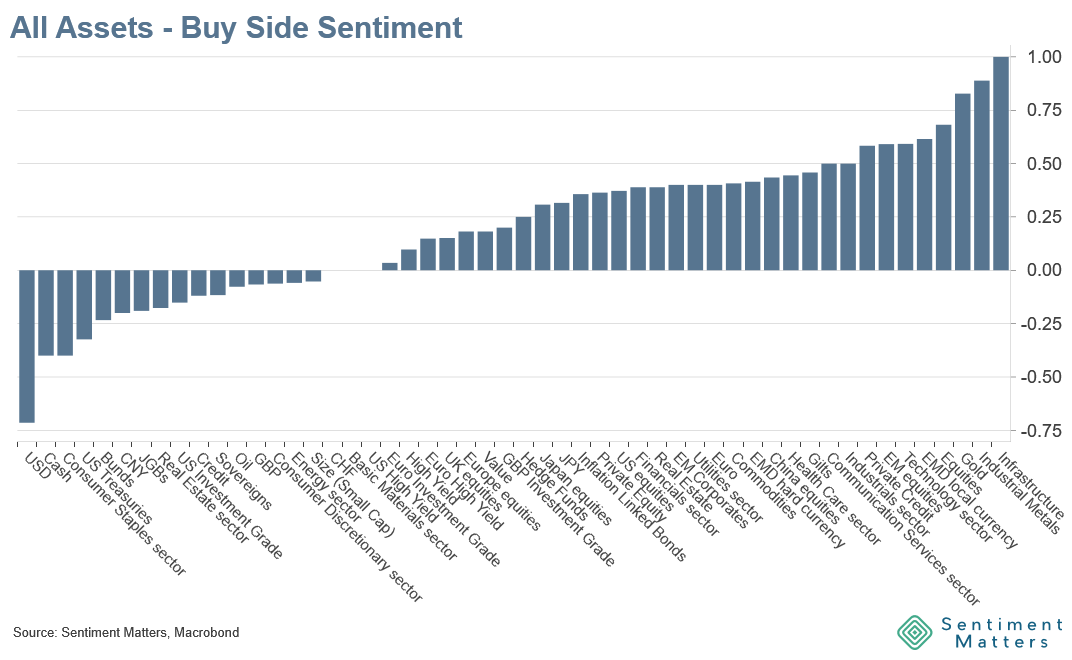

Views from 44 top asset managers across 70 assets, based on 1,200+ individual views - January 2026

Top 4 Takeaways:

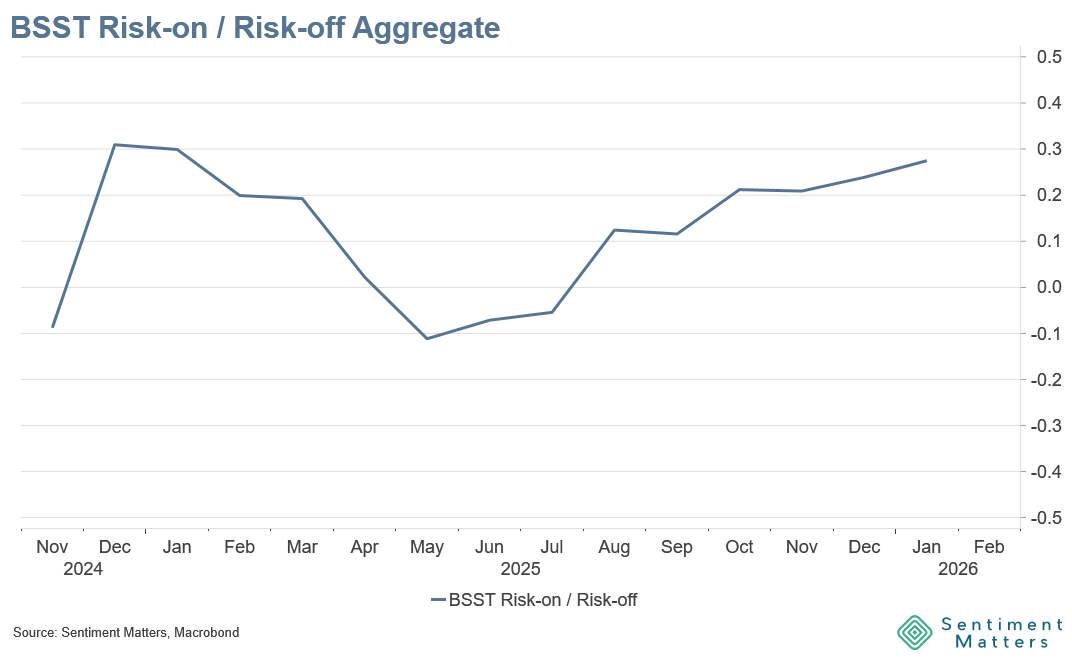

- Overall sentiment: getting more and more bullish — close to the December 2024 highs

- Equity regions: EM remains the favourite, but China is slipping

- Equity sectors: Tech is still #1, but it’s the biggest sector loser this month

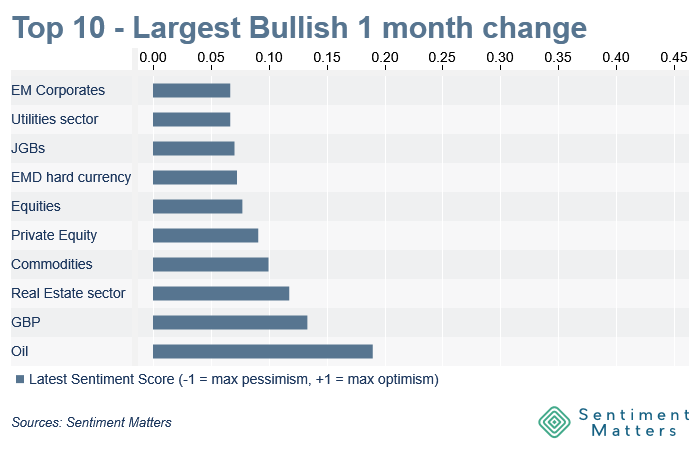

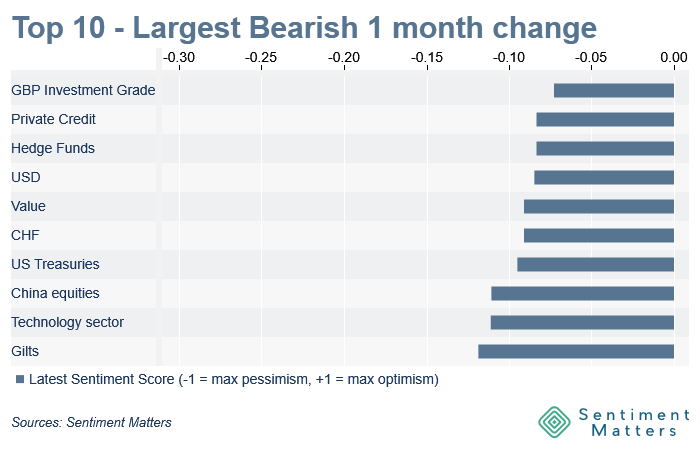

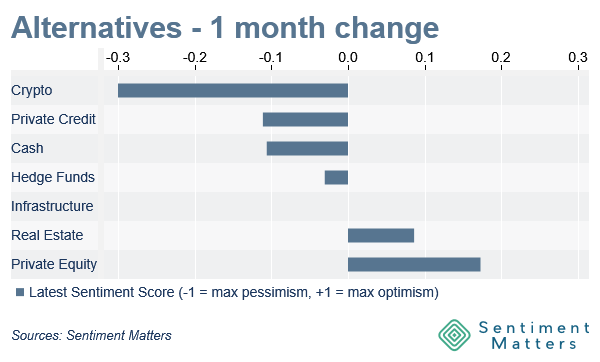

- Private assets: rotation within privates — Private Credit down, Private Equity up

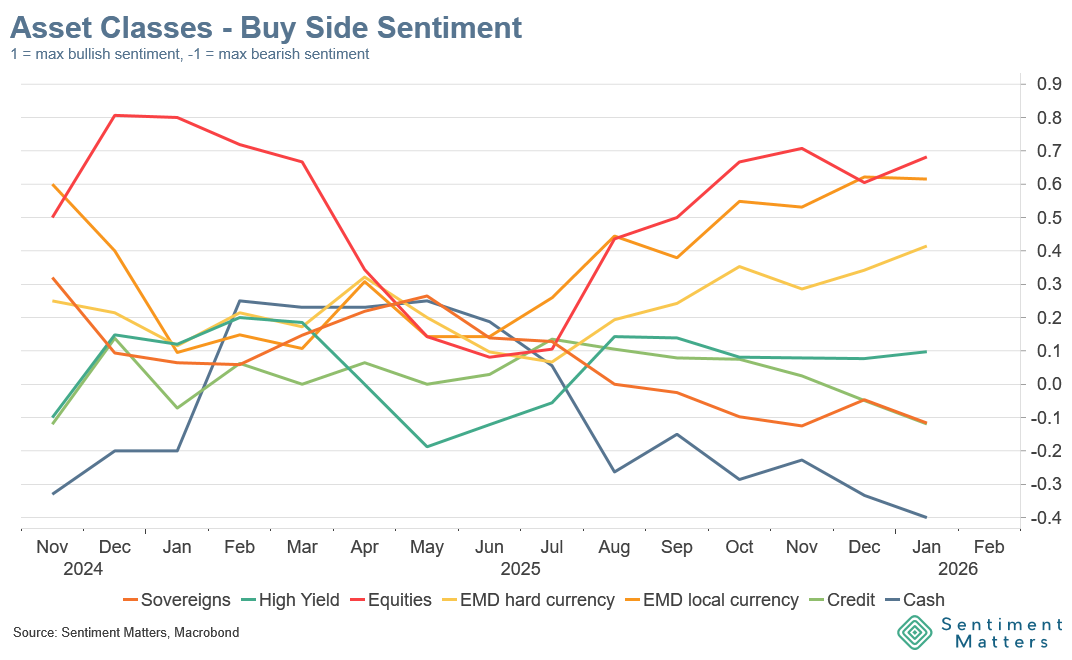

Sentiment: More and More Bullish

- Buy-side sentiment continues to drift higher — almost back to the Dec-2024 peak.

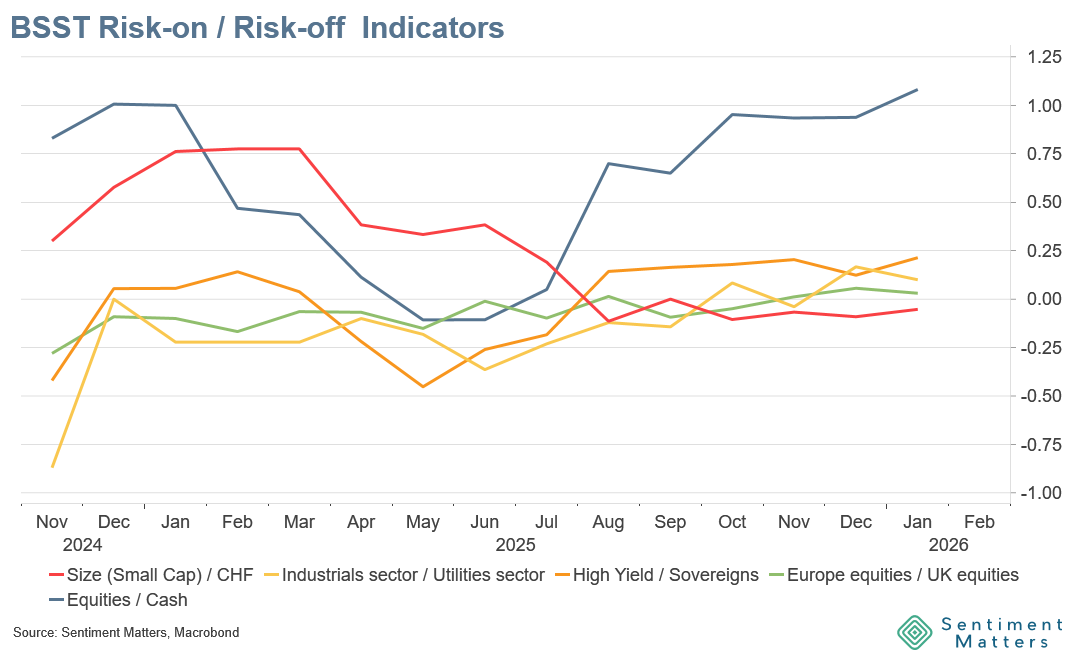

- Risk appetite rose in 3 of 5 risk-on/risk-off indicators.

- 4 of 5 risk-on/risk-off indicators are at the highest or 2nd-highest level in the 15-month history.

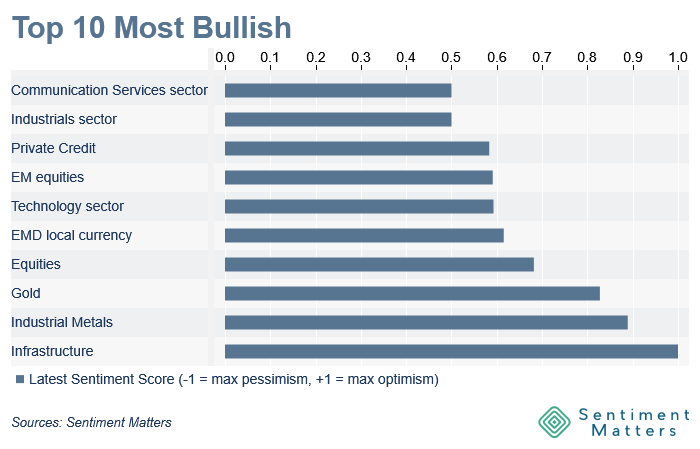

- Equities: upgraded again to +68% net bullish (most popular major asset class)

- Breakdown: 32 Bulls (+3) | 10 Neutrals (-1) | 2 Bears (-1)

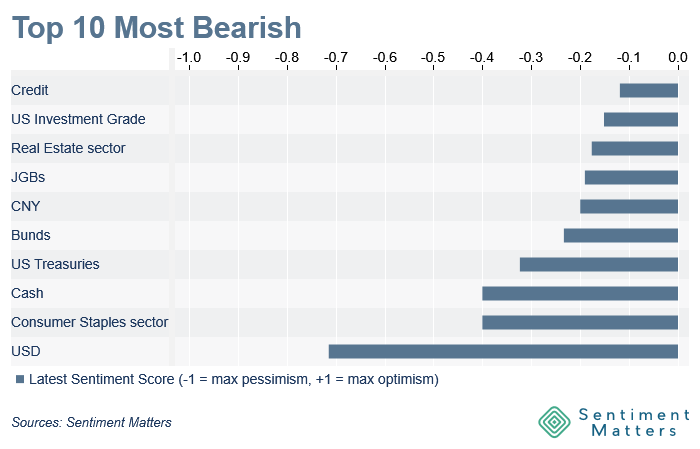

- Cash: downgraded again to -40% net bearish (new low; least popular asset class by far)

- Sovereigns: downgraded to -12% net bearish (2nd-lowest on record)

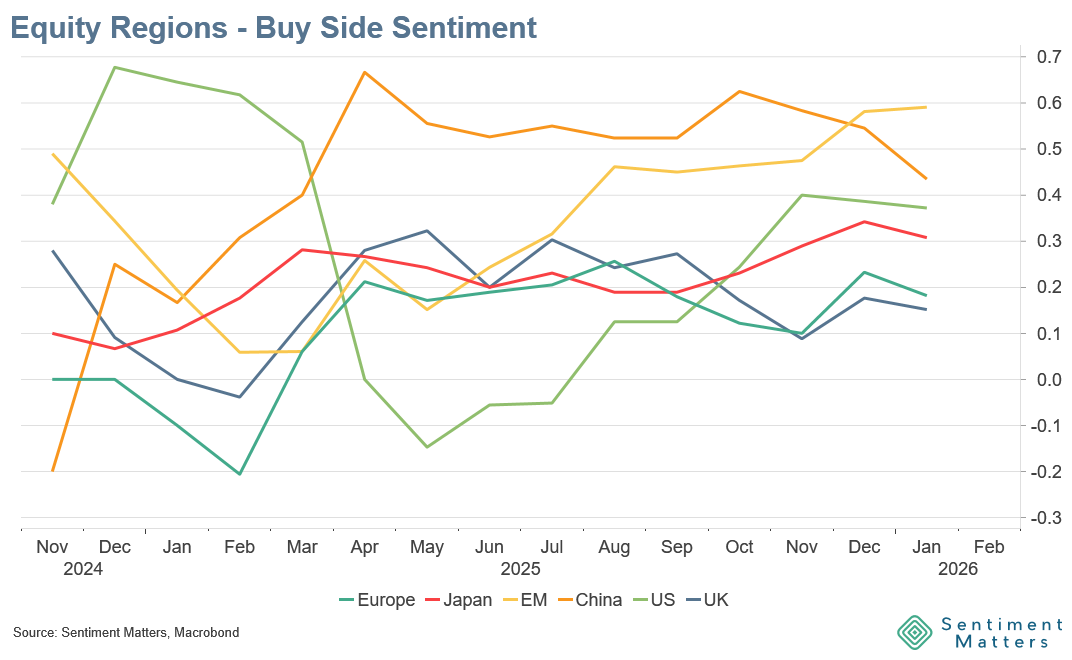

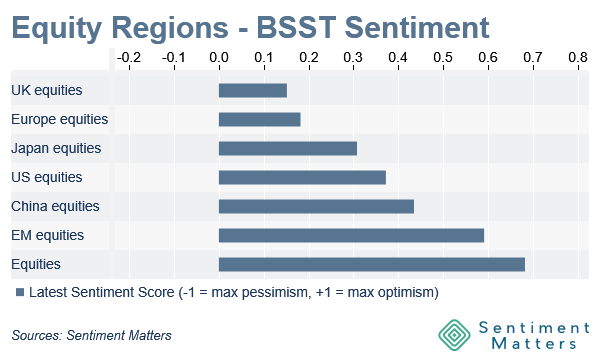

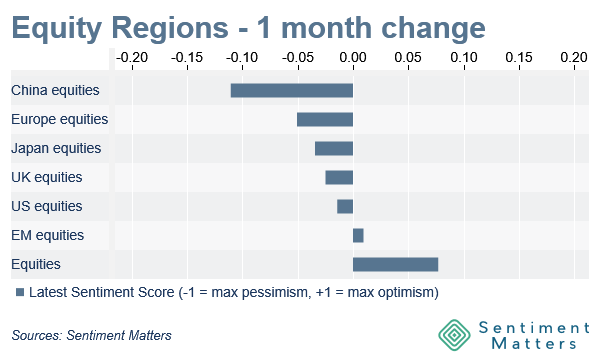

Equity Regions: EM leads, China fades

- US equities: second month of small downgrades. Sentiment rebounded from the Liberation Day lows, but looks to have peaked well below the post-election highs. Now +36% net bullish.

- EM vs China: still the clear leaders for an 8th straight month, but divergence is widening:

- China: 3rd month of downgrades → least bullish since March

- Rest of EM: upgraded again → +59% net bullish (the top equity region)

- Japan: the “Takaichi bounce” has faded. Downgraded this month; now +31% net bullish. Still room for upside if reform/fiscal optimism gets validated by data.

- Europe: one of the bigger regional downgrades this month. Sentiment has been treading water since spring — still net bullish, but 2nd-least popular equity region.

Equity Sectors: Tech Falling

- Biggest upgrades: Real Estate and Utilities (low-beta leadership)

- Technology: biggest sector loser this month; Communication Services (also tech-heavy) was the only other sector with net downgrades.