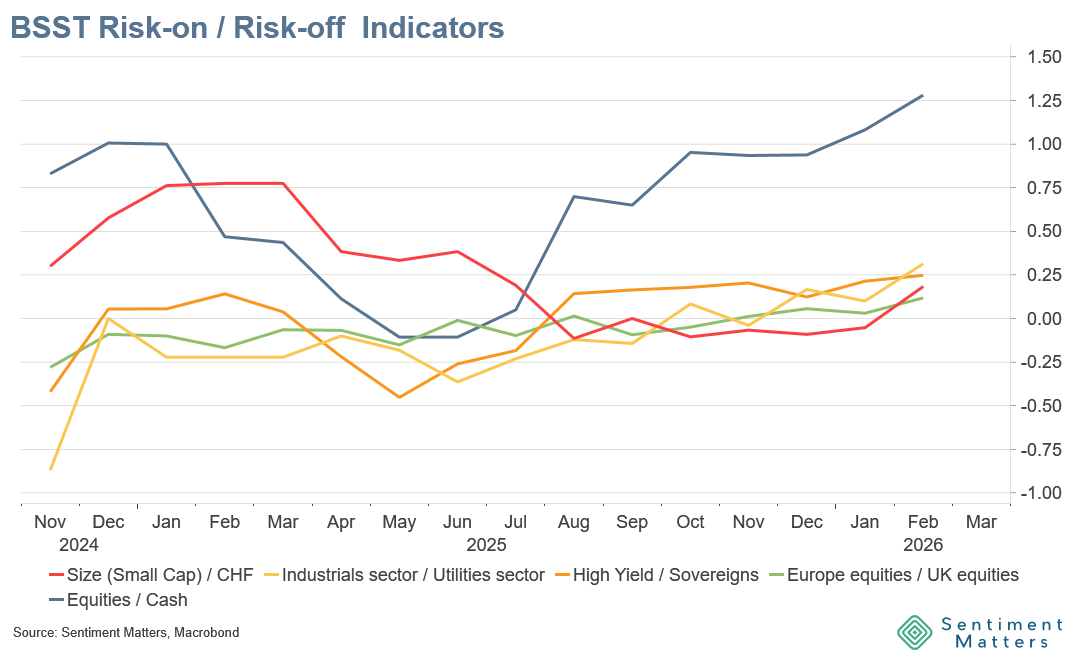

Risk appetite

- Risk appetite rose in all 5 risk-on/risk-off indicators

- All 5 indicators are at the highest level in the 16-month history

Big asset-class shifts

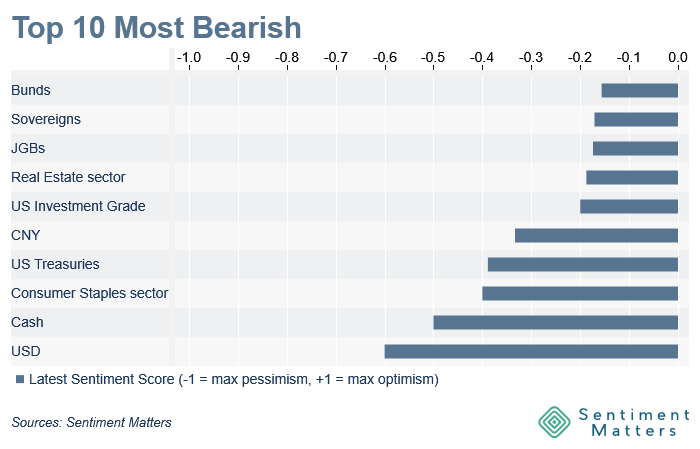

- This was a classic risk-on month: the riskiest assets upgraded — and defensiveness (cash/sovereigns) faded further.

- Equities: upgraded again to +78% net bullish (top major asset class)

- 33 Bulls | 7 Neutrals | 1 Bear

- Cash: downgraded again to -50% net bearish (new low; least popular asset class by far)

- Sovereigns: downgraded to -17% net bearish (2nd-lowest on record)

Positioning tilt

- Clear pro-cyclical lean: biggest overweight of cyclical sectors in BSST history

- Small caps upgraded to their most bullish reading in 10 months

Equity Regions

US equities

- Biggest upgrades among regions: a sharp recovery from “least popular” after Liberation Day to 2nd most popular.

- Now +45% net bullish.

EM vs China: divergence widening

- China: 4th straight month of downgrades → least bullish in a year

- Rest of EM: upgraded again → +61% net bullish (top region)

New: India

- First month in the tracker: 7 views → 4 Bulls | 3 Neutrals | 0 Bears