Why it matters:

Understanding what investors are thinking and doing is far more important than what brokers are saying or writing.

The challenge:

While there are plenty of indicators for overall risk appetite (see my Sentiment Heatmap), most investment decisions sit below the call of being long or short equities. Far fewer indicators focus on more granular investment views.

The solution:

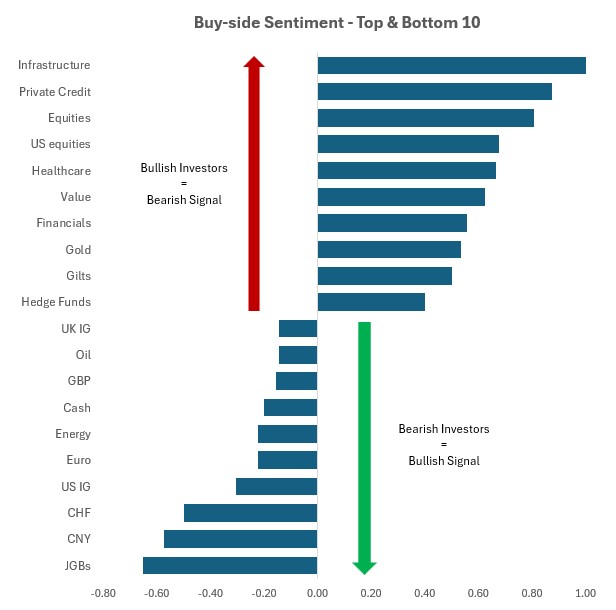

This tool compiles the latest views from 34 of the largest asset managers, offering insight into consensus positioning across 70 assets, with 862 individual views.

Highlights below. DM me if you want more details.

Conclusions:

- Almost everyone is bullish: 25 managers are overweight equities, 6 are neutral and no one is bearish.

- Barbell strategy: Consensus is bullish on equities and there has been a shift towards risky and growth assets, but there remains a slight preference for Defensive sectors over Cyclicals.

- Everyone loves private credit! This isn't new, but it feels a bit like the new ESG.

- No surprise: US equities are popular, but there’s no difference between EU, UK and Japan.

- Value is the most popular style, Size the least popular.

- First view on Crypto. Just one formal view, but it’s bearish. I assume more asset managers will express allocation views before Trump leaves office.

- Most unpopular assets: JGBs, Swiss franc and US investment grade credit are the least popular asset on my list.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.