There is a lot of hype about AI almost everywhere…but I see little evidence of it in financial markets.

Why it matters: We have not talked nearly enough about something that could significantly change the market outlook.

We investors are often accused of short-termism, rightly so. A few weeks ago, nothing mattered but bank runs. Now it’s all about the debt ceiling circus. There’s always something urgent to deal with. So, things that are further in the future, even if they are more important, are too easily ignored.

From a macro perspective, AI progress is one of the few things that could a) dramatically change the medium-term market outlook, b) is likely enough to care about and c) not so distant that it should be ignored. Given how many research hours have been spent on topics like demographics, with no firm conclusions, AI is still extremely under-researched.

I am far from having all the answers, but I have spent a lot of time reading, so you don’t have to.

Go deeper…

Job apocalypse?

The highest profile topic, though not the one with the greatest potential market impact, is the labour market impact of AI. There are two very distinct camps on this debate.

- The economist argument is based on historic precedent. It says that this is not a new problem; we’ve been here before, many times. Pessimists have been worrying about technology destroying jobs forever (see the Luddites) and every time technology has ended up creating more jobs than it has destroyed.

- The techy argument is that it’s different this time. AI is spreading more quickly (exponential) and to the cognitive jobs that had been safe from automation so far. Both make the adjustment process of the past extremely difficult.

Isn’t it strange that economists are the optimists and the Tech crowd are the pessimists on this debate?

Both sides make good points and of course no one can really know today. But some recent academic papers suggest the answer may well, as so often, lie between these two extremes. At least initially, AI could replace some tasks of many jobs rather than many entire jobs.

- Eloundou et al. predict that up to 49% of the workforce could eventually have half or more of their job tasks performed by AI.

- Noy et al. and others have found that the use of AI tools has had a greater impact on up-skilling less experienced or lower-skilled workers than on improving the productivity of high-skilled workers.

But ultimately it is companies that will decide the answer to this question. IBM’s recent comments give a worrying first hint. The company plans to pause hiring for new roles alongside plans to replace almost 8,000 jobs with AI systems. They expect the impact to be greatest in back-office functions, like HR and could see 30% of non-customer-facing roles being replaced by AI within five years.

Signposts

- Watch how companies behave. Will IBM follow through? Will others follow IBM?

- Look for signs of AI implementation in sectors that have been immune from technology so far (e.g. healthcare, education)

Productivity miracle?

The most important macro question is ‘How much will AI boost productivity?’

Goldman Sachs had a stab at estimating productivity gains and estimates that ‘’a widespread adoption of generative AI could raise overall labour productivity growth by around 1.5pp/year (vs. a recent 1.5% average growth pace), roughly the same-sized boost that followed the emergence of prior transformative technologies like the electric motor and personal computer.” They estimate AI could raise global GDP by 7%.

Erik Brynjolfsson et al. generally agree with these estimates in a recent Brookings paper.

The first academic papers and real-life studies on the topic are also starting to give an indication of the impact. Early signs are that it makes an immediate and significant difference to personal productivity.

- Peng, Kalliamvakou et al. found that programmers finished tasks 55% faster and the quality of the work improved.

- Noy, Zhang et al. found that college-educated professionals took 37% off the time it took to perform mid-level writing tasks (e.g. press releases) and the quality of the work improved.

- Korinek estimates that economists who take advantage of LLMs to automate micro tasks can become 10-20% more productive

- Brynjolfsson et al. found that customer support agents using an AI-based conversational assistant became 14% more productive, with gains of over 30% for the least experienced agents. Customer satisfaction also improved.

It’s early days and these are results for what are early versions of general-purpose tools, rather than the more sophisticated and purpose-built tools that are coming. So, results are likely to improve rather than deteriorate.

Market Impact

If the above productivity gains play out it’s a big deal for markets.

From the equity perspective the basics are simple: more growth = more earnings = higher equity prices

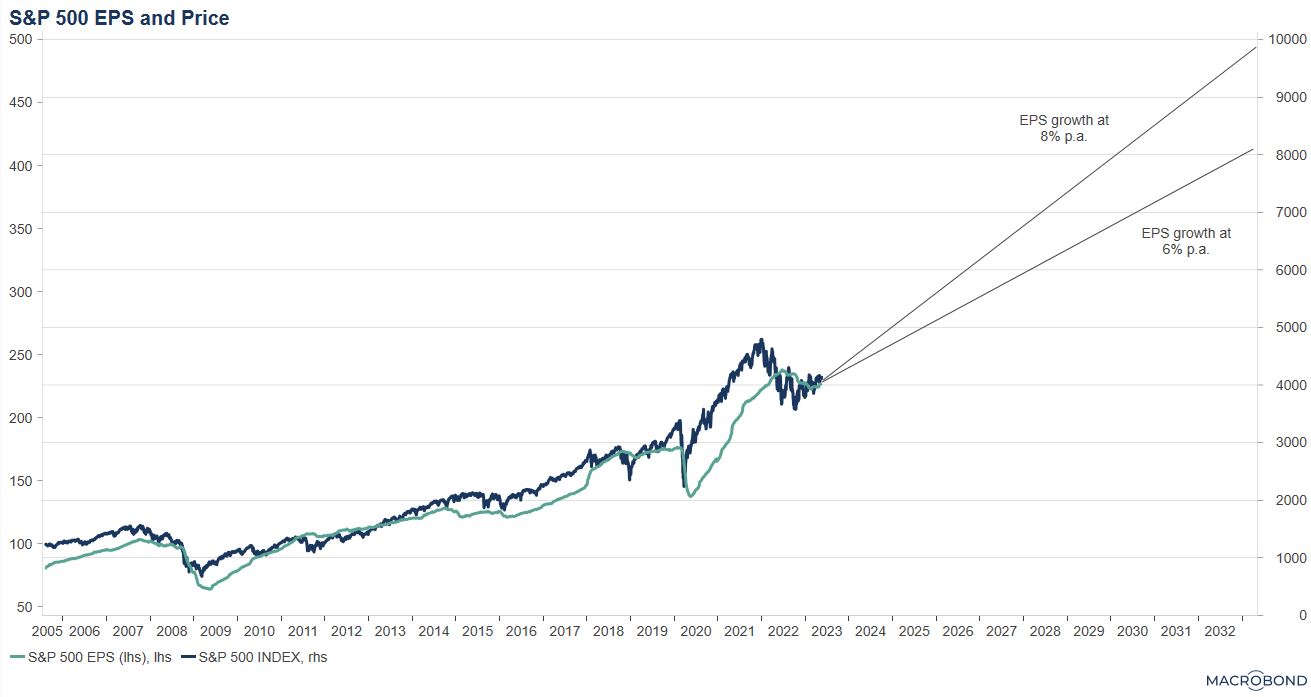

Greater productivity growth boosts GDP growth, which in turn raises earnings growth. Over the medium term, earnings growth is the most important determinant of equity returns, whereas valuations have mean reverting properties. Changing the slope of your earnings projection also steepens the slope of expected equity returns. The chart below shows EPS growth continuing at the historic average of 6% or alternatively at 8%.

Source: Macrobond, Lars Kreckel

Nearer-term and more bottom-up effects are also becoming visible. Some examples below.

Chegg became the most high-profile corporate victim of generative AI so far. The shares were cut in half on the company cutting Q2 guidance and removing 2023 guidance due to an increasing impact of ChatGPT on subscriber numbers for its homework-help service.

Lundgaard et al. found that GPT-4 did a good job at deciphering Fedspeak. It wasn’t perfect, though, so for the time being there still seems to be some value-add form economists in interpreting Jerome Powell’s utterances.

A study by Eisfeldt et al. found evidence that markets had already begun to price the effects of generative AI beyond just the obvious Tech stocks (and Chegg). In the months following ChatGPT’s release, stocks with more to gain from generative AI outperformed those with the least to gain.

Where’s the hype?

Tech has had more than its fair share of hype over the decades. The TMT bubble of 2000 is the biggest example, but there have been excesses during the pandemic and many hype cycles in specific Tech niches from cybersecurity to CRISPR.

But does AI today really register on that historic scale? I don’t think so.

AI stocks have not gone through the roof, far from it. The Robo Global AI index has gained ‘only’ 19% since the release of ChatGPT and is still down 34% from it’s 2021 high. It outperformed the S&P 500 in December and January, but has underperformed since then.

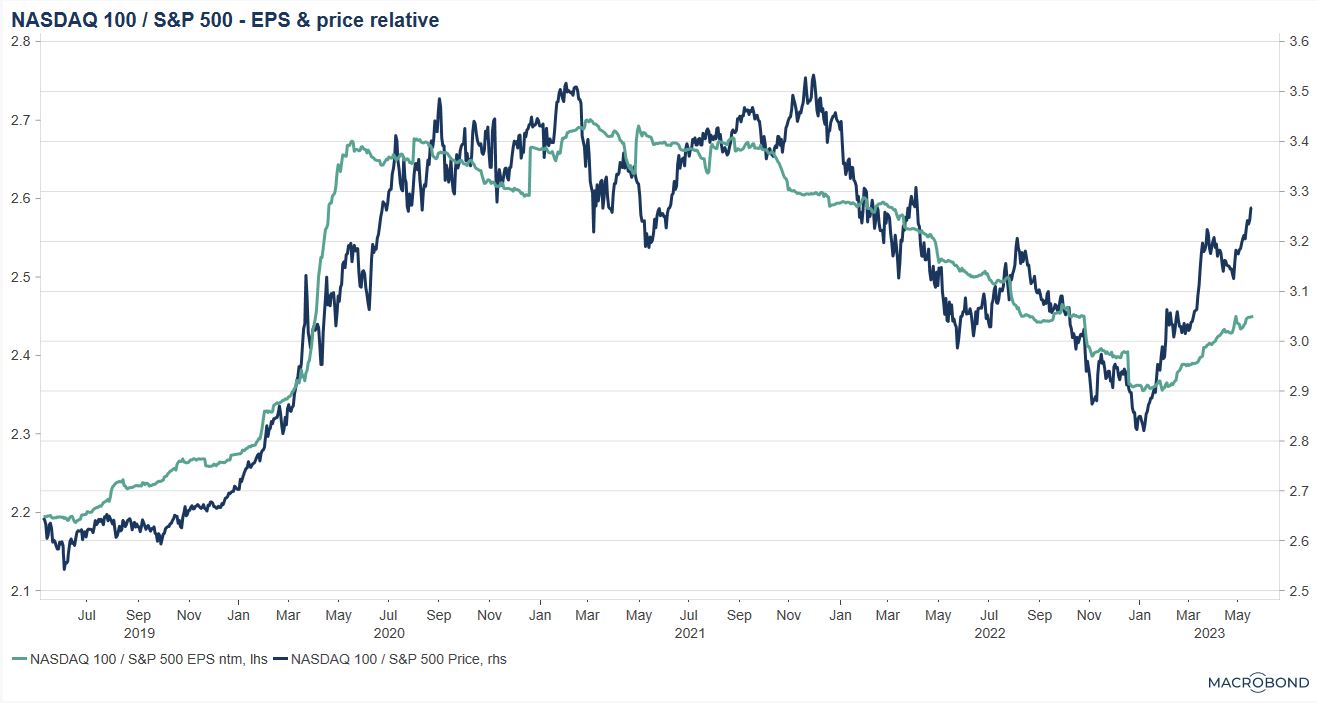

In fact, apart from the first few weeks after the ChatGPT release, it has been Big Tech that has performed best, not AI stocks. And no, the Big Tech outperformance has not been about AI, at least not predominately.

The Tech outperformance this year has been about earnings and bank runs. More than a third of the outperformance came during the bank run worries when cash rich companies like Big Tech were a safe haven. A lot of the rest of the outperformance has come from superior earnings, which have nothing to do with AI. AI is a promise of future earnings and therefore reflected in valuations. So there is some AI optimism in prices, but not enough to call it hype.

Source: Macrobond, Lars Kreckel

Nvidia, which seems to be everyone’s favourite AI pick (‘invest in picks & shovels, not in gold miners’) has almost doubled since the release of ChatGPT. But it’s still 15% below its 2021 high in price terms and 25% in EV/Sales terms. That clearly speaks to optimism being priced in, but can you speak of hype with valuations 25% below recent highs?

Bottom line

- AI is not overhyped in equity markets, so it’s not too late to do the work and invest

- AI is under-researched by investors

- If early estimates and studies play out, it’s a big deal for markets, macro and micro.

- The magnitudes are still uncertain, but more AI = more productivity growth = more GDP growth = more earnings growth = higher equity prices