The S&P 500 rally has taken valuations back to the peak of the last cycle.

Why it matters: Fundamentals can justify any valuation level. But you need to get increasingly aggressive on your assumptions to make the numbers work.

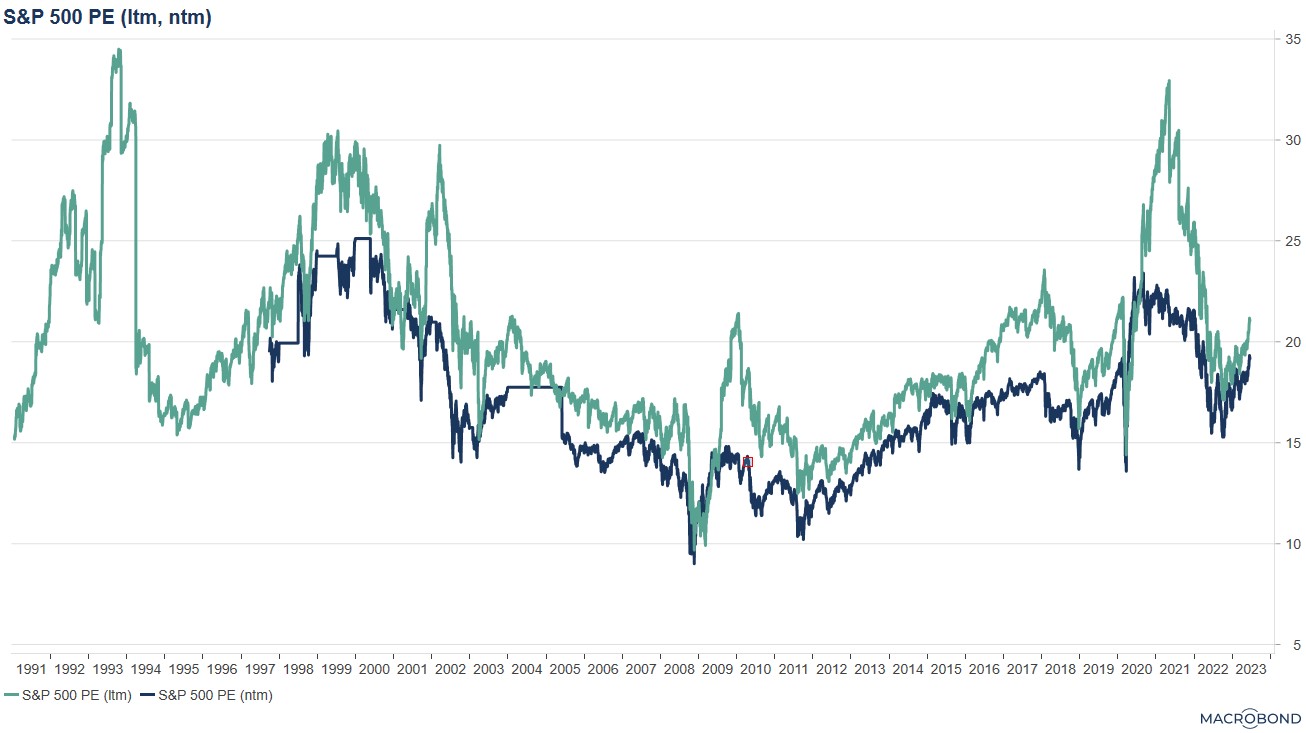

Equity valuations are starting to look a bit pricey. The S&P 500 is trading at 19.3x the earnings expected by analysts over the next 12 months. That is well above the longer-term average and exactly the peak it reached briefly in the late cycle phase just before the pandemic.

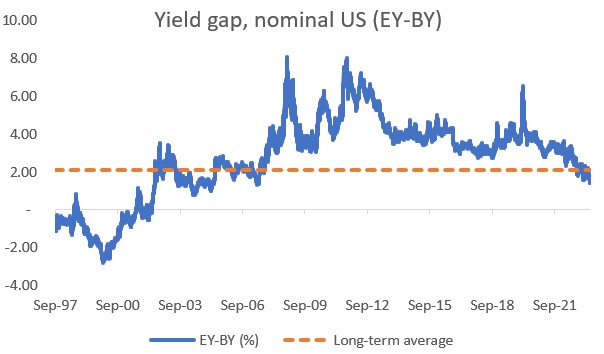

Things don’t look much better when comparing with other asset classes. The rally has taken the (earnings) yield advantage of equities over Treasuries to the lowest since the financial crisis. That says little about future equity returns, but the relative valuation case for equities, that had been so easy to make for decades, has disappeared.

Go deeper…

Absolutely expensive

Fundamentals can provide a justification for any valuation, but let’s look at how far you need to stretch your assumptions to get there.

A high PE makes sense in the lead-up to a surge in earnings. In such circumstances, the apparent PE isn't as high as it initially appears. This is due to the basis of the calculation—analysts' earnings forecasts, which typically lag reality, will initially understate an earnings surge. Prices move ahead of earnings estimates, making the PE look artificially high. This typically happens after recessions, as we just observed in 2020/21.

Source: Macrobond, Lars Kreckel

However, even if we find ourselves in a 'no landing' scenario rather than in a recession, it remains challenging to envision a scenario where earnings growth experiences a sharp uptick. We would still be within what most economists would categorize as a mature or 'late cycle' economic stage. Without a significant acceleration in GDP growth from a relatively low base, it is difficult to get earnings growth well into double-digits.

You could get a bounce in earnings estimates if the initial estimates were overly pessimistic. However, the consensus forecasts for the S&P 500 have merely decreased marginally from their peak in June 2022. Given the relatively stable forecast trends in recent months, it isn't evident that there is an excessive pessimism that would warrant reversal in a 'no landing' scenario.

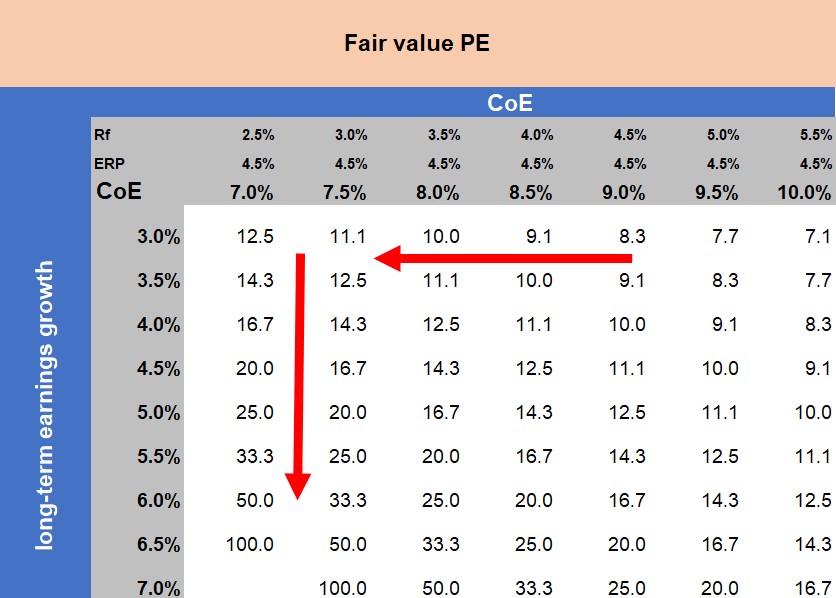

High P/E ratios may also be justified if investors have altered their long-term assumptions. According to the Gordon Growth Model, a reduction in the cost of equity or an increase in structural growth would both do the trick. (see table below).

Source: Lars Kreckel

But the prospect of a structurally lower cost of equity, while appealing, has remained elusive during the 'lower for longer' phase. With persistent high inflation and many central banks continuing to adopt a tightening stance, expectations of a lower cost of equity seems a stretch.

Structurally higher earnings growth would also do the trick. I am in the AI bull camp, so I see a chance of above-average earnings growth over the next decade. Even so, even the most optimistic among us must concede that the magnitude and timing of any structural gains attributed to AI are fraught with uncertainty and are unlikely to materialize immediately. It’s difficult to price this aggressively today.

Relatively speaking

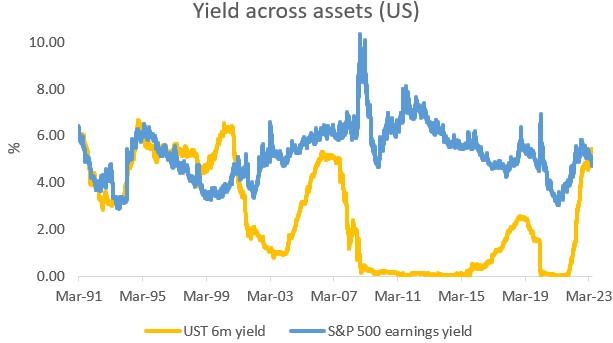

The biggest change in equity valuations has been on the relative side, compared with fixed income assets. In some ways that’s the way it has been often over the past twenty years. Compared to bonds, the yield on equities has been remarkably stable.

For the first time in over twenty years US cash is yielding more than the S&P 500. But what has been unusual in most current investors’ careers, was business as usual before 2000. Maybe it’s time to dust off those old ‘Fed model’ spreadsheets. More broadly, the yield advantage of equities continues to erode against all fixed income assets.

Source: Bloomberg, Lars Kreckel

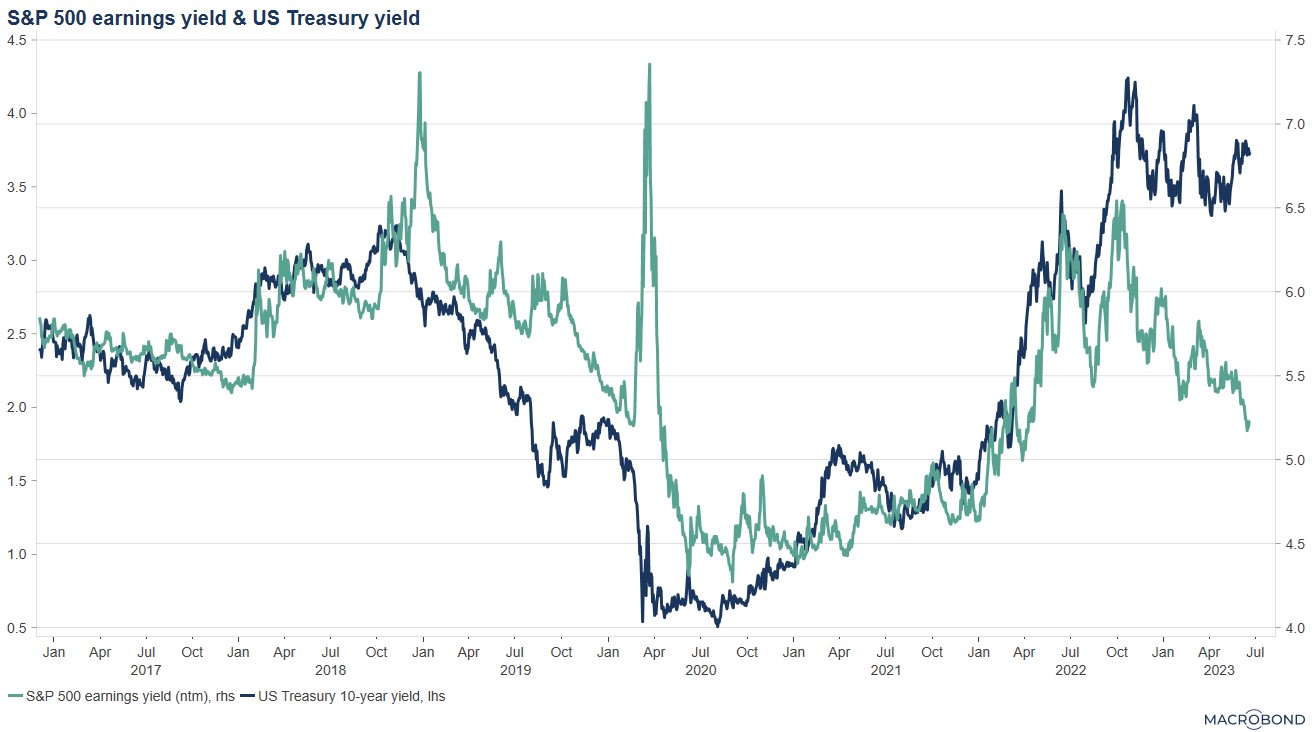

Recently, however, it has been an equity re-rating that is driving the move. Treasury yields have only risen moderately. It’s what you expect to see when growth expectations are re-priced upwards and when growth is the primary market driver rather than inflation. Ironically, it’s the change in correlation many had expected going into this year, but in the opposite direction; ‘more growth’ rather than recession.

Source: Macrobond, Lars Kreckel

That combination has taken the yield gap, which had been between 3-5% for almost a decade, down to 1.4%. That’s a new low since the financial crisis and below the 30-year average.

Source: Bloomberg, Lars Kreckel

But before you panic, this is still far from the extreme witnessed in 2000 or even the average in the 1990’s, when yields were about the same for both asset classes. And of course, the usual caveat applies that relative valuations have not been a good predictor of equity returns. The implication though is that the long-standing relative valuation case for equities has largely disappeared.

Bottom-line

- Equity valuations are getting expensive, fact.

- Justifications for a re-rating, such as an imminent earnings bounce, lower cost of equity, or higher long-term earnings growth, don’t look convincing

- Relative valuations no longer favour equities. The yield gap is the lowest since the financial crisis.

- None of these indicators are at historic extremes, but the air to justify further re-rating is getting very thin.

- Further equity upside needs to be driven by earnings…fingers crossed for the earnings season.

Thanks for reading Macro Equity! Subscribe for free to receive new posts and support my work.