Views from 44 top asset managers across 70 assets, based on 1,200+ individual views

Chart Pack with all 100 charts at the bottom and in the Toolbox section of the website.

Top 3 Takeaways:

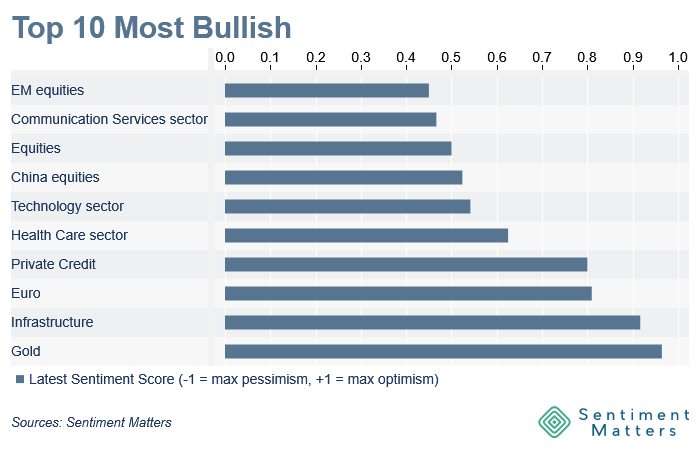

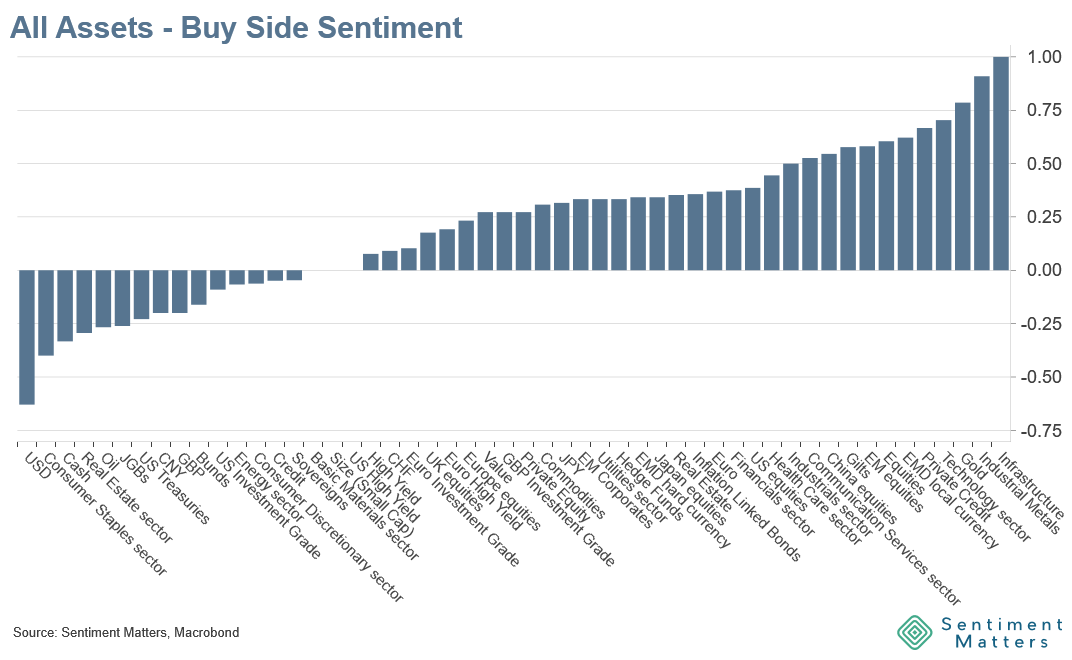

- Overall Sentiment: Bullish, but not extreme

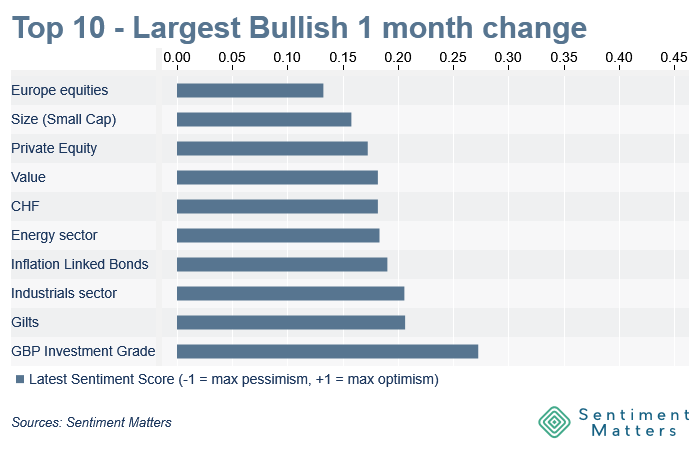

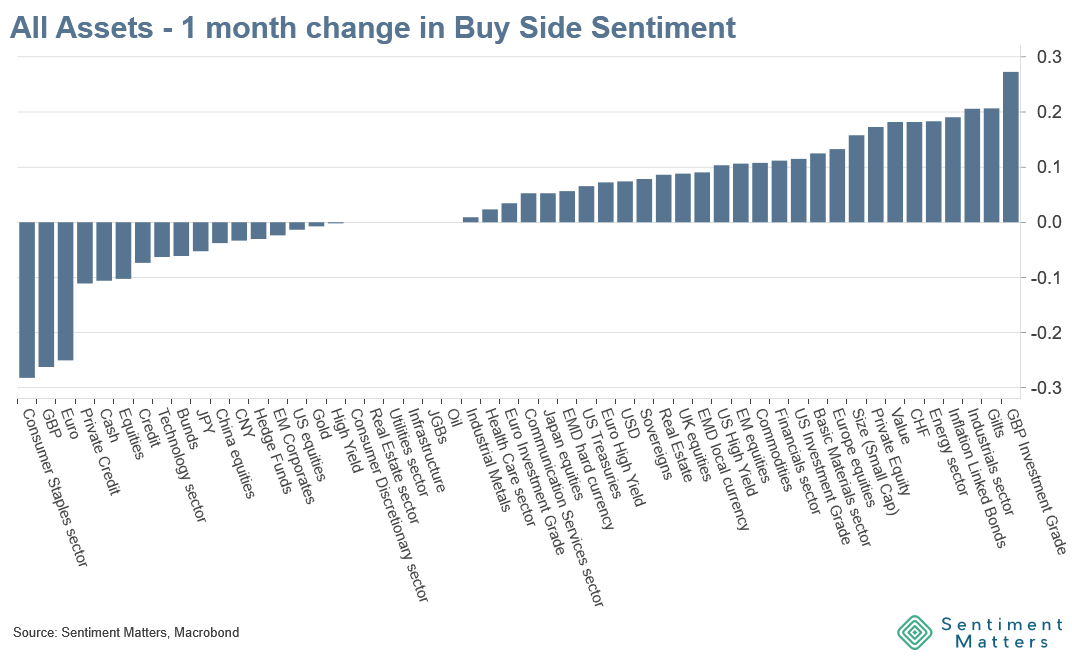

- Economic re-acceleration theme: Clear upgrades across cyclical sectors, small caps, and European equities

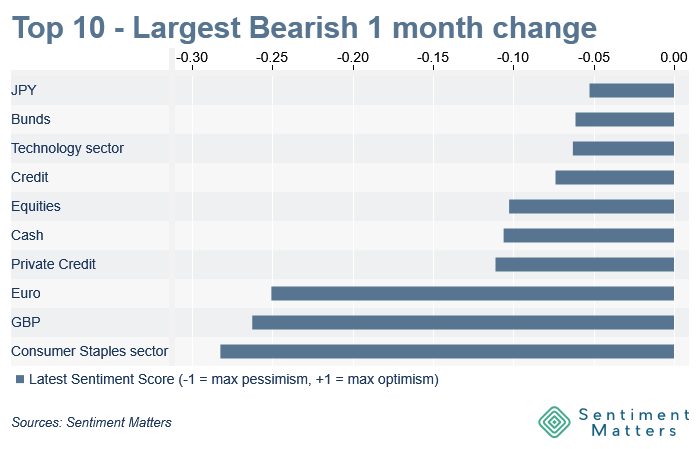

- Private Credit: Downgrades accelerating, but positioning remains crowded (+67% net bullish)

Sentiment: Bullish, but stable

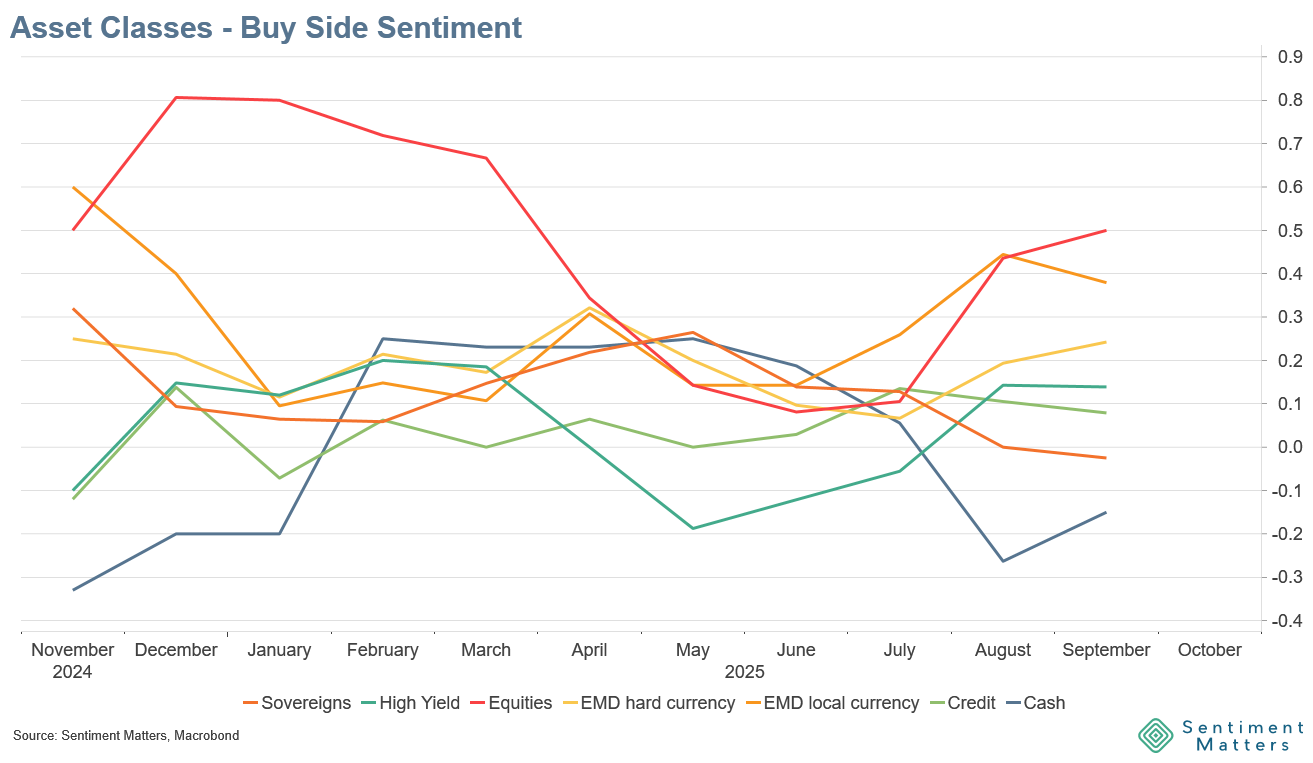

- Overall buy-side sentiment remains very bullish, but broadly unchanged month-on-month.

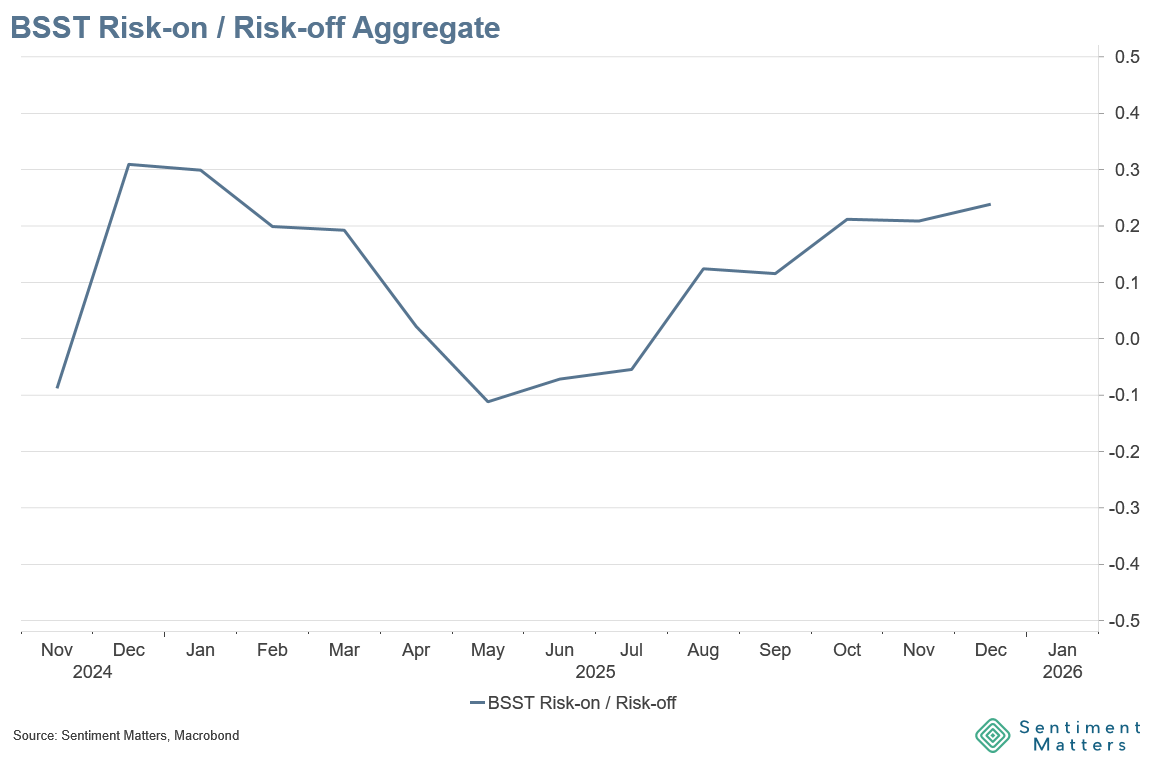

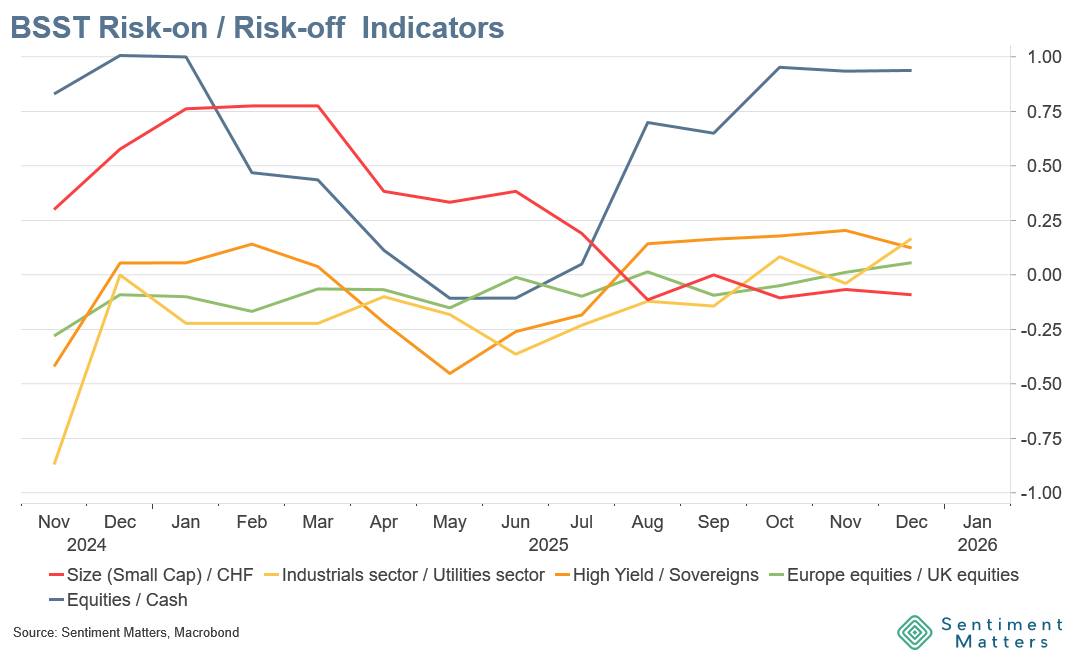

- Risk appetite increased in 3 of 5 risk-on/risk-off indicators.

- Equities: First downgrade in six months. Still popular at +60% net bullish, but below last month’s peak and below the enthusiasm seen a year ago.

- Breakdown: 29 Bulls, 11 Neutrals, 3 Bears.

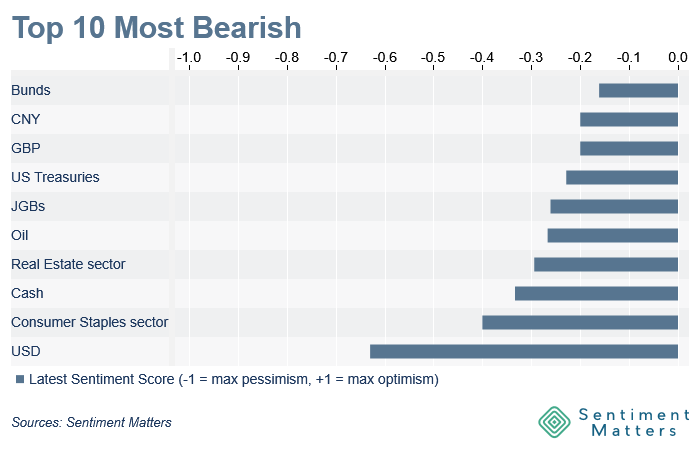

- Cash: Remains the least popular asset class and made a new low in the survey.

- Sovereigns: Saw their first upgrades in seven months, but still have slightly more Bears than Bulls.

- High Yield: Unchanged and still preferred to sovereigns and investment grade.

- Sectors: Clear pro-risk tilt, with upgrades concentrated in cyclicals.

- Small Caps: Benefiting from the cyclical shift, with modest upgrades

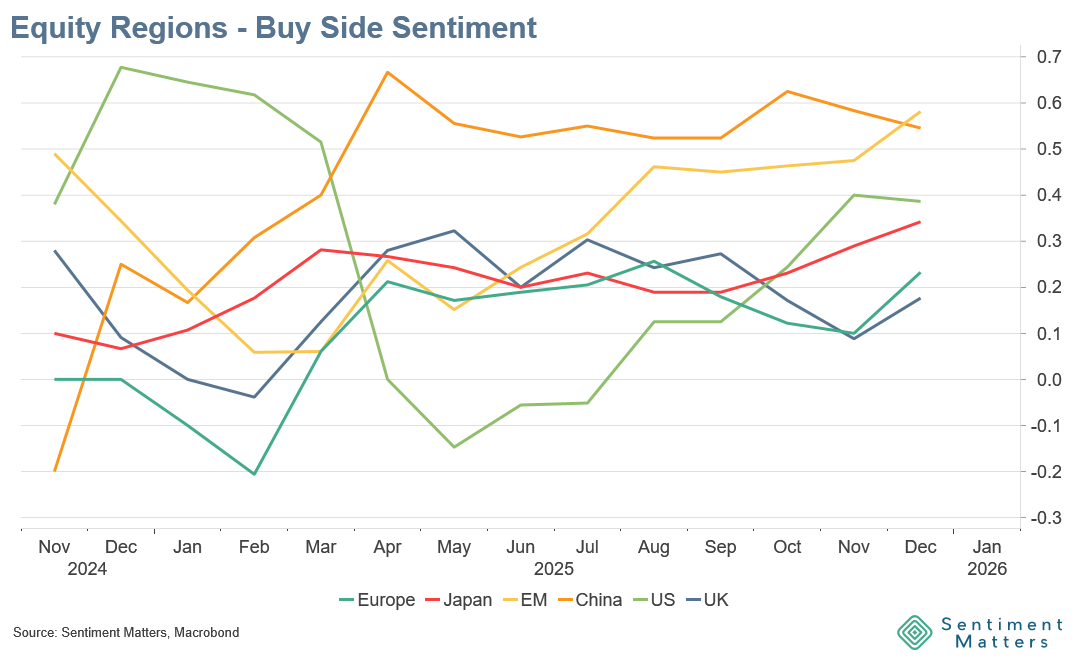

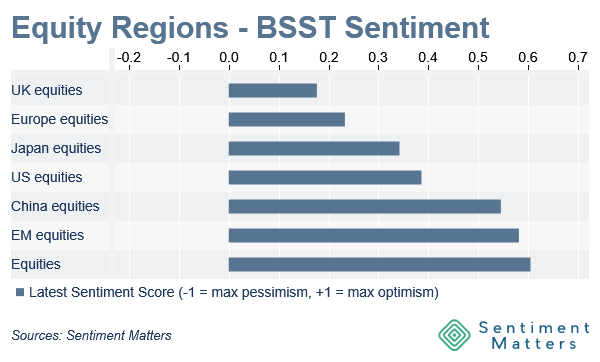

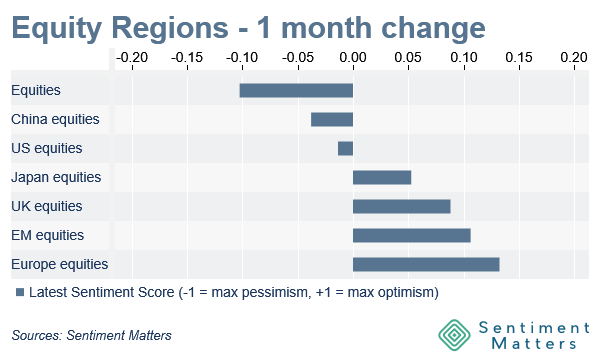

Equity Regions: Japan’s steady upgrades

- US equities: First downgrades in seven months. Still +38% net bullish, but far from both post-Liberation-Day lows and last year’s peak popularity.

- Emerging Markets & China: Remain the clear leaders for the seventh consecutive month. China was stable, while broader EM upgrades narrowed the gap.

- Japan: Continued upgrades since the political shift. Now +34% net bullish, the strongest reading in over a year, with room for further upside if reform and fiscal optimism are validated by data.

- Europe: Biggest regional upgrades this month. Sentiment has rebounded close to spring highs, consistent with renewed interest in cyclical exposure.